Question: Statement 1: True or false Statement 2: True or False Stamenet 3: Incorrect or correct? Ch 02: Homework Assignment - Financial Statements, Cash Flow, and

Statement 1: True or false

Statement 2: True or False

Stamenet 3: Incorrect or correct?

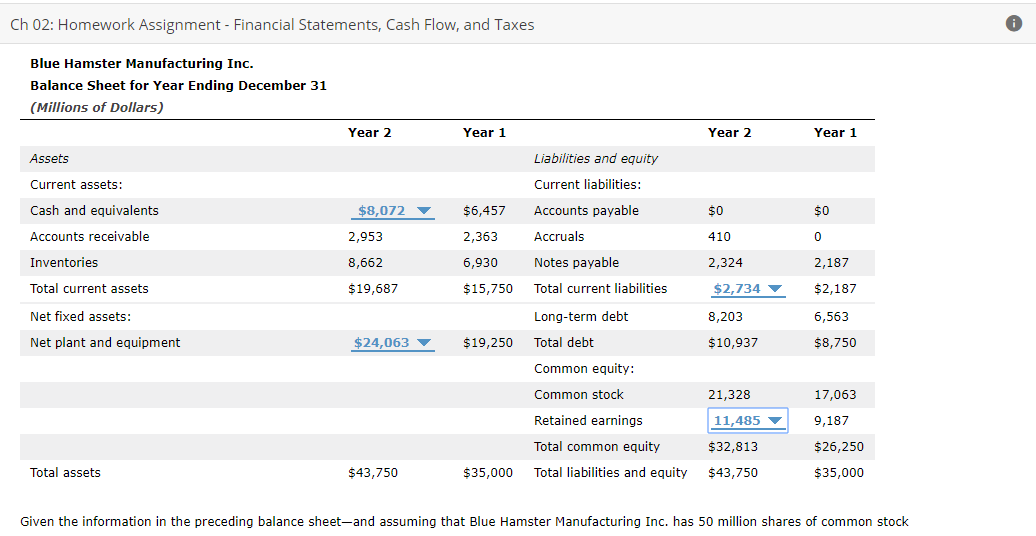

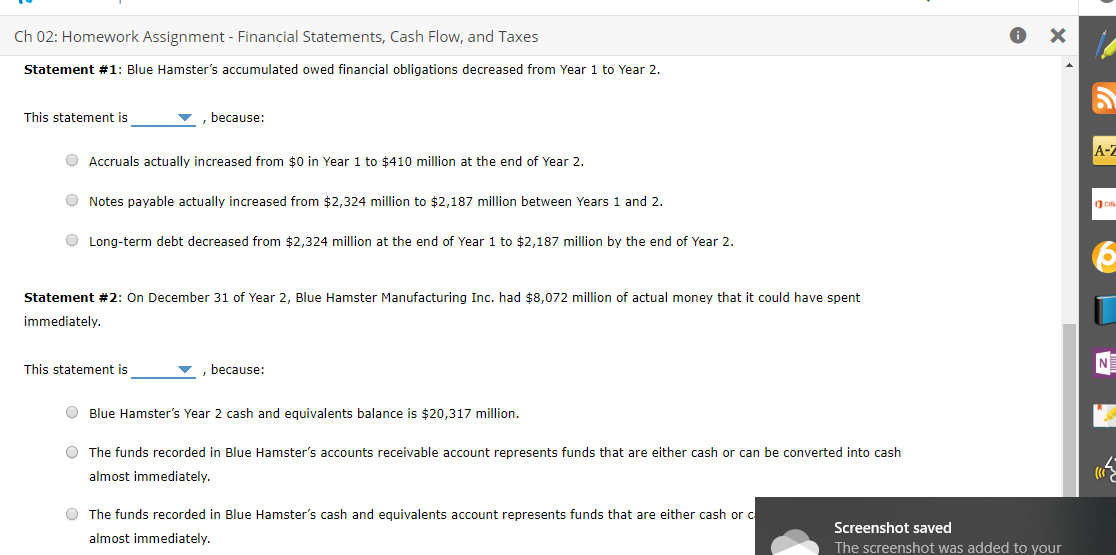

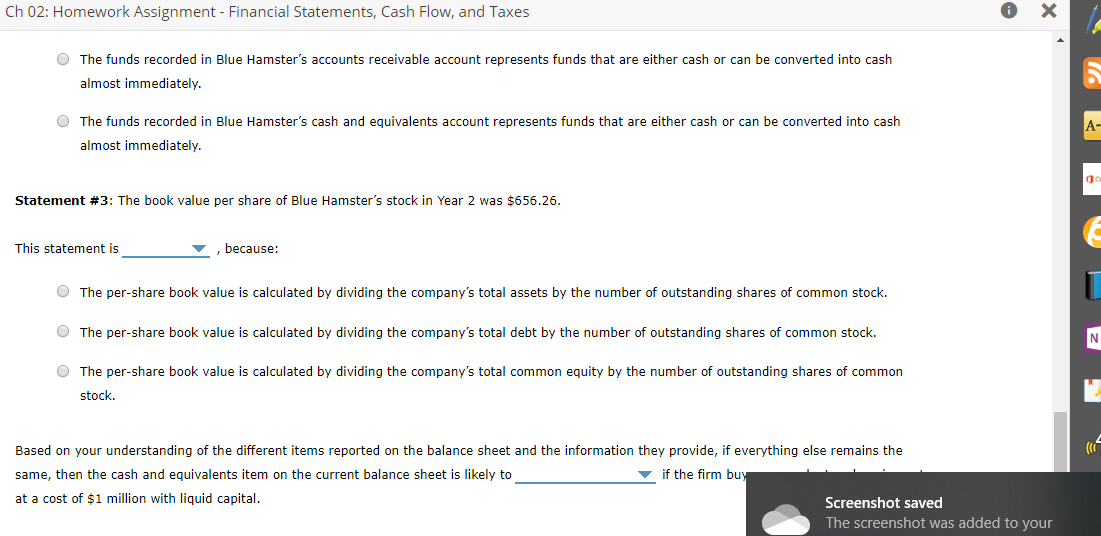

Ch 02: Homework Assignment - Financial Statements, Cash Flow, and Taxes Blue Hamster Manufacturing Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Year 1 Year 2 Liabilities and equity Assets Current assets: Current liabilities: Accounts payable Cash and equivalents $8,072 $6,457 $0 $0 Accruals Accounts receivable 2,953 2,363 410 0 Inventories 6,930 Notes payable 2,324 8,662 2,187 Total current liabilities Total current assets $19,687 $2,734 $15,750 $2,187 Net fixed assets: Long-term debt 8,203 6,563 Net plant and equipment $24,063 $19,250 Total debt $10,937 $8,750 Common equity Common stock 17,063 21,328 Retained earnings 11,485 9,187 Total common equity $32,813 $26,250 Total assets Total liabilities and equity $43,750 $35,000 $35,000 $43,750 Given the information in the preceding balance sheet-and assuming that Blue Hamster Manufacturing Inc. has 50 million shares of common stock Ch 02: Homework Assignment - Financial Statements, Cash Flow, and Taxes Statement #1: Blue Hamster's accumulated owed financial obligations decreased from Year 1 to Year 2 This statement is because: A-Z Accruals actually increased from $0 in Year 1 to $410 million at the end of Year 2 O Notes payable actually increased from $2,324 million to $2,187 million between Years 1 and 2 OLong-term debt decreased from $2,324 million at the end of Year 1 to $2,187 million by the end of Year 2 Statement #2: On December 31 of Year 2, Blue Hamster Manufacturing Inc. had $8,072 million of actual money that it could have spent immediately NO This statement is , because Blue Hamster's Year 2 cash and equivalents balance is $20,317 million O The funds recorded in Blue Hamster's accounts receivable account represents funds that are either cash or can be converted into cash almost immediately OThe funds recorded in Blue Hamster's cash and equivalents account represents funds that are either cash or c Screenshot saved almost immediately The screenshot was added to your X Ch 02: Homework Assignment - Financial Statements, Cash Flow, and Taxes O The funds recorded in Blue Hamster's accounts receivable account represents funds that are either cash or can be converted into cash almost immediately OThe funds recorded in Blue Hamster's cash and equivalents account represents funds that are either cash or can be converted into cash A- almost immediately Statement #3: The book value per share of Blue Hamster's stock in Year 2 was $656.26 This statement is , because OThe per-share book value is calculated by dividing the company's total assets by the number of outstanding shares of common stock. The per-share book value is calculated by dividing the company's total debt by the number of outstanding shares of common stock. O The per-share book value is calculated by dividing the company's total common equity by the number of outstanding shares of common stock Based on your understanding of the different items reported on the balance sheet and the information they provide, if everything else remains the same, then the cash and equivalents item on the current balance sheet is likely to if the firm buy at a cost of $1 million with liquid capital Screenshot saved The screenshot was added to your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts