Question: State whether the following statements are True or False: 1. The expectations theory views long-term interest rates as equaling the average of future short-term interest

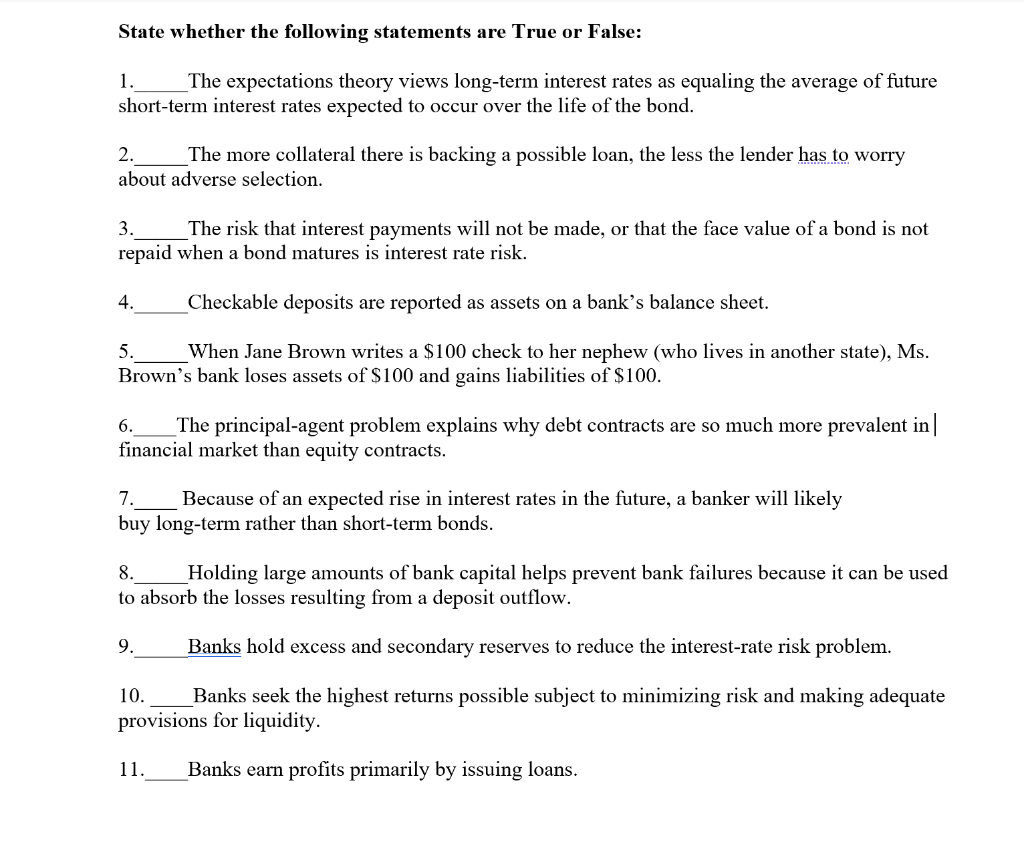

State whether the following statements are True or False: 1. The expectations theory views long-term interest rates as equaling the average of future short-term interest rates expected to occur over the life of the bond. 2. The more collateral there is backing a possible loan, the less the lender has to worry about adverse selection. 3. The risk that interest payments will not be made, or that the face value of a bond is not repaid when a bond matures is interest rate risk. 4. Checkable deposits are reported as assets on a bank's balance sheet. 5. When Jane Brown writes a $100 check to her nephew (who lives in another state), Ms. Brown's bank loses assets of $100 and gains liabilities of $100. 6. The principal-agent problem explains why debt contracts are so much more prevalent in| financial market than equity contracts. 7. Because of an expected rise in interest rates in the future, a banker will likely buy long-term rather than short-term bonds. 8. Holding large amounts of bank capital helps prevent bank failures because it can be used to absorb the losses resulting from a deposit outflow. 9. Banks hold excess and secondary reserves to reduce the interest-rate risk problem. 10. Banks seek the highest returns possible subject to minimizing risk and making adequate provisions for liquidity. 11. Banks earn profits primarily by issuing loans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts