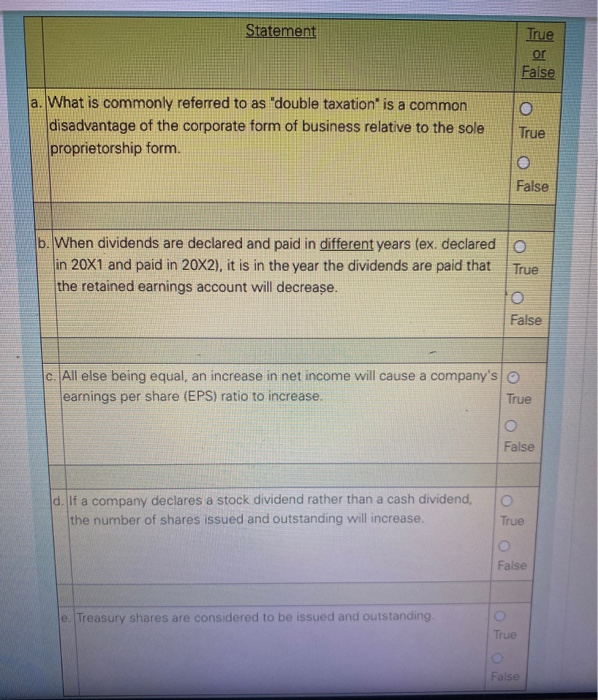

Question: Statement True or False a. What is commonly referred to as double taxation' is a common disadvantage of the corporate form of business relative to

Statement True or False a. What is commonly referred to as "double taxation' is a common disadvantage of the corporate form of business relative to the sole proprietorship form. O True O False b. When dividends are declared and paid in different years (ex. declaredo in 20X1 and paid in 20X2), it is in the year the dividends are paid that True the retained earnings account will decrease. False c. All else being equal, an increase in net income will cause a company's o earnings per share (EPS) ratio to increase. True o False d. If a company declares a stock dividend rather than a cash dividend, the number of shares issued and outstanding will increase. True O False e Treasury shares are considered to be issued and outstanding. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts