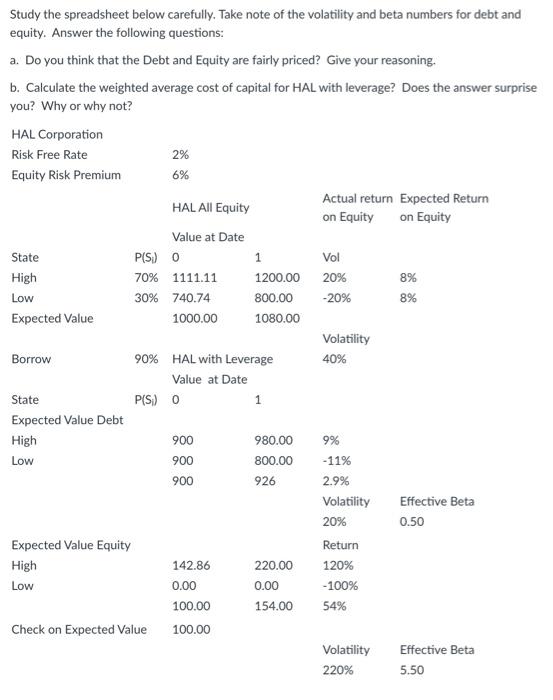

Question: State Vol Study the spreadsheet below carefully. Take note of the volatility and beta numbers for debt and equity. Answer the following questions: a. Do

State Vol Study the spreadsheet below carefully. Take note of the volatility and beta numbers for debt and equity. Answer the following questions: a. Do you think that the Debt and Equity are fairly priced? Give your reasoning. b. Calculate the weighted average cost of capital for HAL with leverage? Does the answer surprise you? Why or why not? HAL Corporation Risk Free Rate 2% Equity Risk Premium 6% HAL All Equity Actual return Expected Return on Equity on Equity Value at Date P(S) 0 1 High 70% 1111.11 1200.00 20% 8% Low 30% 740.74 800.00 -20% 8% Expected Value 1000.00 1080.00 Volatility Borrow 90% HAL with Leverage 40% Value at Date State P(S) 0 1 Expected Value Debt High 900 980.00 9% Low 900 800.00 -11% 900 926 2.9% Volatility Effective Beta 20% 0.50 Expected Value Equity Return High 142.86 220.00 120% Low 0.00 -100% 100.00 154.00 54% Check on Expected Value 100.00 Volatility Effective Beta 220% 5.50 0.00 State Vol Study the spreadsheet below carefully. Take note of the volatility and beta numbers for debt and equity. Answer the following questions: a. Do you think that the Debt and Equity are fairly priced? Give your reasoning. b. Calculate the weighted average cost of capital for HAL with leverage? Does the answer surprise you? Why or why not? HAL Corporation Risk Free Rate 2% Equity Risk Premium 6% HAL All Equity Actual return Expected Return on Equity on Equity Value at Date P(S) 0 1 High 70% 1111.11 1200.00 20% 8% Low 30% 740.74 800.00 -20% 8% Expected Value 1000.00 1080.00 Volatility Borrow 90% HAL with Leverage 40% Value at Date State P(S) 0 1 Expected Value Debt High 900 980.00 9% Low 900 800.00 -11% 900 926 2.9% Volatility Effective Beta 20% 0.50 Expected Value Equity Return High 142.86 220.00 120% Low 0.00 -100% 100.00 154.00 54% Check on Expected Value 100.00 Volatility Effective Beta 220% 5.50 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts