Question: Stark Enterprise issues a 5-year floating rate bond with a par value of $100 million to Tony. Tony will receive annual coupons based on one-year

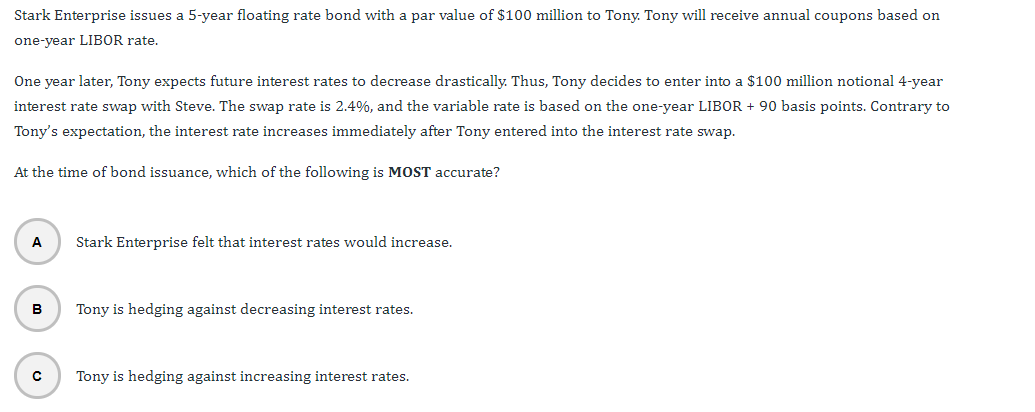

Stark Enterprise issues a 5-year floating rate bond with a par value of $100 million to Tony. Tony will receive annual coupons based on one-year LIBOR rate. One year later, Tony expects future interest rates to decrease drastically. Thus, Tony decides to enter into a $100 million notional 4-year interest rate swap with Steve. The swap rate is 2.4%, and the variable rate is based on the one-year LIBOR + 90 basis points. Contrary to Tony's expectation, the interest rate increases immediately after Tony entered into the interest rate swap. At the time of bond issuance, which of the following is MOST accurate? A Stark Enterprise felt that interest rates would increase. B Tony is hedging against decreasing interest rates. Tony is hedging against increasing interest rates. Stark Enterprise issues a 5-year floating rate bond with a par value of $100 million to Tony. Tony will receive annual coupons based on one-year LIBOR rate. One year later, Tony expects future interest rates to decrease drastically. Thus, Tony decides to enter into a $100 million notional 4-year interest rate swap with Steve. The swap rate is 2.4%, and the variable rate is based on the one-year LIBOR + 90 basis points. Contrary to Tony's expectation, the interest rate increases immediately after Tony entered into the interest rate swap. At the time of bond issuance, which of the following is MOST accurate? A Stark Enterprise felt that interest rates would increase. B Tony is hedging against decreasing interest rates. Tony is hedging against increasing interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts