Question: Start with the partial model in the file cho7 P15 Build a Modelsx Joshua & White (1W) Technology's financial statements are also show here. Joshua

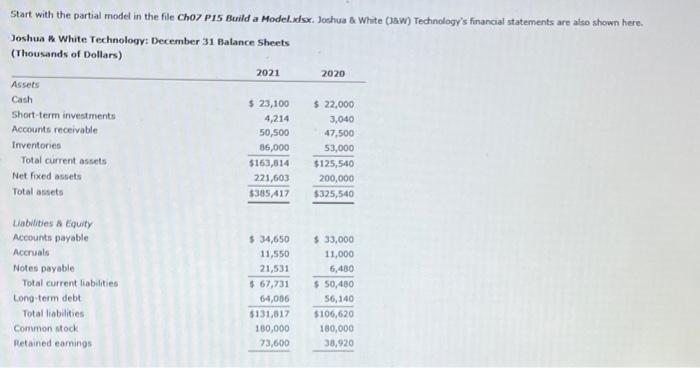

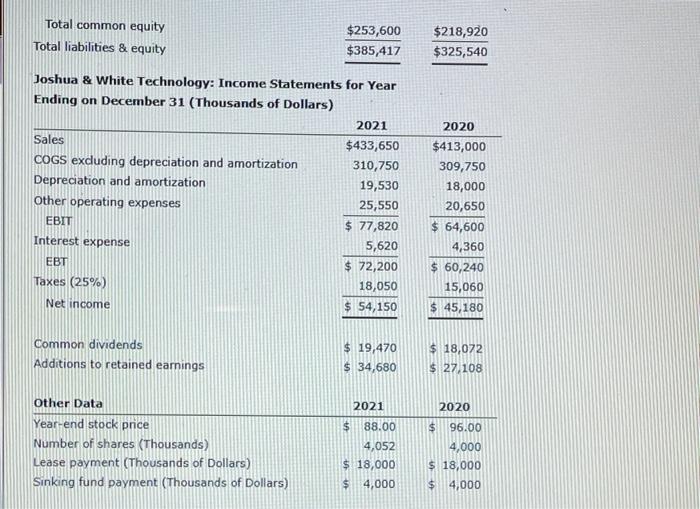

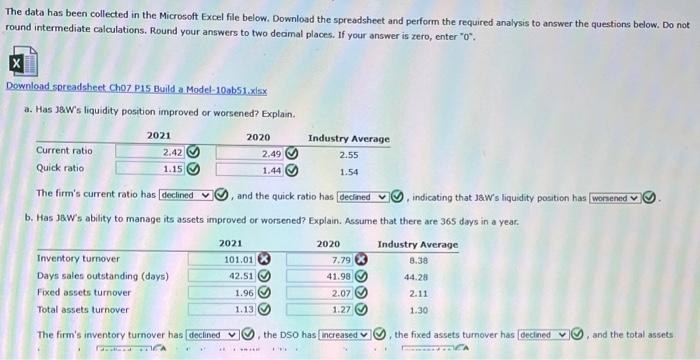

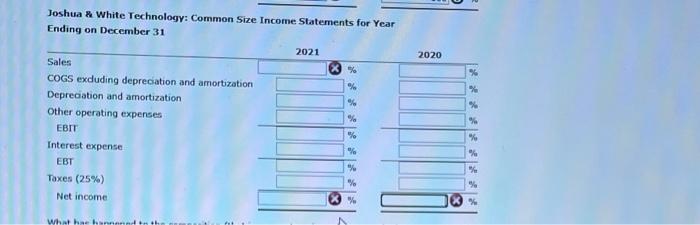

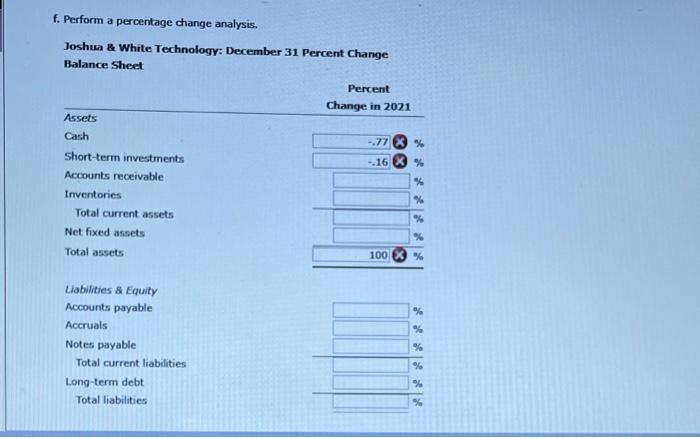

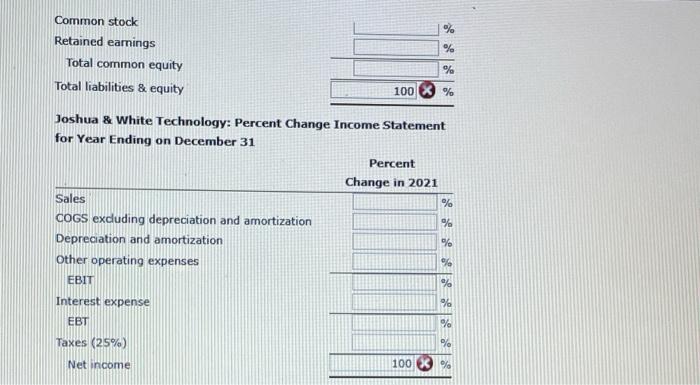

Start with the partial model in the file cho7 P15 Build a Modelsx Joshua & White (1W) Technology's financial statements are also show here. Joshua White Technology: December 31 Balance Sheets (Thousands of Dollars) 2021 2020 Assets Cash $ 23,100 $ 22,000 Short-term investments 4,214 3,040 Accounts receivable 50,500 47,500 Inventories 36,000 53,000 Total current assets $163,814 $125,540 Net fixed assets 221,603 200,000 Total toets $385 417 $325,540 Liabilities acquity Accounts payable Accruals Notes payable Total current liabilities Long term debt Total liabilities Common stock Retained earnings $ 34,650 11,550 21,531 $ 67,731 64,006 $131,817 180,000 73,600 $ 33,000 11,000 6,480 $50,480 56,140 $106,620 180,000 38,920 Total common equity Total liabilities & equity $253,600 $385,417 $218,920 $325,540 2020 Joshua & White Technology: Income Statements for Year Ending on December 31 (Thousands of Dollars) 2021 Sales $433,650 COGS excluding depreciation and amortization 310,750 Depreciation and amortization 19,530 Other operating expenses 25,550 EBIT $ 77,820 Interest expense 5,620 EBT $ 72,200 Taxes (25%) 18,050 Net income $ 54,150 $413,000 309,750 18,000 20,650 $ 64,600 4,360 $ 60,240 15,060 $ 45,180 $ 19,470 Common dividends Additions to retained earnings $ 18,072 $ 34,680 $ 27,108 2020 $ 96.00 Other Data Year-end stock price Number of shares (Thousands) Lease payment (Thousands of Dollars) Sinking fund payment (Thousands of Dollars) 2021 $ 88.00 4,052 $ 18,000 $ 4,000 4,000 $ 18,000 $4,000 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Round your answers to two decimal places. If your answer is zero, enter *o". Download spreadsheet Ch07 P15 Build a Model-10a15.1.xlsx a. Has BW's liquidity position improved or worsened? Explain. 2021 2020 Industry Average Current ratio 2.42 2.49 2.55 Quick ratio 1.15 g 1.44 1.54 The firm's current ratio has declined and the quick ratio has declined indicating that J&W's liquidity position has worsened v b. Has 18w's ability to manage its assets improved or worsened? Explain. Assume that there are 365 days in a year. 2021 2020 Industry Average Inventory turnover 101.01 7.79 8.38 Days sales outstanding (days) 42.51 41.98 M 44.28 Fixed assets turnover 1.96 2.07 2.11 Total assets turnover 1.13 1.27 1.30 The firm's inventory turnover has declined the DSO has increased the fixed assets turnover has decined v and the total assets c. How has Jaw's profitability changed during the last year? Profit margin Basic earning power Return on assets Return on equity 2021 12.49 % 18.73 % 14.05 % 21.35 % 2020 Industry Average 10.94 % 11.42% 18.50 % 20.49% 13.88 % 14.37% 20.64 % 21.02% and the return on The firm's profit margin has increased the basic earning power has increased the return on assets has increased equity has increased vindicating that 8W's profitability has proved v 2020 % % Joshua & White Technology: Common Size Income Statements for Year Ending on December 31 2021 Sales COGS exduding depreciation and amortization Depreciation and amortization Other operating expenses EBIT % Interest expense % EBT Taxes (25%) Net income % % ********* % % Whatha hin f. Perform a percentage change analysis. Joshua & White Technology: December 31 Percent Change Balance Sheet Percent Change in 2021 Assets Cash -.77 X % Short-term investments -.16 X % Accounts receivable % Inventories % Total current assets % Net fixed assets % Total assets 100 % % % Liabilities & Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities % % % % Common stock Retained earnings Total common equity Total liabilities & equity % % 100 % Joshua & White Technology: Percent Change Income Statement for Year Ending on December 31 Percent Change in 2021 Sales % COGS excluding depreciation and amortization Depreciation and amortization % Other operating expenses % EBIT % % Interest expense % % EBT Taxes (25%) % Net income 100 Start with the partial model in the file cho7 P15 Build a Modelsx Joshua & White (1W) Technology's financial statements are also show here. Joshua White Technology: December 31 Balance Sheets (Thousands of Dollars) 2021 2020 Assets Cash $ 23,100 $ 22,000 Short-term investments 4,214 3,040 Accounts receivable 50,500 47,500 Inventories 36,000 53,000 Total current assets $163,814 $125,540 Net fixed assets 221,603 200,000 Total toets $385 417 $325,540 Liabilities acquity Accounts payable Accruals Notes payable Total current liabilities Long term debt Total liabilities Common stock Retained earnings $ 34,650 11,550 21,531 $ 67,731 64,006 $131,817 180,000 73,600 $ 33,000 11,000 6,480 $50,480 56,140 $106,620 180,000 38,920 Total common equity Total liabilities & equity $253,600 $385,417 $218,920 $325,540 2020 Joshua & White Technology: Income Statements for Year Ending on December 31 (Thousands of Dollars) 2021 Sales $433,650 COGS excluding depreciation and amortization 310,750 Depreciation and amortization 19,530 Other operating expenses 25,550 EBIT $ 77,820 Interest expense 5,620 EBT $ 72,200 Taxes (25%) 18,050 Net income $ 54,150 $413,000 309,750 18,000 20,650 $ 64,600 4,360 $ 60,240 15,060 $ 45,180 $ 19,470 Common dividends Additions to retained earnings $ 18,072 $ 34,680 $ 27,108 2020 $ 96.00 Other Data Year-end stock price Number of shares (Thousands) Lease payment (Thousands of Dollars) Sinking fund payment (Thousands of Dollars) 2021 $ 88.00 4,052 $ 18,000 $ 4,000 4,000 $ 18,000 $4,000 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Round your answers to two decimal places. If your answer is zero, enter *o". Download spreadsheet Ch07 P15 Build a Model-10a15.1.xlsx a. Has BW's liquidity position improved or worsened? Explain. 2021 2020 Industry Average Current ratio 2.42 2.49 2.55 Quick ratio 1.15 g 1.44 1.54 The firm's current ratio has declined and the quick ratio has declined indicating that J&W's liquidity position has worsened v b. Has 18w's ability to manage its assets improved or worsened? Explain. Assume that there are 365 days in a year. 2021 2020 Industry Average Inventory turnover 101.01 7.79 8.38 Days sales outstanding (days) 42.51 41.98 M 44.28 Fixed assets turnover 1.96 2.07 2.11 Total assets turnover 1.13 1.27 1.30 The firm's inventory turnover has declined the DSO has increased the fixed assets turnover has decined v and the total assets c. How has Jaw's profitability changed during the last year? Profit margin Basic earning power Return on assets Return on equity 2021 12.49 % 18.73 % 14.05 % 21.35 % 2020 Industry Average 10.94 % 11.42% 18.50 % 20.49% 13.88 % 14.37% 20.64 % 21.02% and the return on The firm's profit margin has increased the basic earning power has increased the return on assets has increased equity has increased vindicating that 8W's profitability has proved v 2020 % % Joshua & White Technology: Common Size Income Statements for Year Ending on December 31 2021 Sales COGS exduding depreciation and amortization Depreciation and amortization Other operating expenses EBIT % Interest expense % EBT Taxes (25%) Net income % % ********* % % Whatha hin f. Perform a percentage change analysis. Joshua & White Technology: December 31 Percent Change Balance Sheet Percent Change in 2021 Assets Cash -.77 X % Short-term investments -.16 X % Accounts receivable % Inventories % Total current assets % Net fixed assets % Total assets 100 % % % Liabilities & Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities % % % % Common stock Retained earnings Total common equity Total liabilities & equity % % 100 % Joshua & White Technology: Percent Change Income Statement for Year Ending on December 31 Percent Change in 2021 Sales % COGS excluding depreciation and amortization Depreciation and amortization % Other operating expenses % EBIT % % Interest expense % % EBT Taxes (25%) % Net income 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts