Question: Starts Inc. gathered the following data for use in developing the budgets for the first quarter (January, February, March) of its fiscal year: a. Estimated

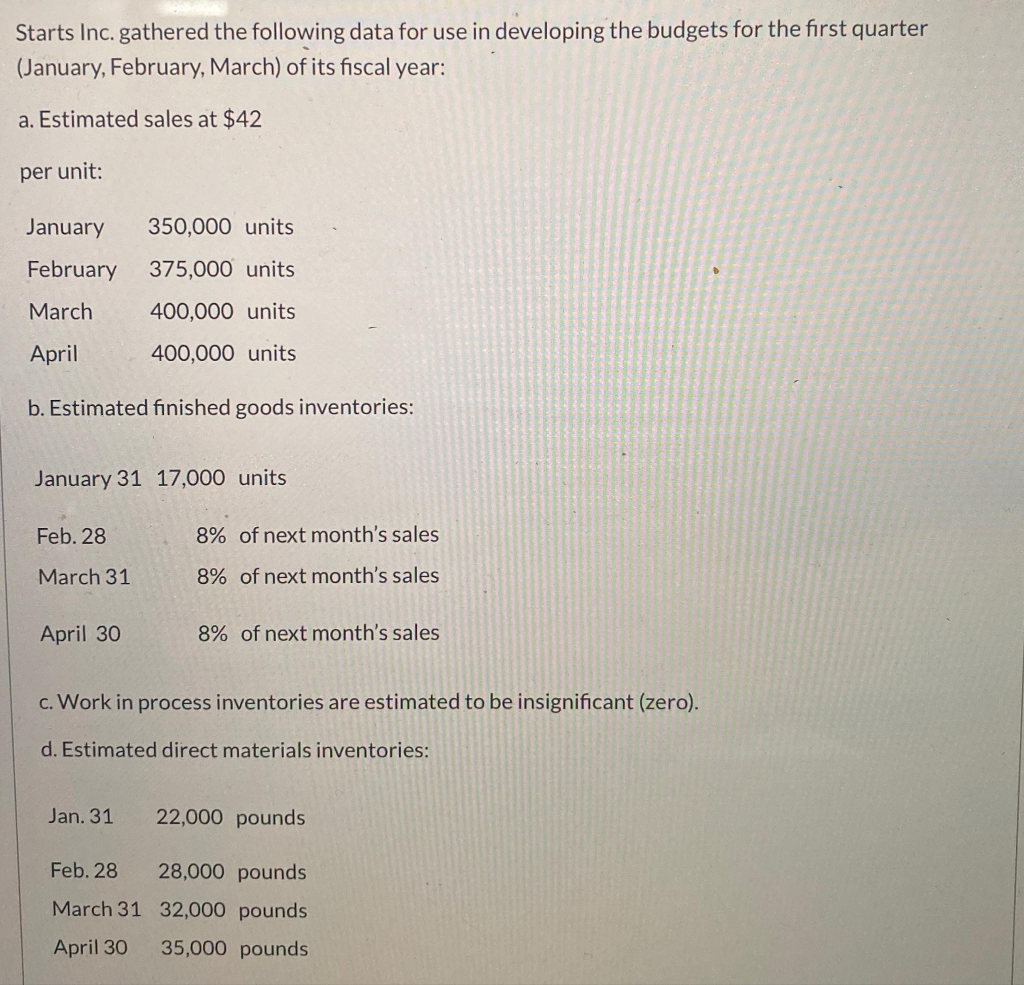

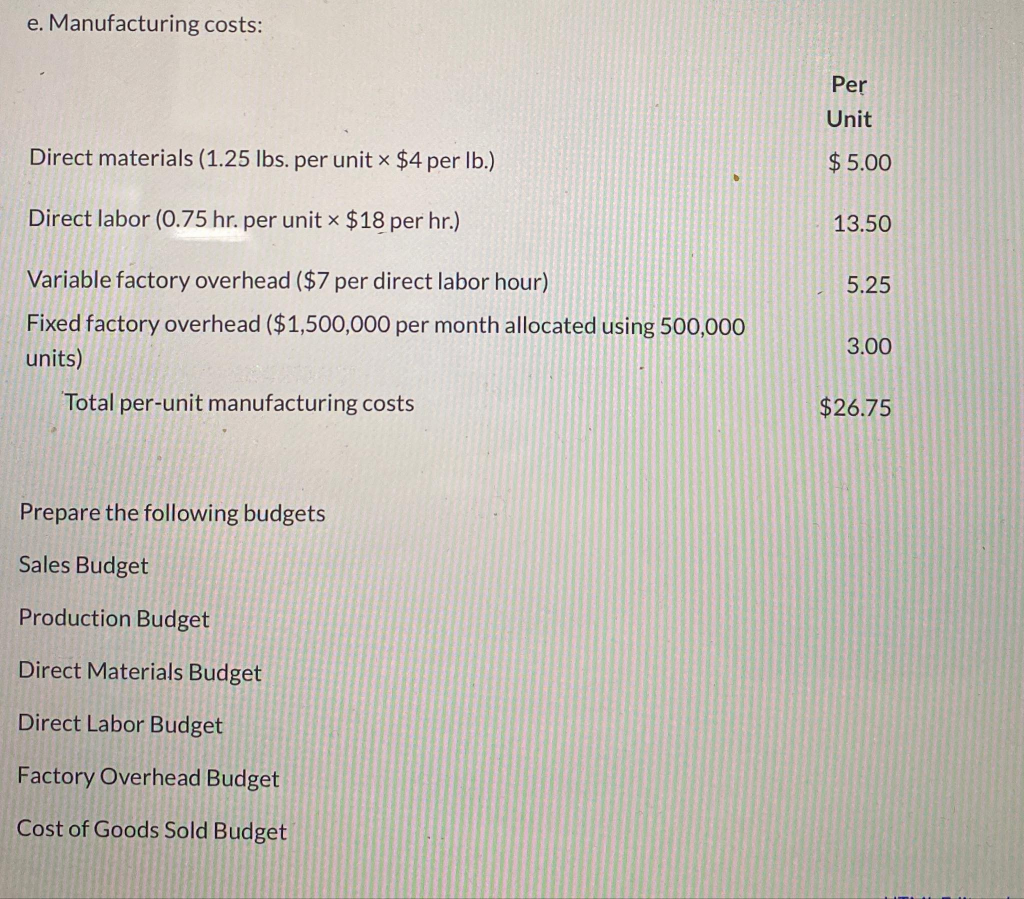

Starts Inc. gathered the following data for use in developing the budgets for the first quarter (January, February, March) of its fiscal year: a. Estimated sales at $42 per unit: January 350,000 units February 375,000 units March 400,000 units April 400,000 units b. Estimated finished goods inventories: January 31 17,000 units Feb. 28 8% of next month's sales March 31 8% of next month's sales April 30 8% of next month's sales c. Work in process inventories are estimated to be insignificant (zero). d. Estimated direct materials inventories: Jan. 31 22,000 pounds Feb. 28 28,000 pounds March 31 32,000 pounds April 30 35,000 pounds e. Manufacturing costs: Per Unit Direct materials (1.25 lbs. per unit $4 per lb.) $ 5.00 Direct labor (0.75 hr. per unit * $18 per hr.) 13.50 5.25 Variable factory overhead ($7 per direct labor hour) Fixed factory overhead ($1,500,000 per month allocated using 500,000 units) 3.00 Total per-unit manufacturing costs $26.75 Prepare the following budgets Sales Budget Production Budget Direct Materials Budget Direct Labor Budget Factory Overhead Budget Cost of Goods Sold Budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts