Question: Starting with the finished version of Example 6 . 2 , change the decision criterion to maximize expected utility, using an exponential utility function with

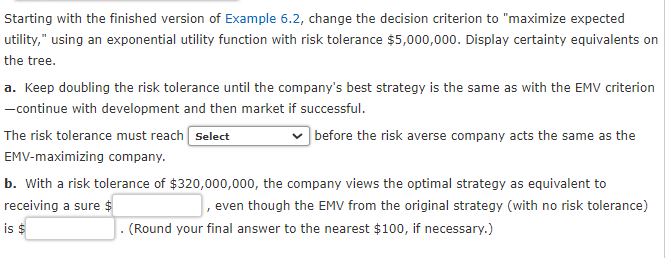

Starting with the finished version of Example change the decision criterion to "maximize expected

utility," using an exponential utility function with risk tolerance $ Display certainty equivalents on

the tree.

a Keep doubling the risk tolerance until the company's best strategy is the same as with the EMV criterion

continue with development and then market if successful.

The risk tolerance must reach

before the risk averse company acts the same as the

EMVmaximizing company.

b With a risk tolerance of $ the company views the optimal strategy as equivalent to

receiving a sure $

even though the EMV from the original strategy with no risk tolerance

is $

Round your final answer to the nearest $ if necessary.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock