Question: Star Construction Corp. has a contract to construct a building for $10,964,200. The building is controlled by the customer throughout the term of the

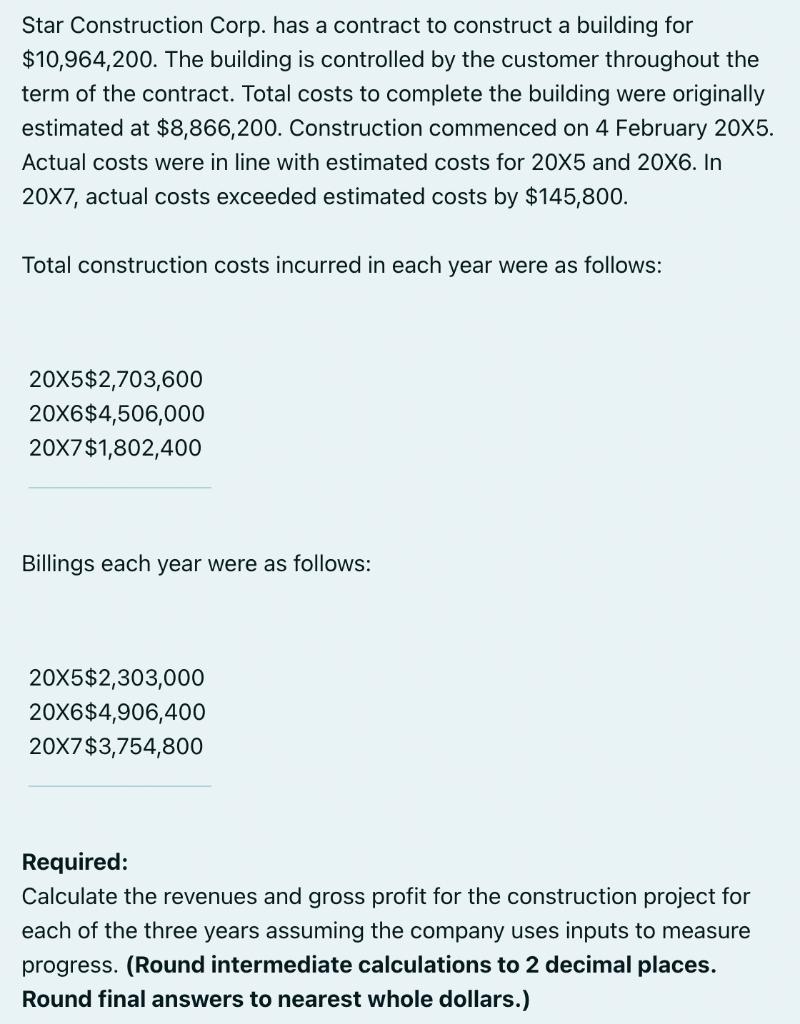

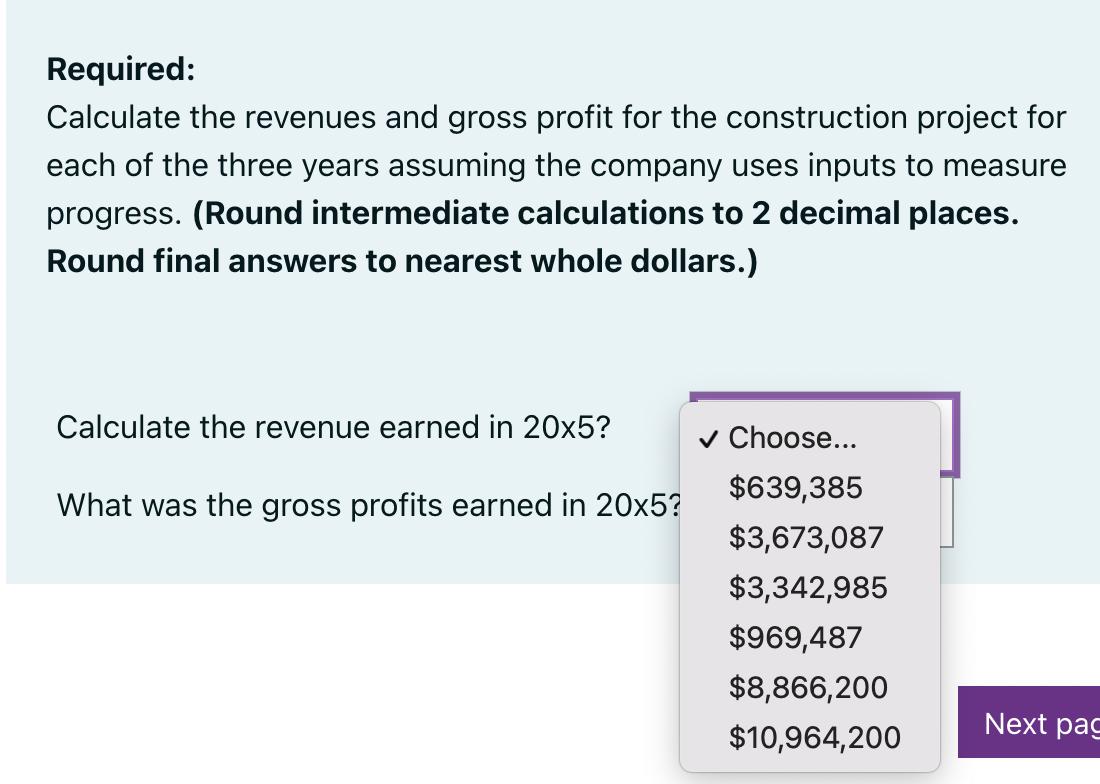

Star Construction Corp. has a contract to construct a building for $10,964,200. The building is controlled by the customer throughout the term of the contract. Total costs to complete the building were originally estimated at $8,866,200. Construction commenced on 4 February 20X5. Actual costs were in line with estimated costs for 20X5 and 20X6. In 20X7, actual costs exceeded estimated costs by $145,800. Total construction costs incurred in each year were as follows: 20X5$2,703,600 20X6$4,506,000 20X7$1,802,400 Billings each year were as follows: 20X5$2,303,000 20X6$4,906,400 20X7 $3,754,800 Required: Calculate the revenues and gross profit for the construction project for each of the three years assuming the company uses inputs to measure progress. (Round intermediate calculations to 2 decimal places. Round final answers to nearest whole dollars.) Required: Calculate the revenues and gross profit for the construction project for each of the three years assuming the company uses inputs to measure progress. (Round intermediate calculations to 2 decimal places. Round final answers to nearest whole dollars.) Calculate the revenue earned in 20x5? What was the gross profits earned in 20x5? Choose... $639,385 $3,673,087 $3,342,985 $969,487 $8,866,200 $10,964,200 Next pag

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Cost incurred in 20X5 Total Estimated Cost to Complete C... View full answer

Get step-by-step solutions from verified subject matter experts