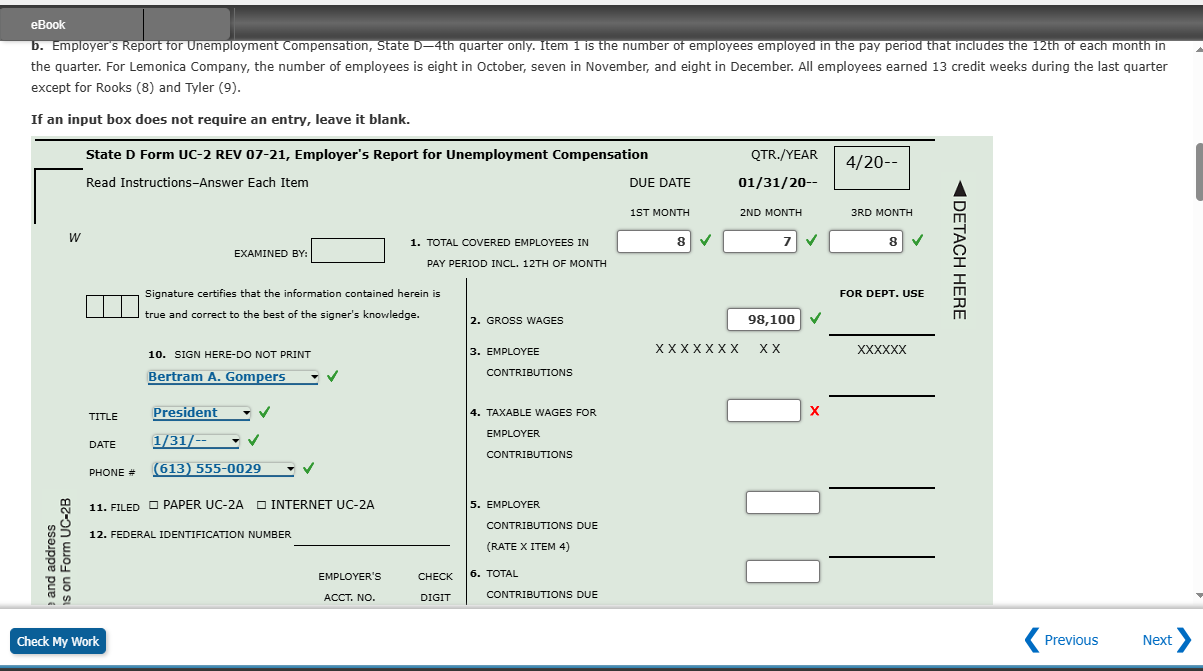

Question: State D Form UC - 2 REV 0 7 - 2 1 , Employer's Report for Unemployment Compensation Lemonica Company What are the employer taxable

State D Form UC REV Employer's Report for Unemployment Compensation Lemonica Company

What are the employer taxable wages for lines

the quarter. For Lemonica Company, the number of employees is eight in October, seven in November, and eight in December. All employees earned credit weeks during the last quarter

except for Rooks and Tyler

If an input box does not require an entry, leave it blank.

SIGN HEREDO NOT PRINT

Bertram A Gompers

Employer name and address

Make any corrections on Form UCB

EMPLOYEE

CONTRIBUTIONS

TAXABLE WAGES FOR

EMPLOYER

CONTRIBUTIONS

EMPLOYER

CONTRIBUTIONS DUE

RATE X ITEM

TOTAL

CONTRIBUTIONS DUE

ITEMS

INTEREST DUE

SEE INSTRUCTIONS

PENALTY DUE

SEE INSTRUCTIONS

TOTAL REMITTANCE

ITEMS

X

$

MAKE CHECKS PAYABLE TO:

PA UC FUND

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock