Question: Step 1 Answer: a ) Before the merger, the optimal network for each firm to minimize costs can be found by comparing the variable production

Step

Answer:

a Before the merger, the optimal network for each firm to minimize costs can be found by comparing the variable production and shipping costs to the regional demand in each market. A plant should be located in each region where the variable production and shipping costs are lower than the price per unit of the appliance euros and where the regional demand is high enough to justify the investment.

For Hot&Cold, the optimal network would consist of plants in France, Germany, and Finland, as they have lower variable production and shipping costs than the price per unit, and their combined capacities are sufficient to meet the regional demand in each market.

For CaldoFreddo, the optimal network would consist of plants in the UK and Italy, as they have lower variable production and shipping costs than the price per unit, and their combined capacities are sufficient to meet the regional demand in each market.

Explanation:

To maximize aftertax profits, the optimal network would also take into account the tax rates in each country. The plants should be located in regions where the tax rates are lower, and where the aftertax profits would be higher. This would result in a slightly different network than the one to minimize costs.

Step

b

b After the merger, the minimum cost configuration can be found by comparing the combined capacities of the plants to the total demand in each region. The configuration that minimizes costs would be the one that meets the total demand in each region with the lowest combined variable production and shipping costs.

Assuming none of the plants are shut down, the minimum cost configuration would consist of:

France plant for the North region capacity of million units per year

Germany plant for the East region capacity of million units per year

Finland plant for the South region capacity of million units per year

UK plant for the West region capacity of million units per year

Italy plant for the South region capacity of million units per year

The configuration that maximizes aftertax profits would take into account the tax rates in each country, and would locate the plants in regions where the tax rates are lower, and where the aftertax profits would be higher. This would result in a different network than the one to minimize costs.

Assuming none of the plants are shut down, the configuration that maximizes aftertax profits would consist of:

France plant for the North region capacity of million units per year

Germany plant for the East region capacity of million units per year

Finland plant for the South region capacity of million units per year

UK plant for the West region capacity of million units per year

The Italy plant would be shut down, as its capacity is not needed to meet the demand in the South region, and its tax rate is the highest

Step

c After the merger, if plants can be shut down, the minimum cost configuration would consist of the same plants as in part b except for the Italy plant, which would be shut down. This would save percent of the annual fixed cost of the plant, which is million euros per year.

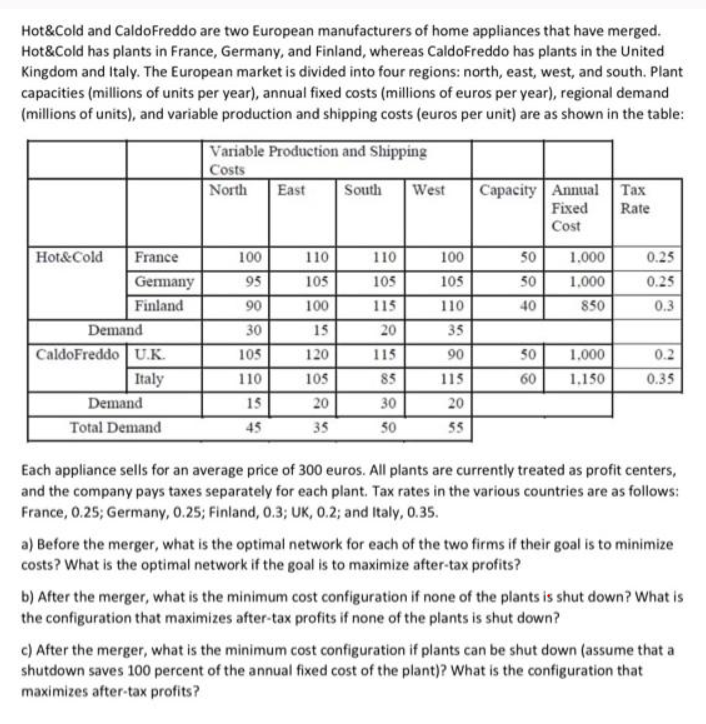

The configuration that maximizes aftertax profits would be the same as in part b as shutting down the Italy plant would not affect the aftertax profits of the other plants. The tax savings from shutting down the Italy plant would be offset by the loss of profits from the lower capacity.Hot&Cold and CaldoFreddo are two European manufacturers of home appliances that have merged.

Hot&Cold has plants in France, Germany, and Finland, whereas CaldoFreddo has plants in the United

Kingdom and Italy. The European market is divided into four regions: north, east, west, and south. Plant

capacities millions of units per year annual fixed costs millions of euros per year regional demand

millions of units and variable production and shipping costs euros per unit are as shown in the table:

Each appliance sells for an average price of euros. All plants are currently treated as profit centers,

and the company pays taxes separately for each plant. Tax rates in the various countries are as follows:

France, ; Germany, ; Finland, ; UK; and Italy,

a Before the merger, what is the optimal network for each of the two firms if their goal is to minimize

costs? What is the optimal network if the goal is to maximize aftertax profits?

b After the merger, what is the minimum cost configuration if none of the plants is shut down? What is

the configuration that maximizes aftertax profits if none of the plants is shut down?

c After the merger, what is the minimum cost configuration if plants can be shut down assume that a

shutdown saves percent of the annual fixed cost of the plant What is the configuration that

maximizes aftertax profits?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock