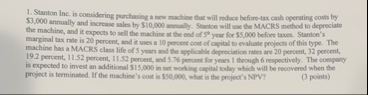

Question: Stanton Ine. is comsidering purchasing a new machine that will rodace before - tax cash operating costs by $ 3 , 0 0 0 annually

Stanton Ine. is comsidering purchasing a new machine that will rodace beforetax cash operating costs by $ annually and increase sales by $ menally. Sturtoe will use the MMCRS method to depreciate the mochine, and it expects to sell the machine as the ond ar $ y yer for $ before laxes. Stanton's marginal tax nite is percent, and it uses a peroent oost of capital to evaluate projects of this type. The machine has a MACRS class life of years and the applicable depreciation rates are pervent, percent, percent, percent, percent, and percent fir years I through respectively. The company is expected to invest an aditional in net mathy cuithl tisty whilch with he rocoverod when the projoct is terminated. If the machine's cont is SSO,OOL, what is the project's NPVT

Please help me solve this without excel

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock