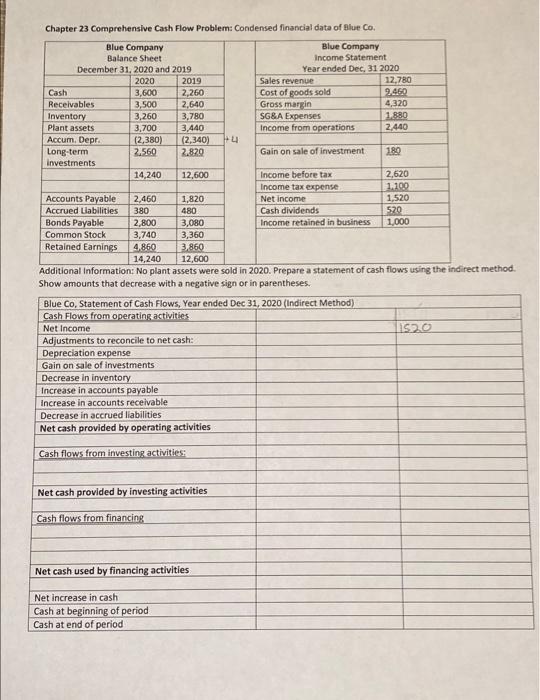

Question: statment of cash flows using the indirect method Chapter 23 Comprehensive Cash Flow Problem: Condensed financial data of Blue Co. Blue Company Blue Company Balance

Chapter 23 Comprehensive Cash Flow Problem: Condensed financial data of Blue Co. Blue Company Blue Company Balance Sheet Income Statement December 31, 2020 and 2019 Year ended Dec, 31 2020 2020 2019 Sales revenue 12,780 Cash 3,600 2,260 Cost of goods sold 9.460 Receivables 3,500 2,640 Gross margin 4,320 Inventory 3,260 3,780 SG&A Expenses 1.880 Plant assets 3,700 3,440 Income from operations 2,440 Accum, Depr. (2,380) (2,340) 4 Long-term 2.560 2.820 Gain on sale of investment 180 Investments 14,240 12,600 Income before tax 2,620 Income tax expense 1.100 Accounts Payable 2,460 1,820 Net income 1,520 Accrued Liabilities 380 480 Cash dividends 520 Bonds Payable 2,800 3,080 Income retained in business 1,000 Common Stock 3,740 3,360 Retained Earnings 4,860 3,860 14,240 12,600 Additional Information: No plant assets were sold in 2020. Prepare a statement of cash flows using the indirect method. Show amounts that decrease with a negative sign or in parentheses. Blue Co, Statement of Cash Flows, Year ended Dec 31, 2020 (Indirect Method) Cash Flows from operating activities Net Income 1520 Adjustments to reconcile to net cash: Depreciation expense Gain on sale of investments Decrease in inventory Increase in accounts payable Increase in accounts receivable Decrease in accrued liabilities Net cash provided by operating activities Cash flows from investing activities: Net cash provided by investing activities Cash flows from financing Net cash used by financing activities Net increase in cash Cash at beginning of period Cash at end of period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts