Question: Step 1: Create a realistic spending estimate by listing your yearly expenses, which are all your costs. If your parent(s)/guardian($] support most of your living

![expenses, which are all your costs. If your parent(s)/guardian($] support most of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6cebe43e36_81466f6cebe2059d.jpg)

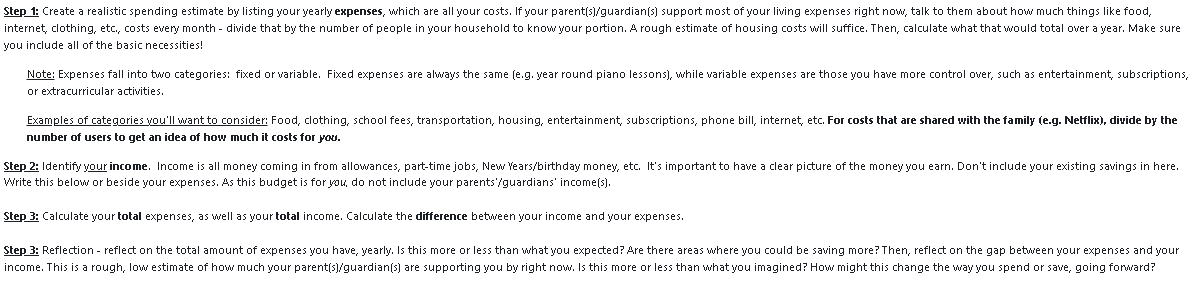

Step 1: Create a realistic spending estimate by listing your yearly expenses, which are all your costs. If your parent(s)/guardian($] support most of your living expenses right now, talk to them about how much things like food, internet, clothing, etc., costs every month - divide that by the number of people in your household to know your portion. A rough estimate of housing costs will suffice. Then, calculate what that would total over a year. Make sure you include all of the basic necessities! Note: Expenses fall into two categories: fixed orvariable. Fixed expenses are always the same (e.g. year round piano lessons), while variable expenses are those you have more control over, such as entertainment, subscriptions, or extracurricular activities. Examples of categories you'll want to consider: Food, clothing, school fees, transportation, housing, entertainment, subscriptions, phone bill, internet, etc. For costs that are shared with the family (e.g. Netflix), divide by the number of users to get an idea of how much it costs for you. Step 2: Identify your income. Income is all money coming in from allowances, part-time jobs, New Years/birthday money, etc. It's important to have a clear picture of the money you earn. Don't include your existing savings in here. Write this below or beside your expenses. As this budget is for you, do not include your parents'/guardians' income(s). Step 3: Calculate your total expenses, as well as your total income. Calculate the difference between your income and your expenses. Step 3: Reflection - reflect on the total amount of expenses you have, yearly. Is this more or less than what you expected? Are there areas where you could be saving more? Then, reflect on the gap between your expenses and your income. This is a rough, low estimate of how much your parent(s)/guardian(s) are supporting you by right now. Is this more or less than what you imagined? How might this change the way you spend or save, going forward?setting Up a Budget Look into how much it costs right now to maintain your current lifestyle, and record your annual expenses and income here. This will give you a rough idea of your current cost of living. >Include only expenses and income that appliesto you. Your parent(s)/guardian(s) may be paying for your expenses, but still find outwhat your share is and add it (e.g. your share of the hydro bill). * Do NOT include any one else'sincome. *You may need to talk to your parent(s)/guardian(s) about some items. > Feel free to add more rowsif needed. Expenses - Essentials Amount Income Amount Annually Annually Groceries S (E.g. Part-time job) S Clothing ( Add more) Expenses - Amount Non-Essentials Annually Dining out Total annual expenses: Total annual income: Gap between income and expenses (income minus expenses):Reflection Reflect on the total amount of expenses you have, yearly. Is this more or less than what you expected? Are there areas where you could be saving more? Then, reflect on the gap between your expenses and your income. This is a rough, low estimate of how much your parent (s)/guardian(s) are supporting you by right now. Is this more or less than what you imagined? How might this change the way you spend or save, going forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts