Question: You are attending an interview session for a post of finance officer at Ukay Budiman Corporation (UBC). During the interview, the director of UBC

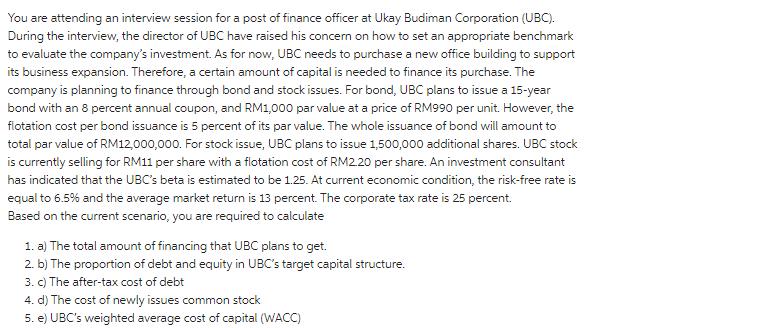

You are attending an interview session for a post of finance officer at Ukay Budiman Corporation (UBC). During the interview, the director of UBC have raised his concern on how to set an appropriate benchmark to evaluate the company's investment. As for now, UBC needs to purchase a new office building to support its business expansion. Therefore, a certain amount of capital is needed to finance its purchase. The company is planning to finance through bond and stock issues. For bond, UBC plans to issue a 15-year bond with an 8 percent annual coupon, and RM1,000 par value at a price of RM990 per unit. However, the flotation cost per bond issuance is 5 percent of its par value. The whole issuance of bond will amount to total par value of RM12,000,000. For stock issue, UBC plans to issue 1,500,000 additional shares. UBC stock is currently selling for RM11 per share with a flotation cost of RM2.20 per share. An investment consultant has indicated that the UBC's beta is estimated to be 1.25. At current economic condition, the risk-free rate is equal to 6.5% and the average market return is 13 percent. The corporate tax rate is 25 percent. Based on the current scenario, you are required to calculate 1. a) The total amount of financing that UBC plans to get. 2. b) The proportion of debt and equity in UBC's target capital structure. 3. c) The after-tax cost of debt 4. d) The cost of newly issues common stock 5. e) UBC's weighted average cost of capital (WACC)

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

a The amount of financing the UBC plans to get is the amount raised after floatation costs Let us ca... View full answer

Get step-by-step solutions from verified subject matter experts