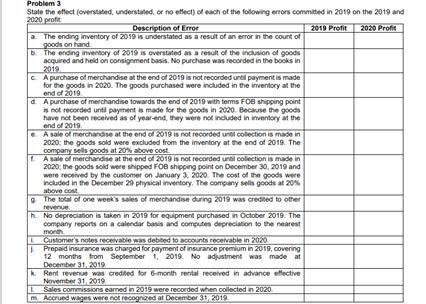

Question: State the effect (overstated, understated, or no effect) of each of the following errors committed in 2019 on the 2019 and 2020 profit: Problem ]

State the effect (overstated, understated, or no effect) of each of the following errors committed in 2019 on the 2019 and 2020 profit:

Problem ] Stain the effect (overdated, understated, or no effect) of each of the folowing error committed in 2010 on the 2010 and 2020 profit Description of Error 3019 Profit 2030 Profit The ending inventory of 2019 is understated as a result of an error in the count of goods on hand. The ending inventory of 2019 is overstated as a result of the inclusion of goods acquired and held on consignment basis, No purchase was recorded in the books in C. A purchase of merchandise at the end of 2019 is not recorded until payment is made for the goods in 2020. The goods purchased were included in the inventory at the and of 2019. dL A purchase of merchandise towards the end of 2010 with terms FOB shipping point Is not recorded unil payment is made for the goods in 2030. Because the goods have not been received as of your-and, they were not included in inventory at the end of 20 10. A sale of merchandise at the end of 2019 is not recorded until collection is made in 2020; the goods sold were excluded from the inventory at the end of 2019. The company sells goods at 20% above cost. L A sale of merchandise at the and of 2010 is not recorded unol collection is made in 2020; the goods sold were shipped FOB shipping point on December 30, 2019 and wore received by the customer on January 3. 2020. The cast of the goods were Included in the December 39 physical inventory, The company sells goods of 30% nbawn caall The total of one week's sales of merchandise during 2019 was credited to offer No depreciation is taken in 2019 for equipment purchased in October 2019. The comparry reports on a calendar badly and computes depreciation to the nearest month Customer's notes receivable was debited to accountsreceivable in 2020 Prepaid insurance was charged for payment of insurance premium in 2019, covering 12 months from September 1, 2019. No adjustment was made December 31, 2019. Rent revenue was credited for 6 month rental received in advance effective November 31, 2010 Sales commissions canned in 2017 were recorded when collected in 2020. m. A scrund wigas were not moognow' hit December 31, 2010

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts