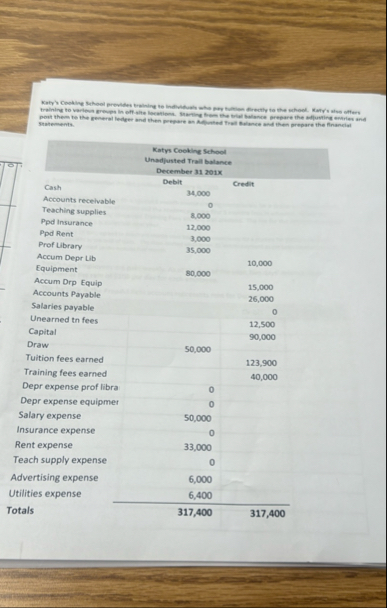

Question: statementy. table [ [ table [ [ Katys Cooking School Unadjusted Trall balance ] , [ December 3 1 2 0 1 5

statementy.

tabletableKatys Cooking School Unadjusted Trall balanceDecember CashDebit,CreditAccounts recelvable,Teaching supplies,Ppd Insurance,Ppd Rent,Prof Library,Accum Depr Lib,,EquipmentAccum Drp Equip,,Accounts Payable,,Salaries payable,,Unearned tn fees,,CapitalDrawTuition fees earned,,Training fees earned,,Depr expense prof libra,Depr expense equipmer,Salary expense,Insurance expense,Rent expense,Teach supply expense,Advertising expense,Jtilities expense,Totals

Enter the account balances from the trall balance in the General Ledger

Journal the following adjusting Entries

a An analysis of the insurance policies show that $ of coverage has explied

b An inventory count shows that teaching supplies costine $ are available at yearend.

c Xinual Depreciation on the equipment is $

d Annual Depreciation on the professional library is

On Nov katy apreed to do a spectatt imbuth course starting in ediately for a student. The contract calls for a monthly fee of $ and the student paid the first mosths fees in advance. When the cash was recelved, the Unearned Training Fees account was credited. The fee for the th month with be e recorded when it is collected next year.

On Octaber Taby acreed to teach a month class beensing imediativi for a slodent for $ tultion per month parable at the end of class. The class started on October is but no payment as yet been received. Katy's f accruals are applied to the nearest hall month.

Katy's two employees are paid weekly. As of the end of the year, two days' salaries have g accrued at the rate of $ per day for each employee.

h The balance in the Prepaid Rent account represents rent for December.

eneral Journal

Debit

Credit

tabletabletableAdjusted Trail BalanceTRIAL BALANCE,,,AccountsDRCRTotalsKatys Cooking School Income statement December X

Revenue Expenses

tableTotal Expenses,Net Income,

Katys Cooking School

Statement of Owners Equity

December X

Statement of owner equity

Beginning Equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock