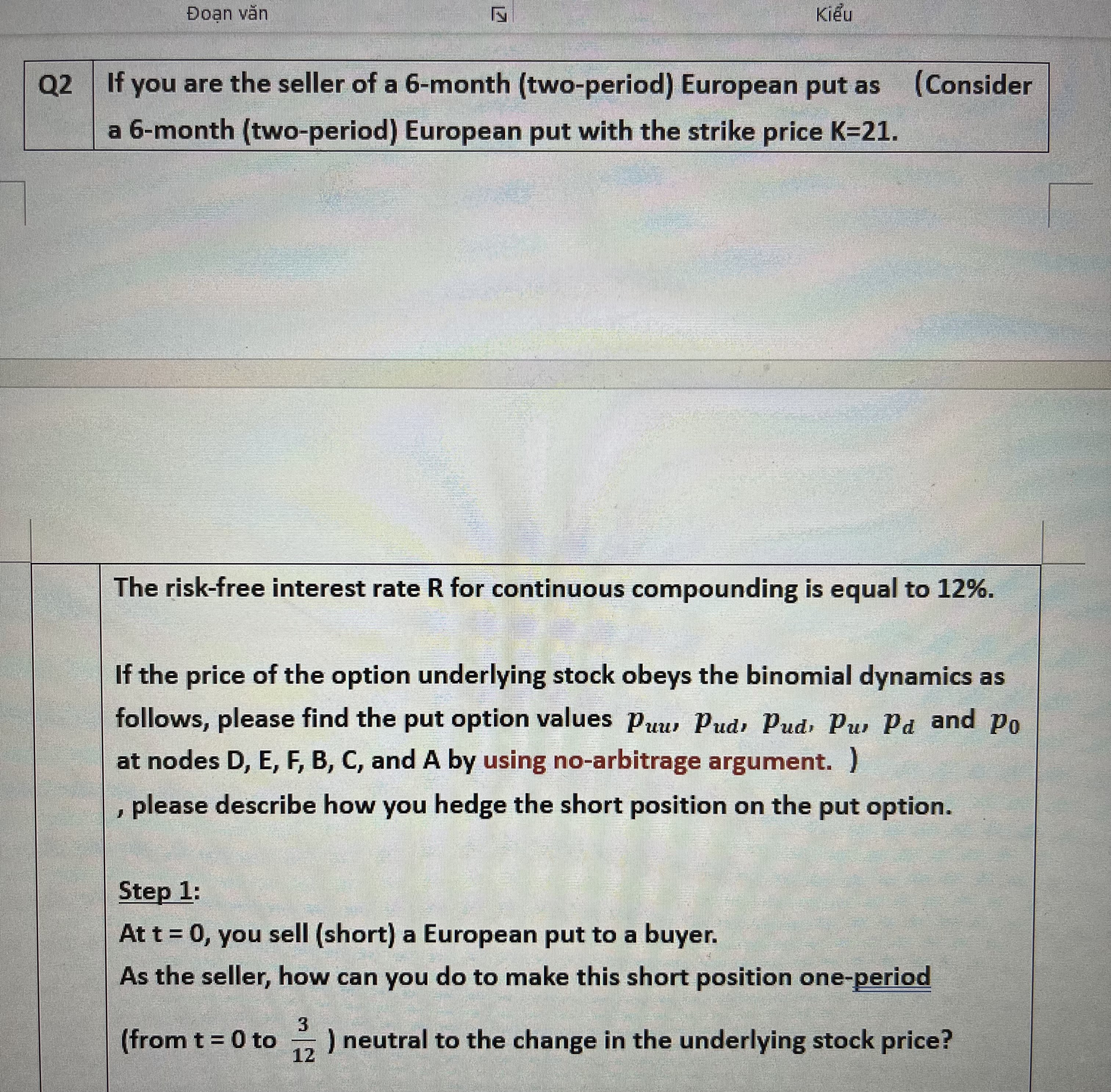

Question: Step 1 : At t = 0 , you sell ( short ) a European put to a buyer. As the seller, how can you

Step :

At you sell short a European put to a buyer.

As the seller, how can you do to make this short position oneperiod from to neutral to the change in the underlying stock price?

Ans.

Step : At and

How much do you have in your bank account?

Ans.

When the price of the underlying stock goes up to $ the delta of the put option increase from to Show

Ans.

What's delta of the portfolio constructed at time if you keep the delta unchanged ie

Ans.

To make the portfolio delta neutral ie when how should you do

Step : At and

How much do you have in your bank account?

Ans.

When the price of the underlying stock goes down to $ the delta of the put option decrease from to Show

Ans.

To make the portfolio delta neutral ie when how should you do

Ans.

Step : Show your profits or losses when the stock price on the option maturity date is from

Ans.

Show your profits or losses when the stock price on the option maturity date is from

Ans.

Step : Show your profits or losses when the stock price on the option maturity date is from

Ans.

Show your profits or losses when the stock price on the option maturity date is from

Ans.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock