Question: Statement of Cash Flows (Indirect Method) Financial statement data for Bankhead, Inc., are provided. (All numbers are shown rounded to the nearest thousand, with O00's

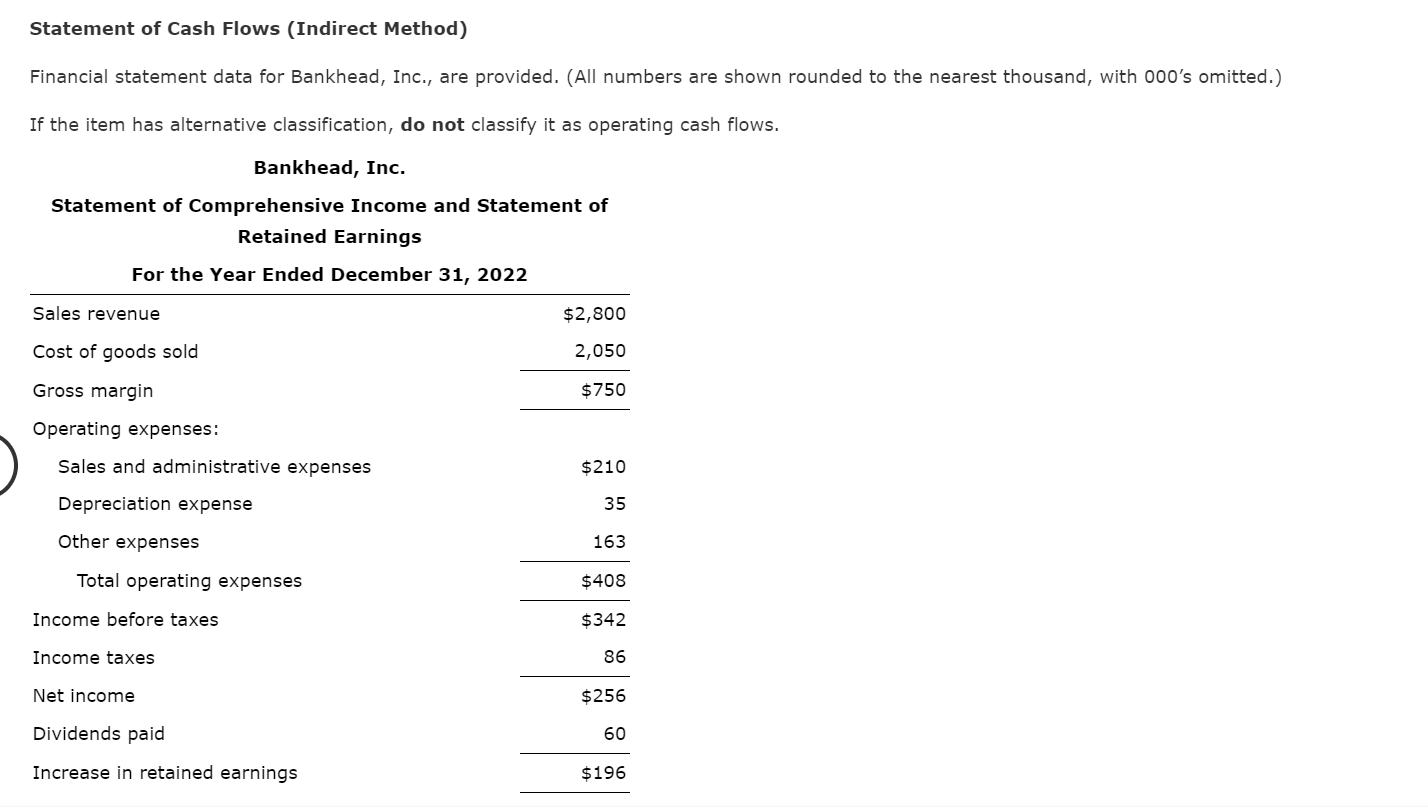

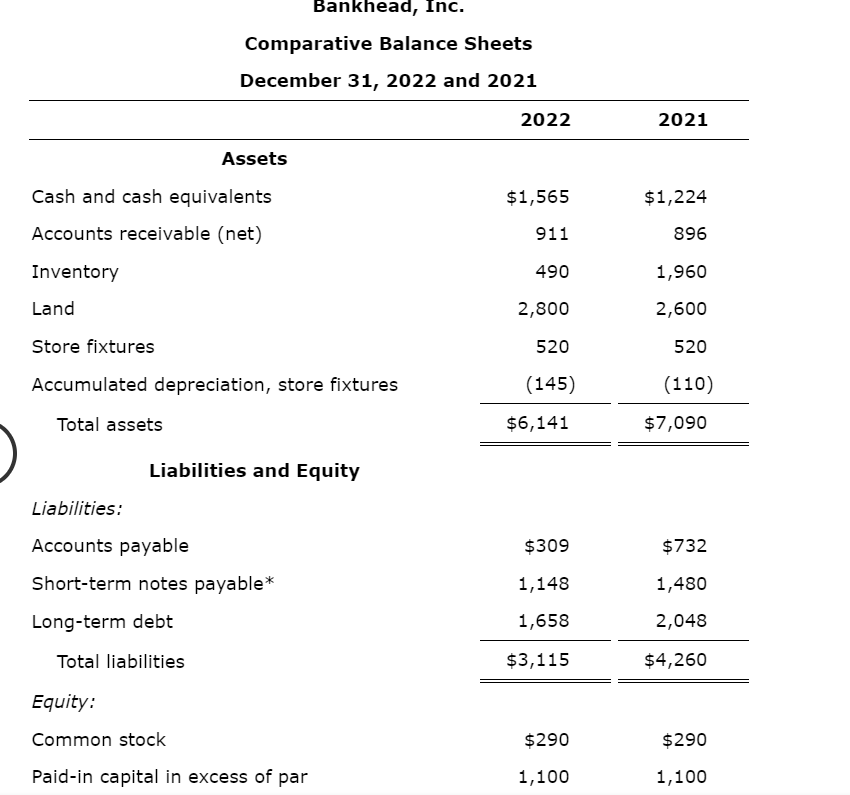

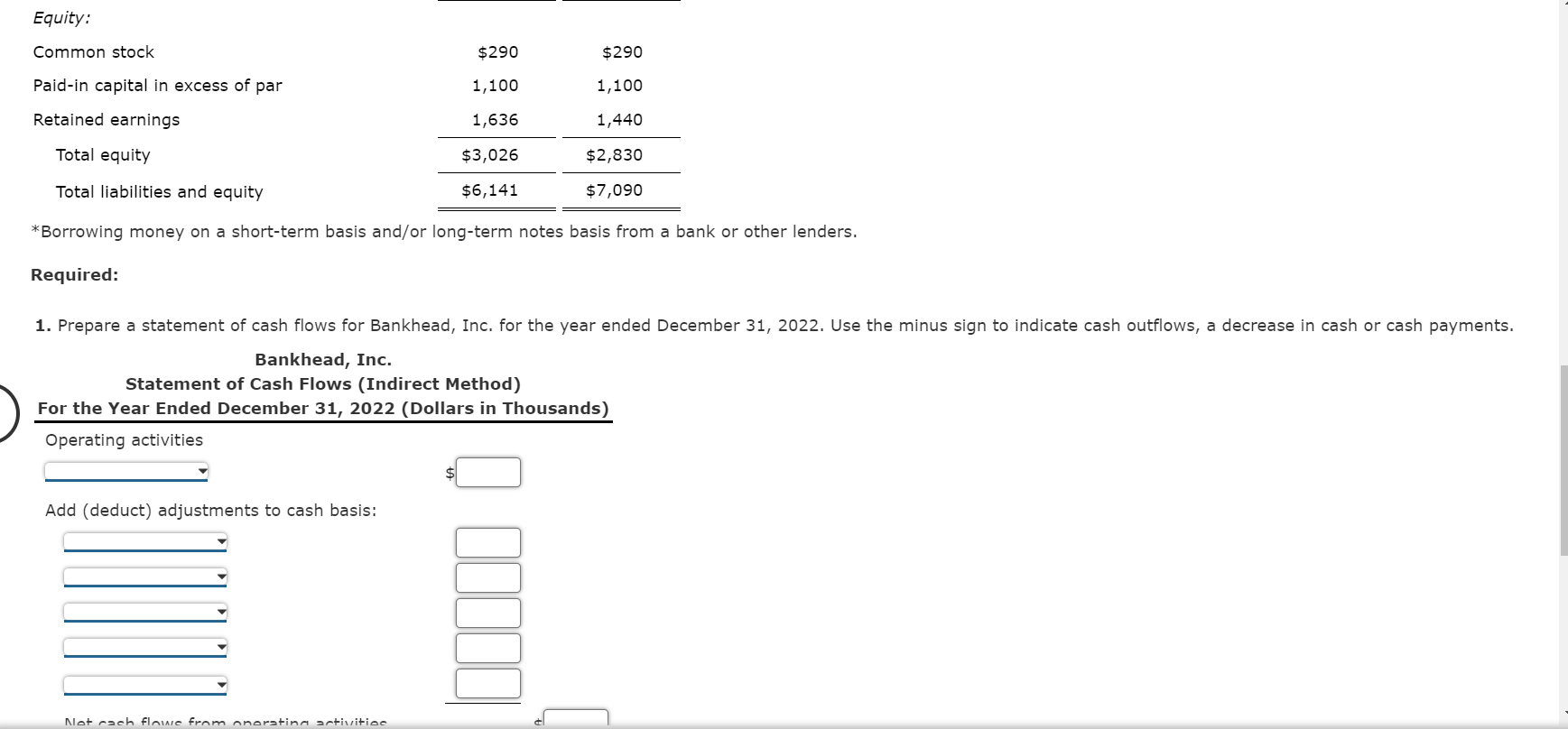

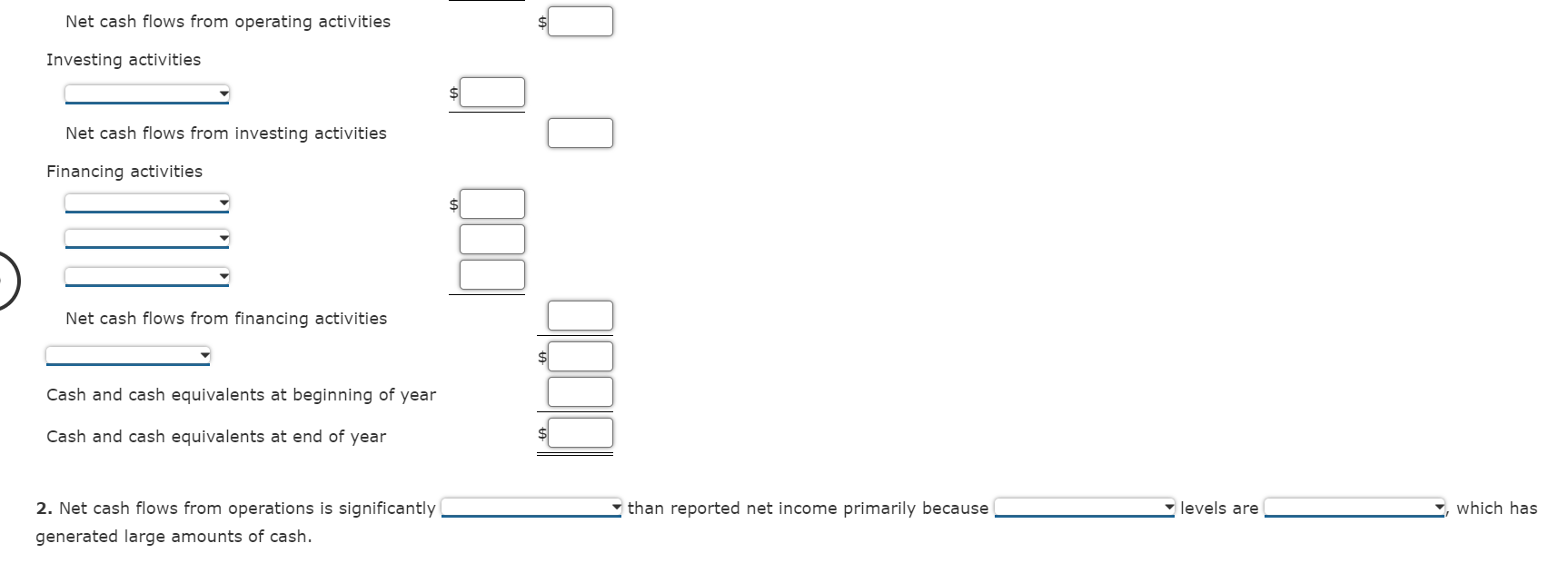

Statement of Cash Flows (Indirect Method) Financial statement data for Bankhead, Inc., are provided. (All numbers are shown rounded to the nearest thousand, with O00's omitted.) If the item has alternative classification, do not classify it as operating cash flows. Bankhead, Inc. Comparative Balance Sheets December 31, 2022 and 2021 \begin{tabular}{lrr} \hline & 2022 & 2021 \\ \hline \multicolumn{1}{c}{ Assets } & & \\ & & \\ Cash and cash equivalents & $1,565 & $1,224 \\ Accounts receivable (net) & 911 & 896 \\ Inventory & 490 & 1,960 \\ Land & 2,800 & 2,600 \\ Store fixtures & 520 & 520 \\ Accumulated depreciation, store fixtures & (145) & (110) \\ Total assets & $6,141 & $7,090 \\ \end{tabular} Liabilities and Equity Liabilities: \begin{tabular}{lcc} Accounts payable & $309 & $732 \\ Short-term notes payable* & 1,148 & 1,480 \\ Long-term debt & 1,658 & 2,048 \\ \cline { 2 - 3 } Total liabilities & $3,115 & $4,260 \\ Equity: & & \\ Common stock & $290 & $290 \\ Paid-in capital in excess of par & 1,100 & 1,100 \end{tabular} *Borrowing money on a short-term basis and/or long-term notes basis from a bank or other lenders. 2. Net cash flows from operations is significantly than reported net income primarily because levels are which has Statement of Cash Flows (Indirect Method) Financial statement data for Bankhead, Inc., are provided. (All numbers are shown rounded to the nearest thousand, with O00's omitted.) If the item has alternative classification, do not classify it as operating cash flows. Bankhead, Inc. Comparative Balance Sheets December 31, 2022 and 2021 \begin{tabular}{lrr} \hline & 2022 & 2021 \\ \hline \multicolumn{1}{c}{ Assets } & & \\ & & \\ Cash and cash equivalents & $1,565 & $1,224 \\ Accounts receivable (net) & 911 & 896 \\ Inventory & 490 & 1,960 \\ Land & 2,800 & 2,600 \\ Store fixtures & 520 & 520 \\ Accumulated depreciation, store fixtures & (145) & (110) \\ Total assets & $6,141 & $7,090 \\ \end{tabular} Liabilities and Equity Liabilities: \begin{tabular}{lcc} Accounts payable & $309 & $732 \\ Short-term notes payable* & 1,148 & 1,480 \\ Long-term debt & 1,658 & 2,048 \\ \cline { 2 - 3 } Total liabilities & $3,115 & $4,260 \\ Equity: & & \\ Common stock & $290 & $290 \\ Paid-in capital in excess of par & 1,100 & 1,100 \end{tabular} *Borrowing money on a short-term basis and/or long-term notes basis from a bank or other lenders. 2. Net cash flows from operations is significantly than reported net income primarily because levels are which has

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts