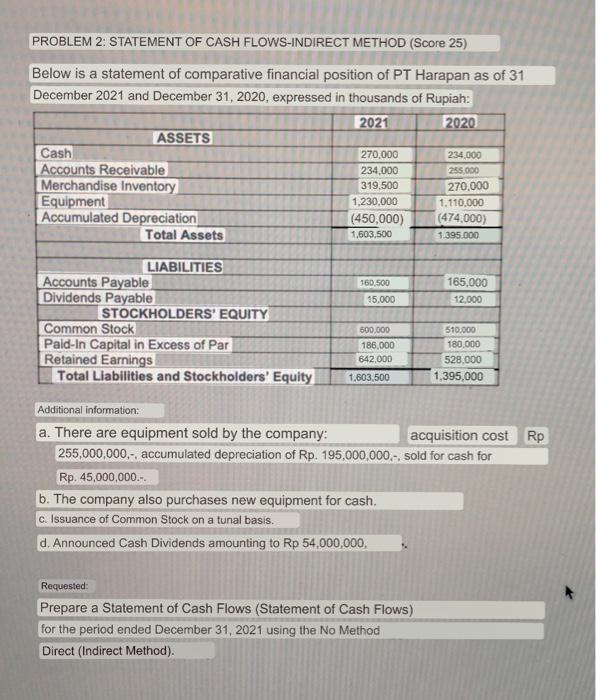

Question: statement of cash flow - INDIRECT METHOD PROBLEM 2: STATEMENT OF CASH FLOWS-INDIRECT METHOD (Score 25) Below is a statement of comparative financial position of

PROBLEM 2: STATEMENT OF CASH FLOWS-INDIRECT METHOD (Score 25) Below is a statement of comparative financial position of PT Harapan as of 31 December 2021 and December 31, 2020, expressed in thousands of Rupiah: 2021 2020 ASSETS Cash Accounts Receivable Merchandise Inventory Equipment Accumulated Depreciation Total Assets LIABILITIES Accounts Payable Dividends Payable STOCKHOLDERS' EQUITY Common Stock Paid-In Capital in Excess of Par Retained Earnings Total Liabilities and Stockholders' Equity 270,000 234,000 319,500 1,230,000 (450,000) 1,603,500 160,500 15,000 600,000 186,000 642,000 1,603,500 234,000 255.000 270,000 1,110,000 (474,000) 1.395.000 Requested: Prepare a Statement of Cash Flows (Statement of Cash Flows) for the period ended December 31, 2021 using the No Method Direct (Indirect Method). 165,000 12,000 510,000 180,000 528,000 1,395,000 Additional information: a. There are equipment sold by the company: 255,000,000,-, accumulated depreciation of Rp. 195,000,000,-, sold for cash for Rp. 45,000,000.-. b. The company also purchases new equipment for cash. c. Issuance of Common Stock on a tunal basis. d. Announced Cash Dividends amounting to Rp 54,000,000, acquisition cost Rp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts