Question: State St. Co. The State St. Co. has just gone public. Under a firm commitment agreement, the company received $17.64 for each of the 3.2

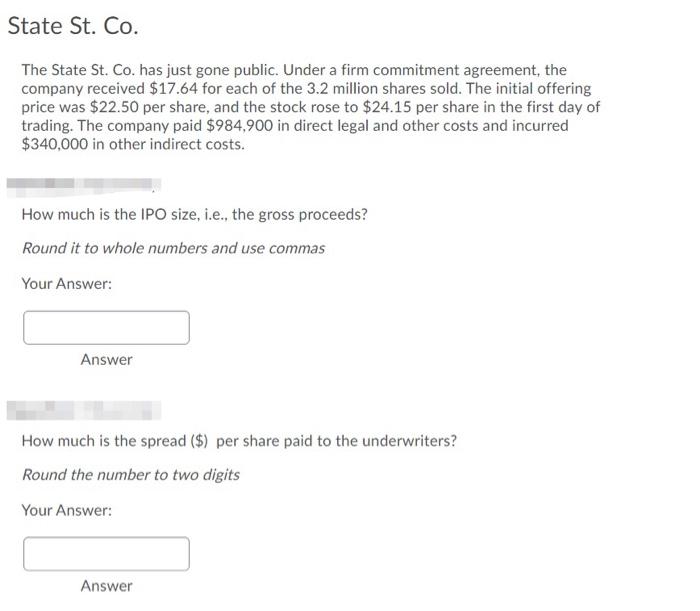

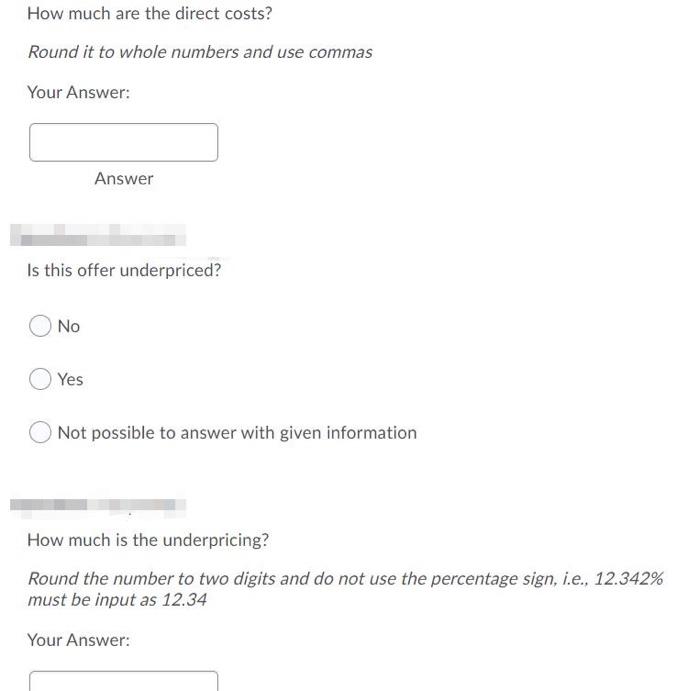

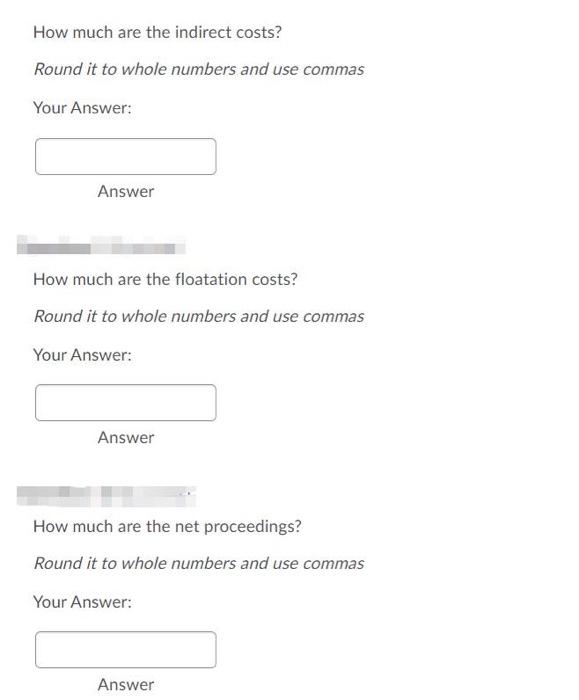

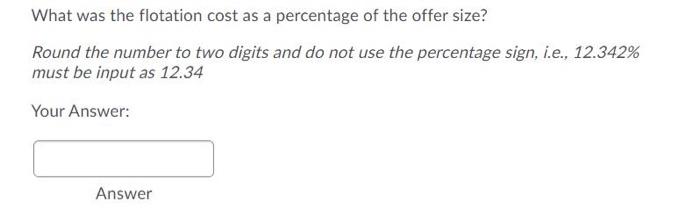

State St. Co. The State St. Co. has just gone public. Under a firm commitment agreement, the company received $17.64 for each of the 3.2 million shares sold. The initial offering price was $22.50 per share, and the stock rose to $24.15 per share in the first day of trading. The company paid $984,900 in direct legal and other costs and incurred $340,000 in other indirect costs. How much is the IPO size, i.e., the gross proceeds? Round it to whole numbers and use commas Your Answer: Answer How much is the spread ($) per share paid to the underwriters? Round the number to two digits Your Answer: Answer How much are the direct costs? Round it to whole numbers and use commas Your Answer: Answer Is this offer underpriced? No Yes Not possible to answer with given information How much is the underpricing? Round the number to two digits and do not use the percentage sign, i.e., 12.342% must be input as 12.34 Your Answer: How much are the indirect costs? Round it to whole numbers and use commas Your Answer: Answer How much are the floatation costs? Round it to whole numbers and use commas Your Answer: Answer How much are the net proceedings? Round it to whole numbers and use commas Your Answer: Answer What was the flotation cost as a percentage of the offer size? Round the number to two digits and do not use the percentage sign, i.e., 12.342% must be input as 12.34 Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts