Question: State Allowed Marijuana Activity: Do Regular Business Deduction Rules Apply (or Those for Drug Dealers) (MO 3.1) Cole England operates Herbal Center in Sacramento, CA,

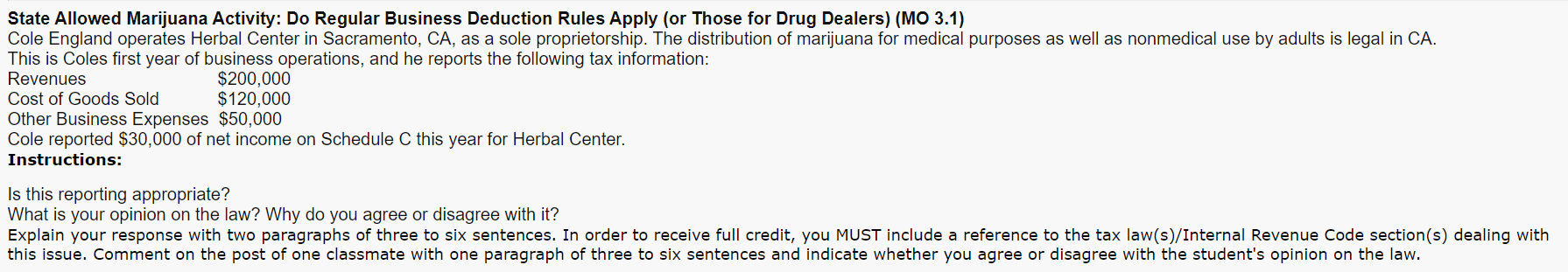

State Allowed Marijuana Activity: Do Regular Business Deduction Rules Apply (or Those for Drug Dealers) (MO 3.1) Cole England operates Herbal Center in Sacramento, CA, as a sole proprietorship. The distribution of marijuana for medical purposes as well as nonmedical use by adults is legal in CA. This is Coles first year of business operations, and he reports the following tax information: Revenues $200,000 Cost of Goods Sold $120,000 Other Business Expenses $50,000 Cole reported $30,000 of net income on Schedule C this year for Herbal Center. Instructions: Is this reporting appropriate? What is your opinion on the law? Why do you agree or disagree with it? Explain your response with two paragraphs of three to six sentences. In order to receive full credit, you MUST include a reference to the tax law(s)/Internal Revenue Code section(s) dealing with this issue. Comment on the post of one classmate with one paragraph of three to six sentences and indicate whether you agree or disagree with the student's opinion on the law

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts