Question: State Ns sales factor is double-weighted, can't seem to get the apportionment percentage. The answer is not .6135 either. Please help. Oldham Incorporated conducts business

State Ns sales factor is double-weighted, can't seem to get the apportionment percentage. The answer is not .6135 either. Please help.

State Ns sales factor is double-weighted, can't seem to get the apportionment percentage. The answer is not .6135 either. Please help.

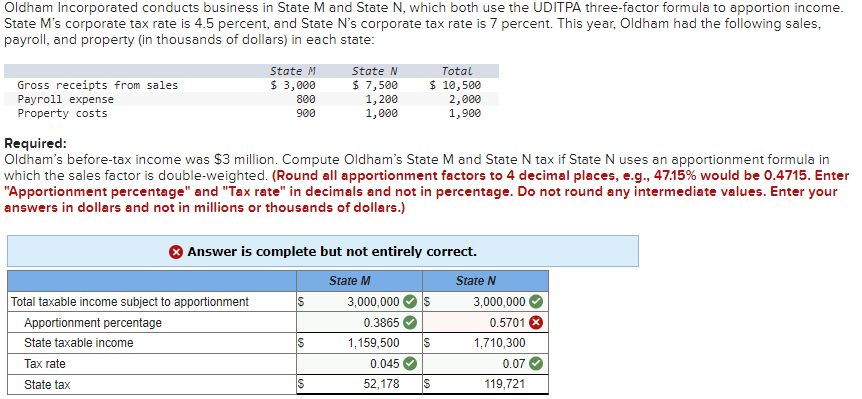

Oldham Incorporated conducts business in State Mand State N, which both use the UDITPA three-factor formula to apportion income. State M's corporate tax rate is 4.5 percent, and State N's corporate tax rate is 7 percent. This year, Oldham had the following sales, payroll, and property (in thousands of dollars) in each state: Gross receipts from sales Payroll expense Property costs State M $ 3,000 800 900 State N $ 7,500 1,200 1,000 Total $ 10,500 2,000 1,900 Required: Oldham's before-tax income was $3 million. Compute Oldham's State M and State N tax if State N uses an apportionment formula in which the sales factor is double-weighted. (Round all apportionment factors to 4 decimal places, e.g., 47.15% would be 0.4715. Enter "Apportionment percentage" and "Tax rate" in decimals and not in percentage. Do not round any intermediate values. Enter your answers in dollars and not in millions or thousands of dollars.) Answer is complete but not entirely correct. State M State N Total taxable income subject to apportionment S 3,000,000 3,000,000 Apportionment percentage 0.3865 0.5701 State taxable income S 1,159,500 S 1,710,300 Tax rate 0.045 0.07 State tax S 52,178 S 119,721

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts