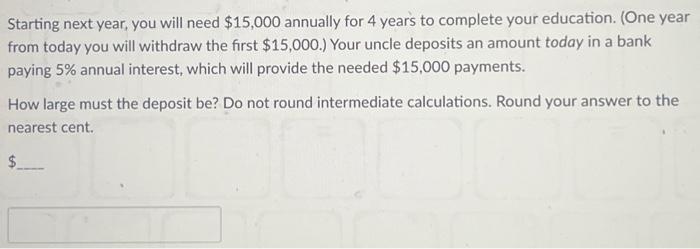

Question: Starting next year, you will need $15,000 annually for 4 years to complete your education. (One year from today you will withdraw the first $15,000.)

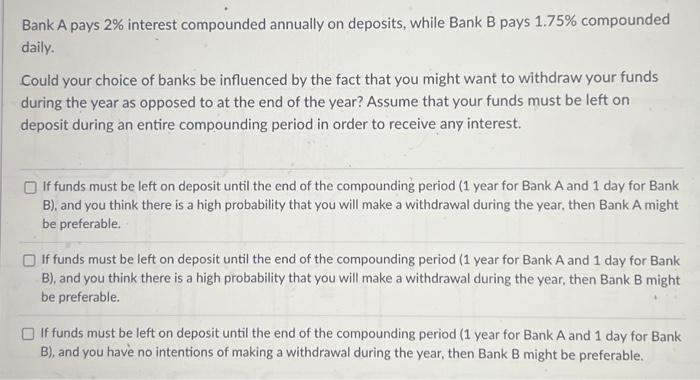

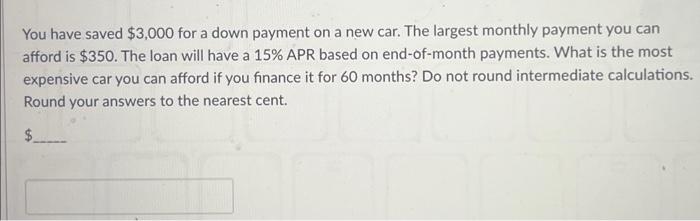

Starting next year, you will need $15,000 annually for 4 years to complete your education. (One year from today you will withdraw the first $15,000.) Your uncle deposits an amount today in a bank paying 5% annual interest, which will provide the needed $15,000 payments. How large must the deposit be? Do not round intermediate calculations. Round your answer to the nearest cent. Bank A pays 2% interest compounded annually on deposits, while Bank B pays 1.75% compounded daily. Could your choice of banks be influenced by the fact that you might want to withdraw your funds during the year as opposed to at the end of the year? Assume that your funds must be left on deposit during an entire compounding period in order to receive any interest. If funds must be left on deposit until the end of the compounding period ( 1 year for Bank A and 1 day for Bank B ), and you think there is a high probability that you will make a withdrawal during the year, then Bank A might be preferable. If funds must be left on deposit until the end of the compounding period ( 1 year for Bank A and 1 day for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank B might be preferable. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you have no intentions of making a withdrawal during the year, then Bank B might be preferable. You have saved $3,000 for a down payment on a new car. The largest monthly payment you can afford is $350. The loan will have a 15% APR based on end-of-month payments. What is the most expensive car you can afford if you finance it for 60 months? Do not round intermediate calculations. Round your answers to the nearest cent. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts