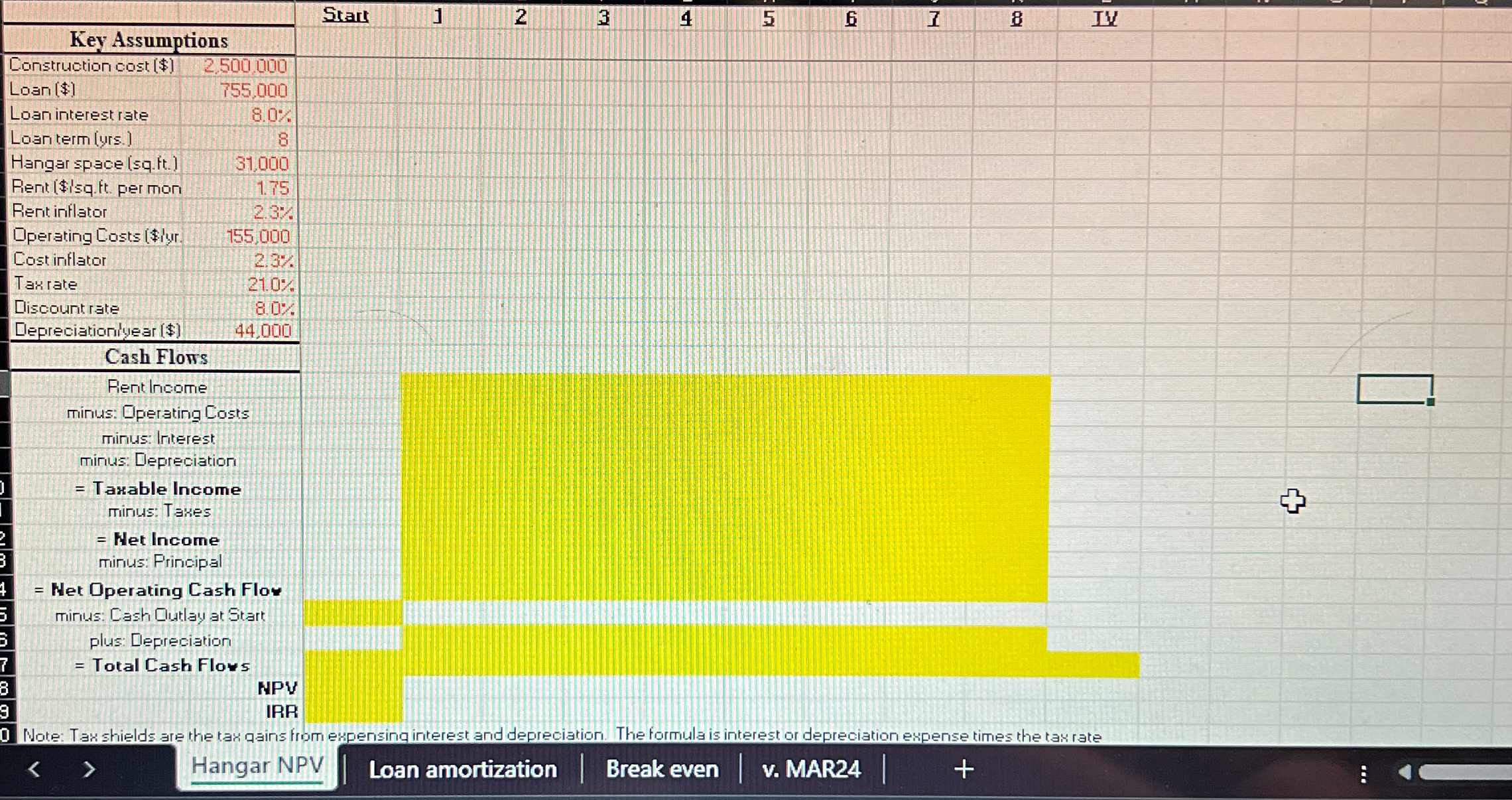

Question: Start 1 2 3 4 5 6 7 8 IV Key Assumptions Construction cost [$] 2.500.000 Loan ($) Loan interest rate Loan term (yrs.)

Start 1 2 3 4 5 6 7 8 IV Key Assumptions Construction cost [$] 2.500.000 Loan ($) Loan interest rate Loan term (yrs.) Hangar space (sq.ft.) 755,000 8.0% 8 31,000 Rent ($/sq.ft. per mon 1.75 Rent inflator 2.3% Operating Costs ($/yr. 155,000 Cost inflator 2.3% Tax rate 21.0% Discount rate 80% Depreciation/year ($) 44,000 3 7 8 9 Cash Flows Rent Income minus: Operating Costs minus: Interest minus: Depreciation = Taxable Income = minus: Taxes Net Income minus: Principal Net Operating Cash Flow minus: Cash Outlay at Start plus: Depreciation = Total Cash Flows NPV IRR 0 Note: Tax shields are the tax gains from expensing interest and depreciation. The formula is interest or depreciation expense times the tax rate < > Hangar NPV Loan amortization | Break even v. MAR24 + +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts