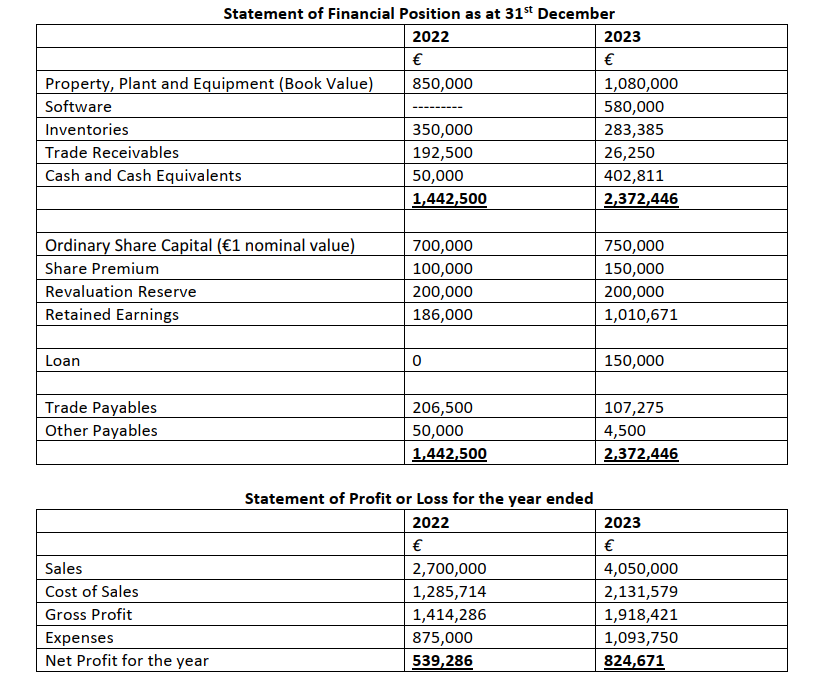

Question: Statement o f financial Position a s a t 3 1 s t December 2 0 2 2 Statement of Financial Position as at 3

Statement financial Position December Statement of Financial Position as at December

Statement of Profit or Loss for the year ended

Property, Plant and Equipment Value

Software

Inventories

Trade Receivables

Cash and Cash Equivalents

Total

Ordinary Share Capital nominal value

Share Premium

Revaluation Reserve

Retained Earnings

Loan

Trade Payables

Other Payables

Total

Statement financial Position December

Property, Plant and Equipment Value

Software

Inventories

Trade Receivables

Cash and Cash Equivalents

Total

Ordinary Share Capital nominal value

Share Premium

Revaluation Reserve

Retained Earnings

Loan

Trade Payables

Other Payables

Total

Statement Profit Loss for the year ended

Sales

Cost Sales

Gross Profit

Expenses

Net Profit for the year

Statement Profit Loss for the year ended

Sales

Cost Sales

Gross Profit

Expenses

Net Profit for the year

Using this information prepare a report highlighting and analyzing the expected performance comparing the financial results Blue Oyster for the years ended December and using the following accounting ratios:

Profitability Gross Profit Margin and Net Profit Margin

Liquidity Ratio and Acid Test Ratio

Efficiency Collection Period and Creditors Payment Period

Financial Structure Ratio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock