Question: QUESTION 3 You purchase a 2 year call option. The option gives you the right to buy the stock at $65. The current stock

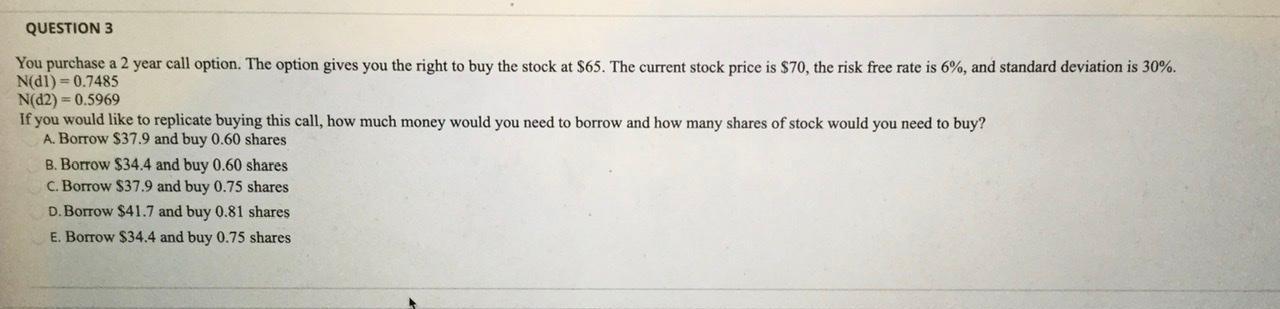

QUESTION 3 You purchase a 2 year call option. The option gives you the right to buy the stock at $65. The current stock price is $70, the risk free rate is 6%, and standard deviation is 30%. N(dl) = 0.7485 N(d2) = 0.5969 If you would like to replicate buying this call, how much money would you need to borrow and how many shares of stock would you need to buy? A. Borrow $37.9 and buy 0.60 shares B. Borrow $34.4 and buy 0.60 shares C. Borrow $37.9 and buy 0.75 shares D. Borrow $41.7 and buy 0.81 shares E. Borrow $34.4 and buy 0.75 shares

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

The replicating portfolio is embedded in the BlackScholes model To replicate this call you w... View full answer

Get step-by-step solutions from verified subject matter experts