Question: Starfish Enteprises is considering purchasing a machine that would cost $1,450,000. The machine would allow the company to speed up the manufacturing process and bring

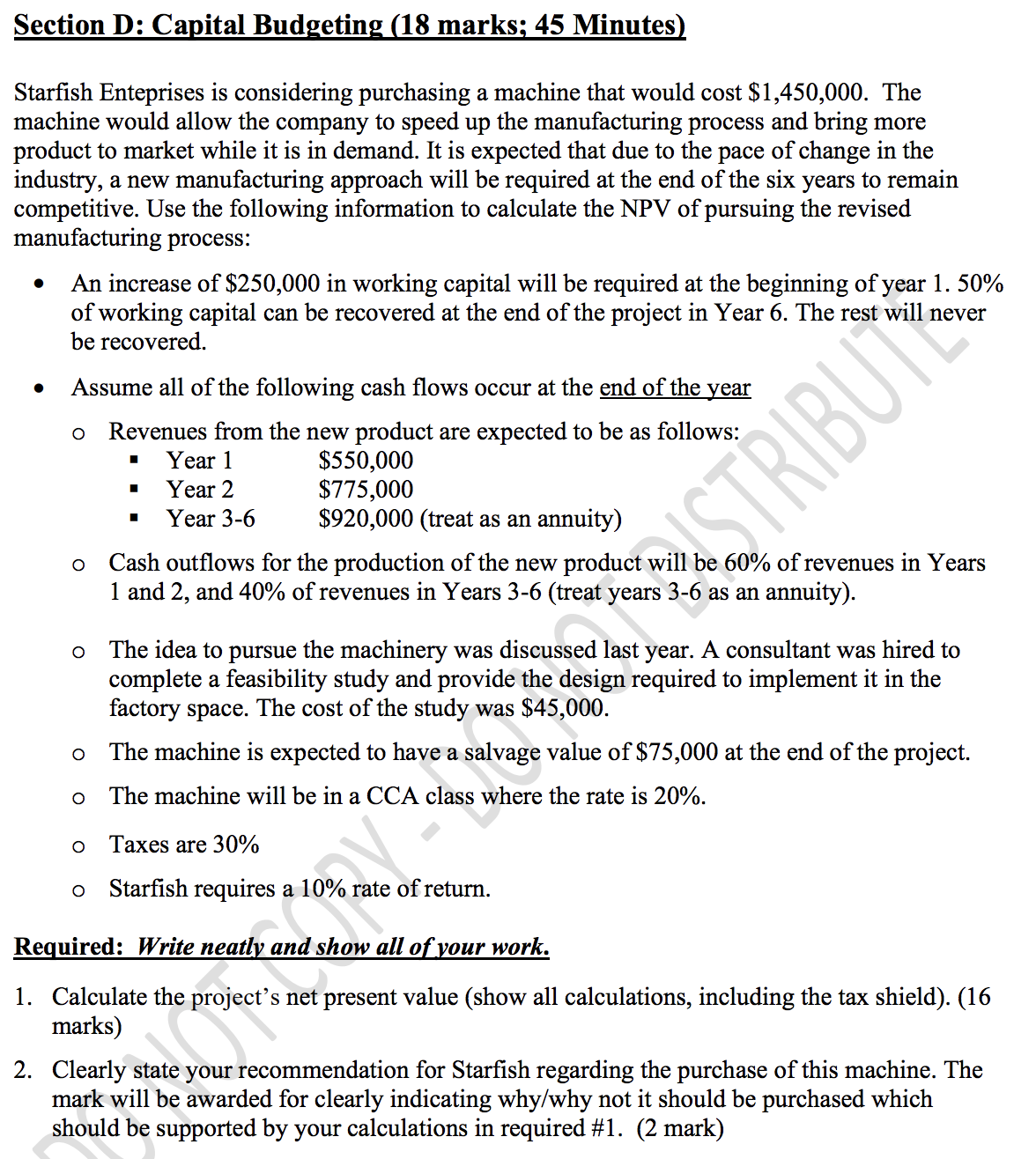

Starfish Enteprises is considering purchasing a machine that would cost $1,450,000. The machine would allow the company to speed up the manufacturing process and bring more product to market while it is in demand. It is expected that due to the pace of change in the industry, a new manufacturing approach will be required at the end of the six years to remain competitive. Use the following information to calculate the NPV of pursuing the revised manufacturing process:

Section D: Capital Budgeting (18 marks; 45 Minutes] Starsh Enteprises is considering purchasing a machine that would cost $1,450,000. The machine would allow the company to speed up the manufacturing process and bring more product to market while it is in demand. It is expected that due to the pace of change in the industry, a new manufacturing approach will be required at the end of the six years to remain competitive. Use the following information to calculate the NPV of pursuing the revised manufacturing process: An increase of $250,000 in working capital will be required at the beginning of year 1. 50% of working capital can be recovered at the end of the project in Year 6. The rest will never be recovered. Assume all of the following cash ows occur at the end of the year 0 Revenues from the new product are expected to be as follows: I Year 1 $550,000 I Year 2 $775,000 I Year 3-6 $920,000 (treat as an annuity) 0 Cash outows for the production of the new product will be 60% of revenues in Years 1 and 2, and 40% of revenues in Years 3-6 (treat years 3-6 as an annuity). o The idea to pursue the machinery was discussed last year. A consultant was hired to complete a feasibility study and provide the design required to implement it in the factory space. The cost of the study was $45,000. 0 The machine is expected to have a salvage value of $75,000 at the end of the project. 0 The machine will be in a CCA class where the rate is 20%. 0 Taxes are 30% o Starsh requires a 10% rate of return. Reg uired: Write neatbg and Show all at your work. 1. Calculate the project's net present value (show all calculations, including the tax shield). (16 marks) Clearly state your recommendation for Starsh regarding the purchase of this machine. The mark will be awarded for clearly indicating why/why not it should be purchased which should be supported by your calculations in required #1. (2 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts