Question: Step 1. identify and analyze the transactions 1-12 Step 2. Record transactions to Journal on the sheet namedJournal Entries-1 Step 3. Post journal information from

Step 1. identify and analyze the transactions 1-12

Step 2. Record transactions to Journal on the sheet named"Journal Entries-1"

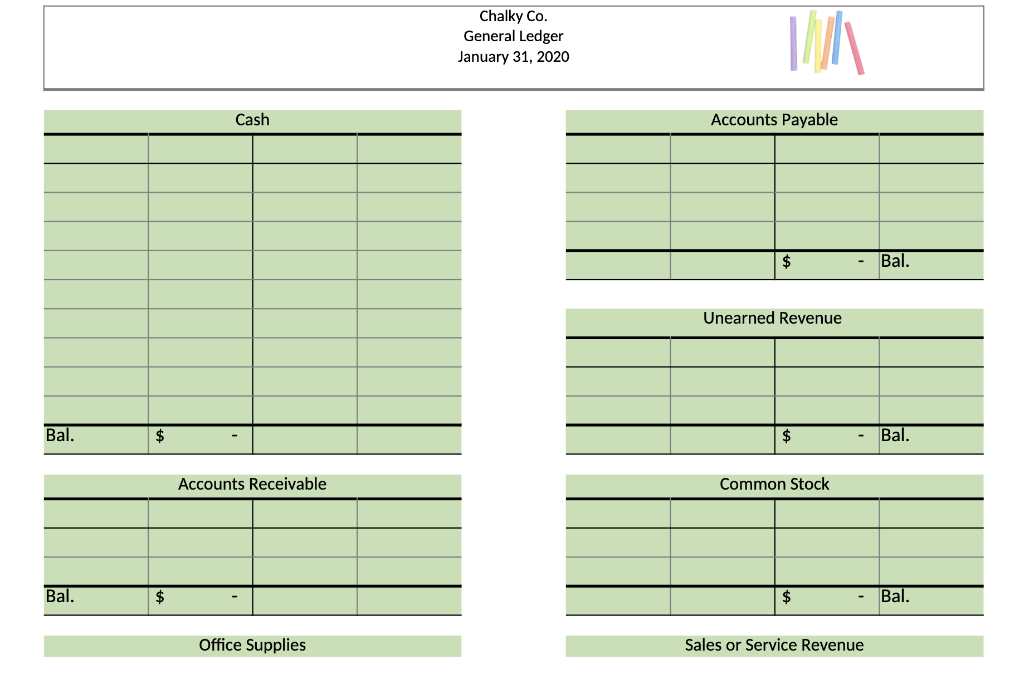

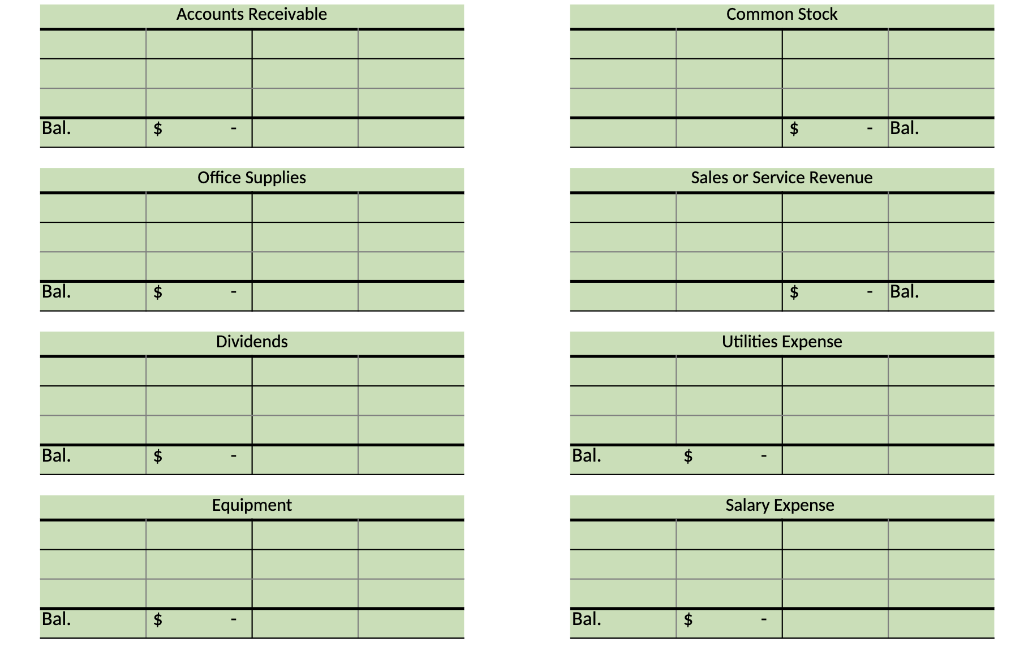

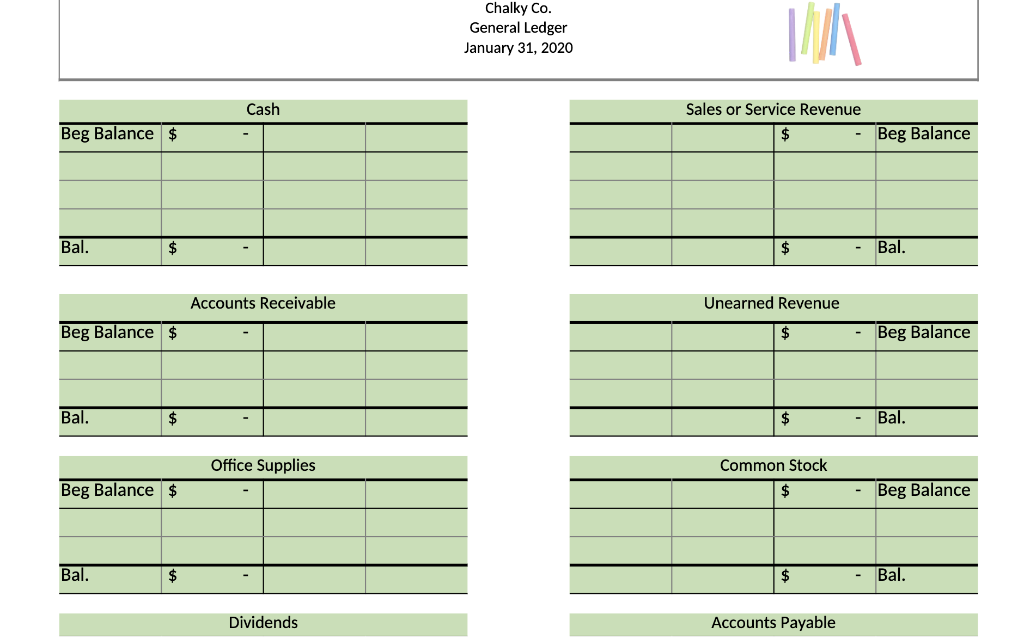

Step 3. Post journal information from "Journal Entries -1" to the sheet named "General Ledger-1"

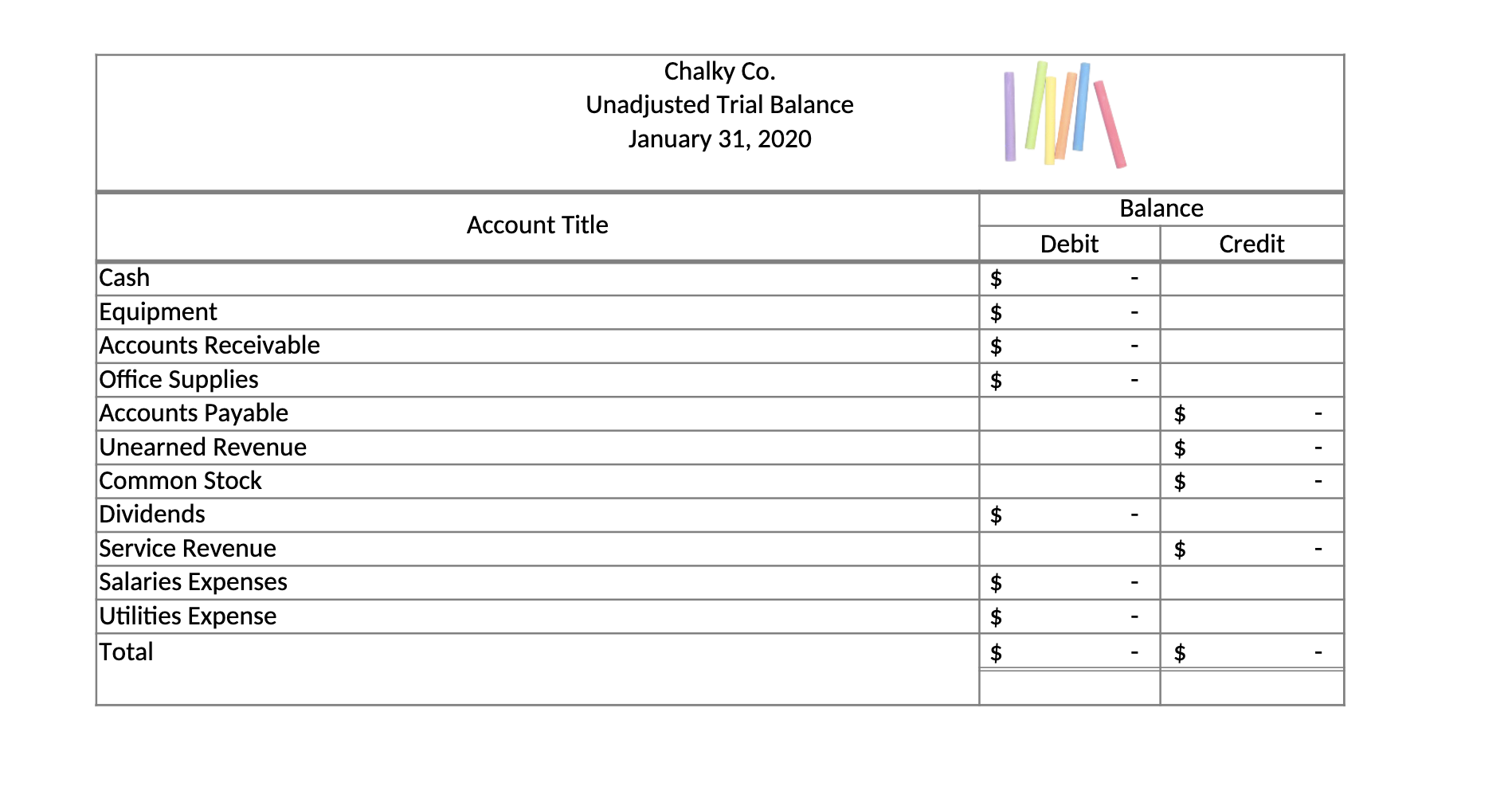

Step 4. Use the information on "General Ledger-1" to prepare the unadjusted trial balance.

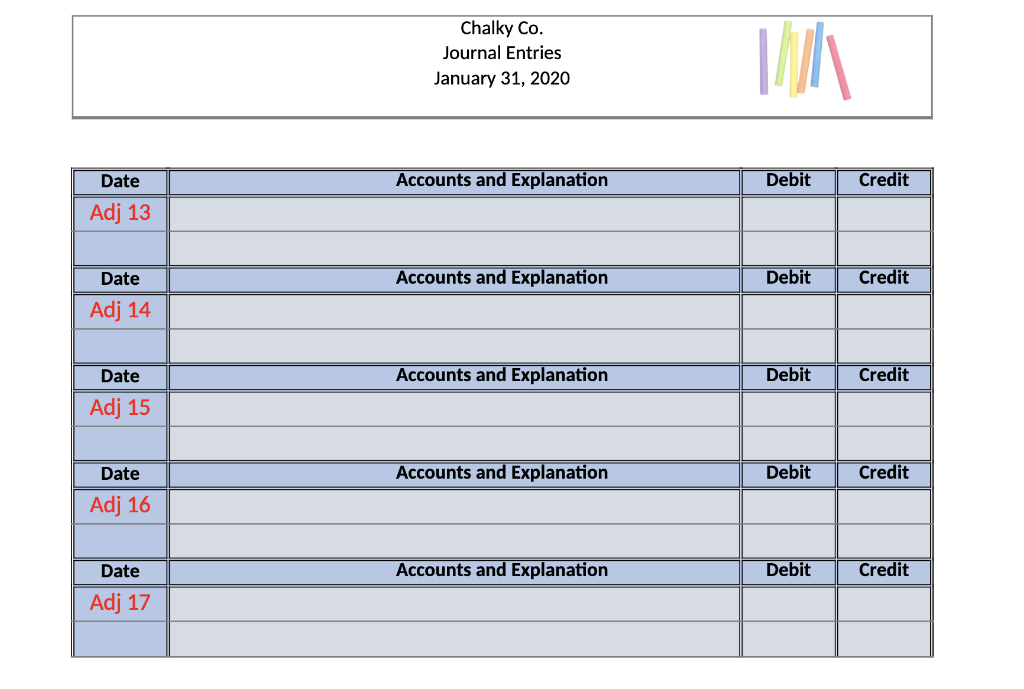

Step 5. Identify and analyze the transactions 13-17

Record transactions to the Journal on the sheet named"Journal Entries-2"

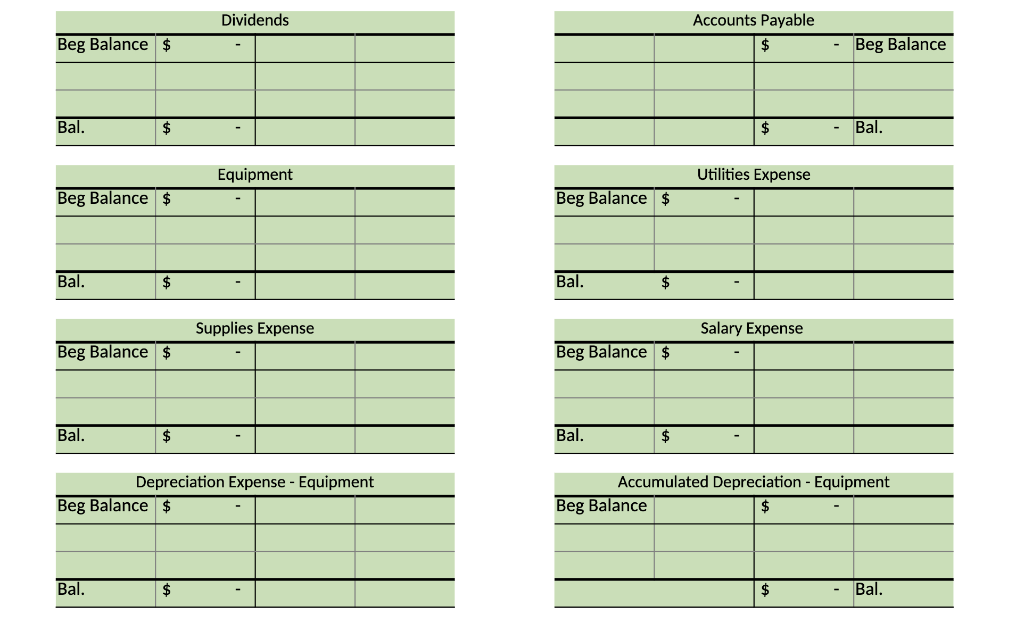

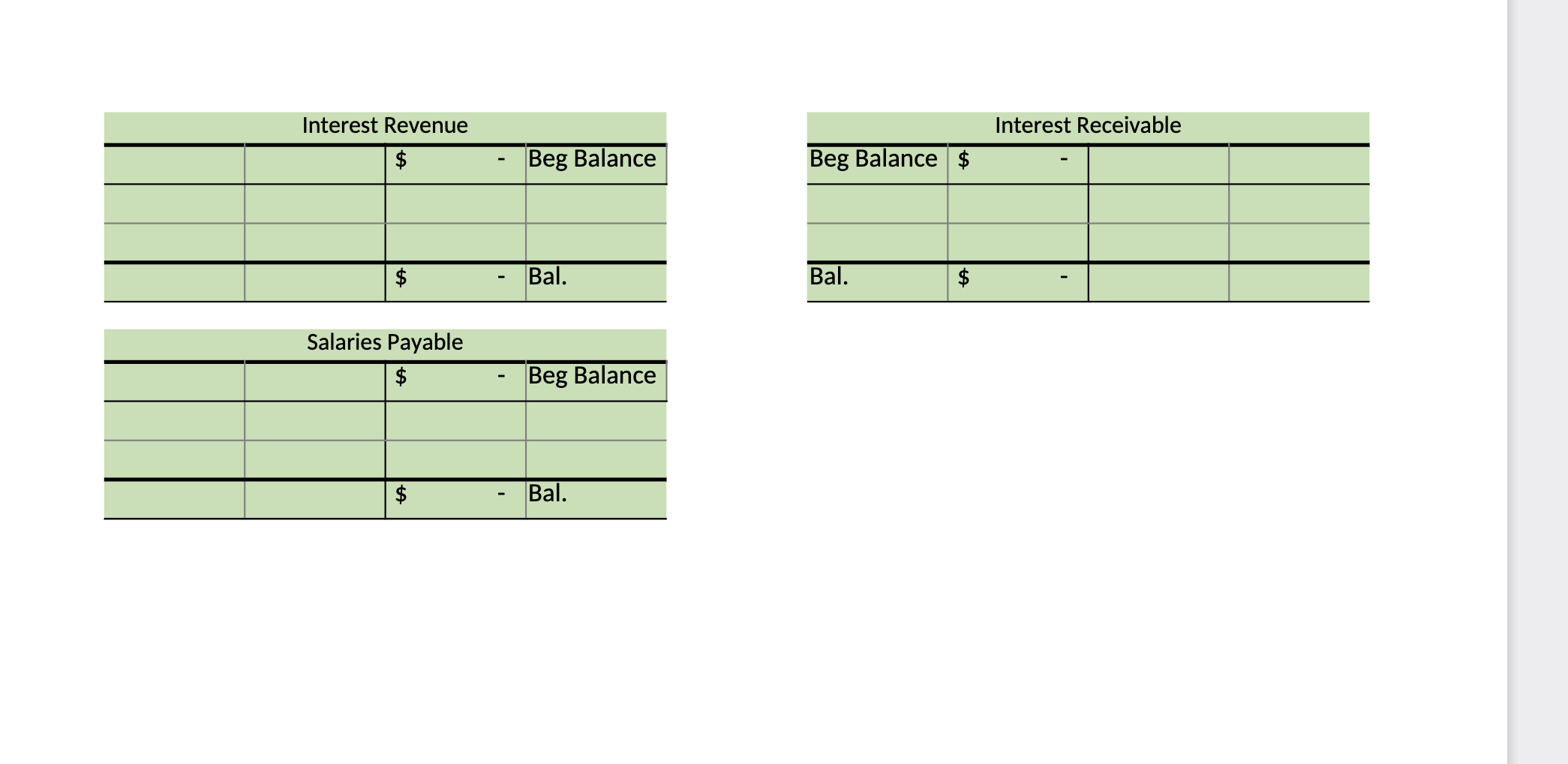

Post Journal information from "Journal Entries-2" to the sheet named"General Ledger -2"

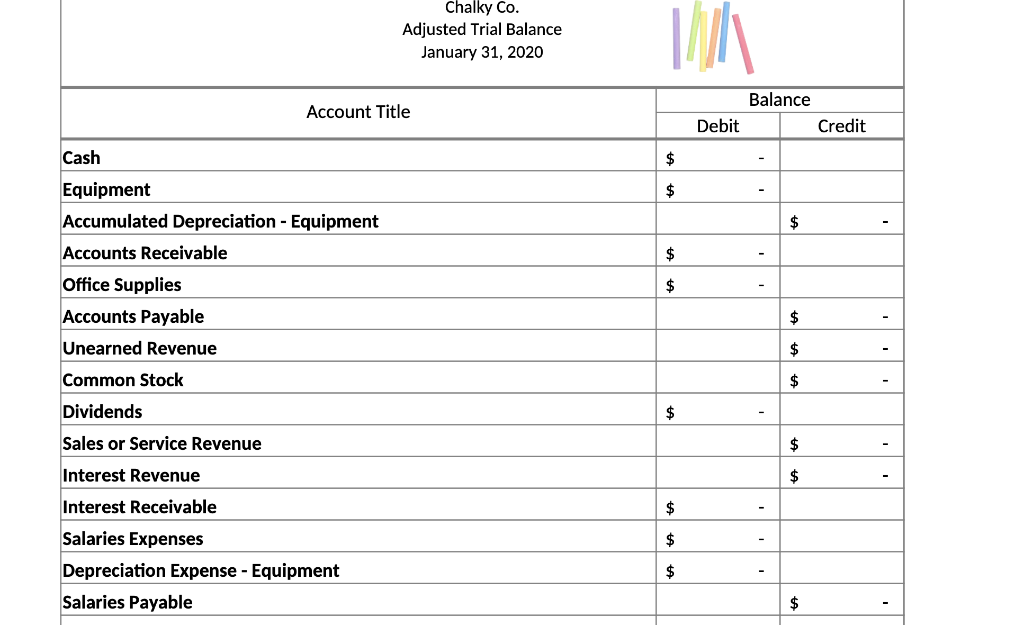

Step 6. Use the information on "General Ledger -2" to prepare the adjusted trial balance.

-remember the beginning balance on "General Ledger-2" come from your Unadjusted trial balance-

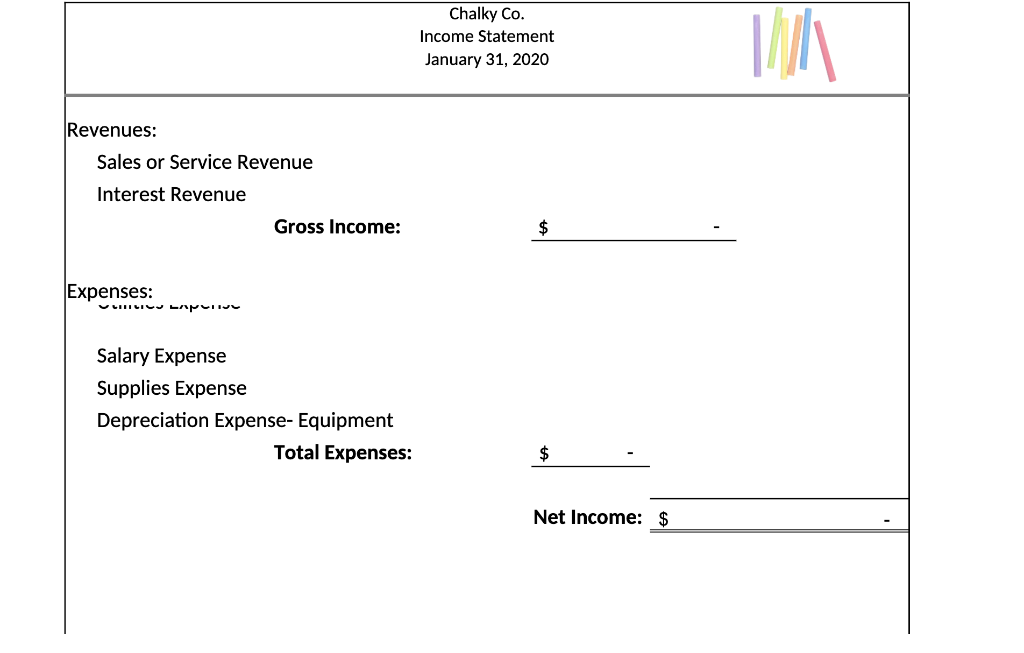

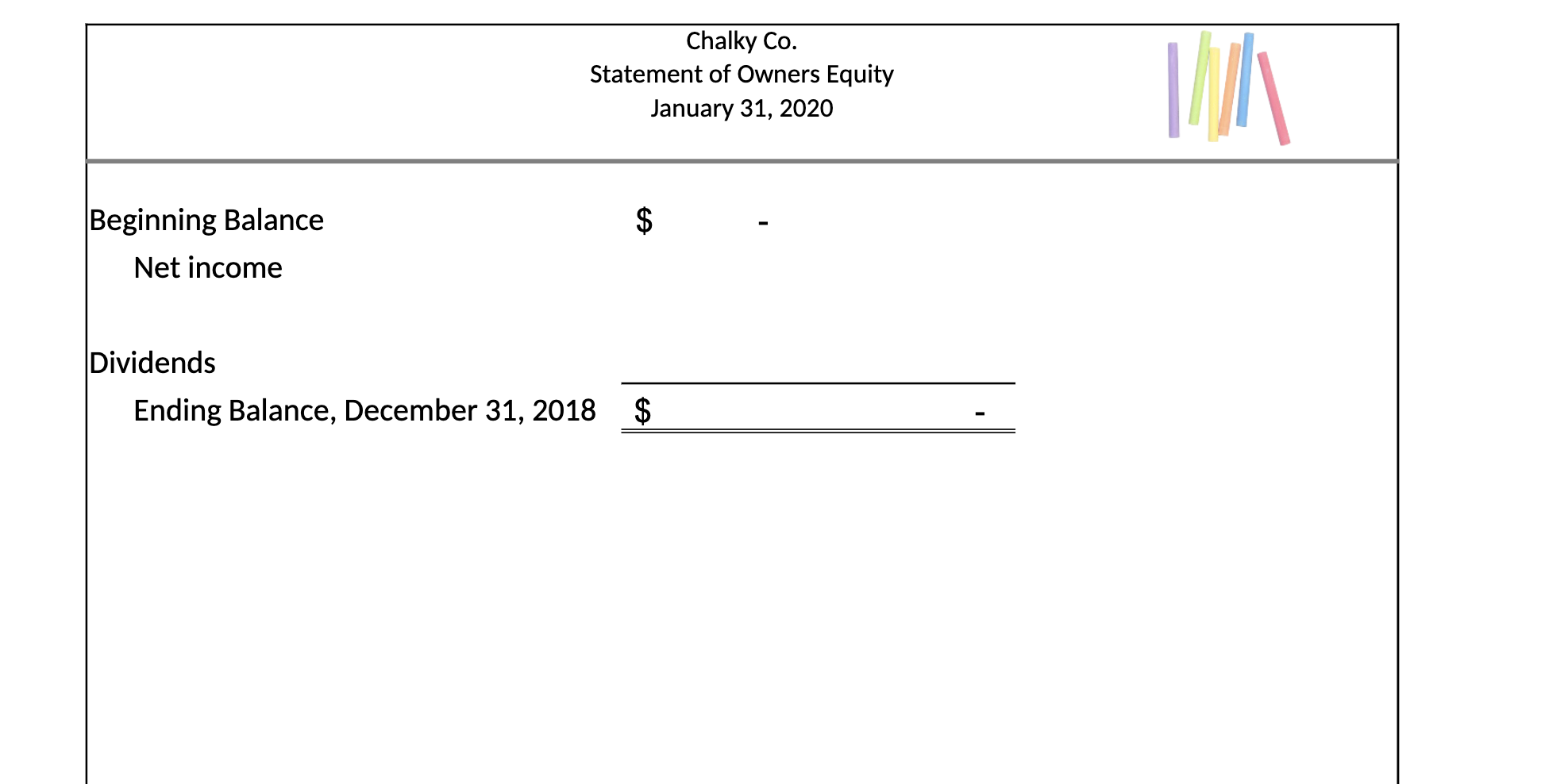

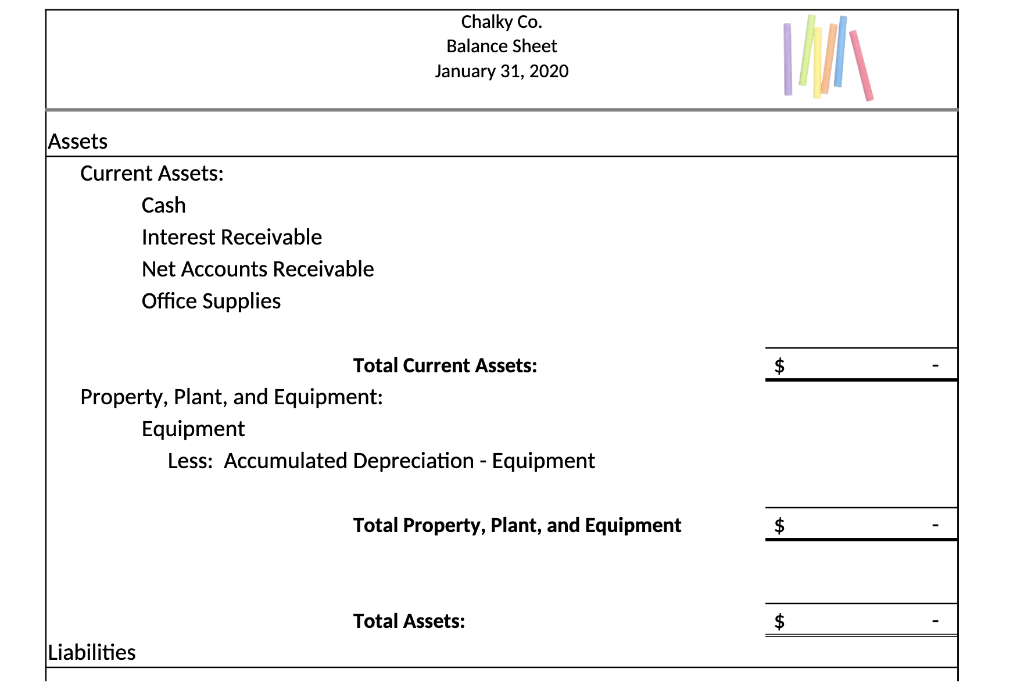

Step 7. Prepare your income statement,Statement of retained Earnings, and Balance Sheet

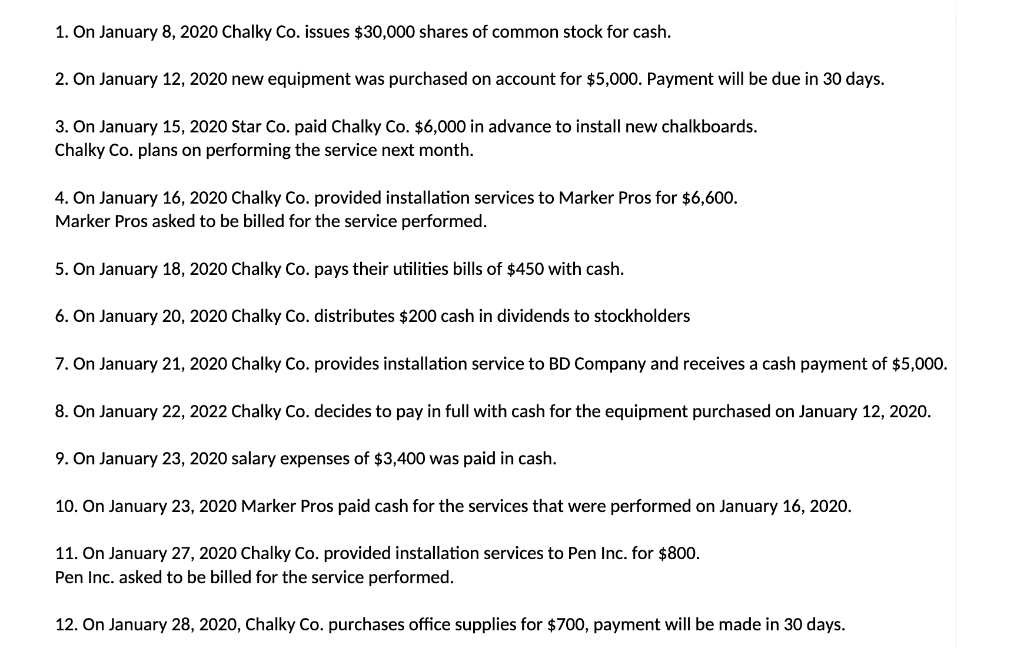

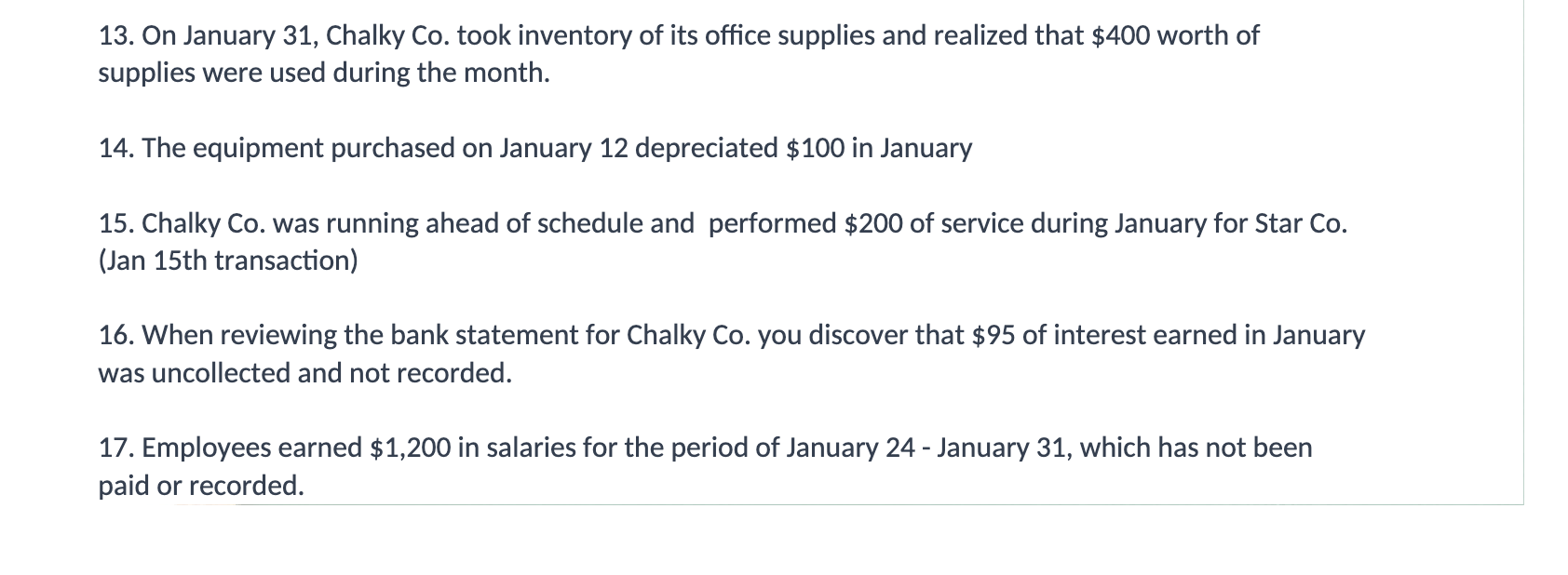

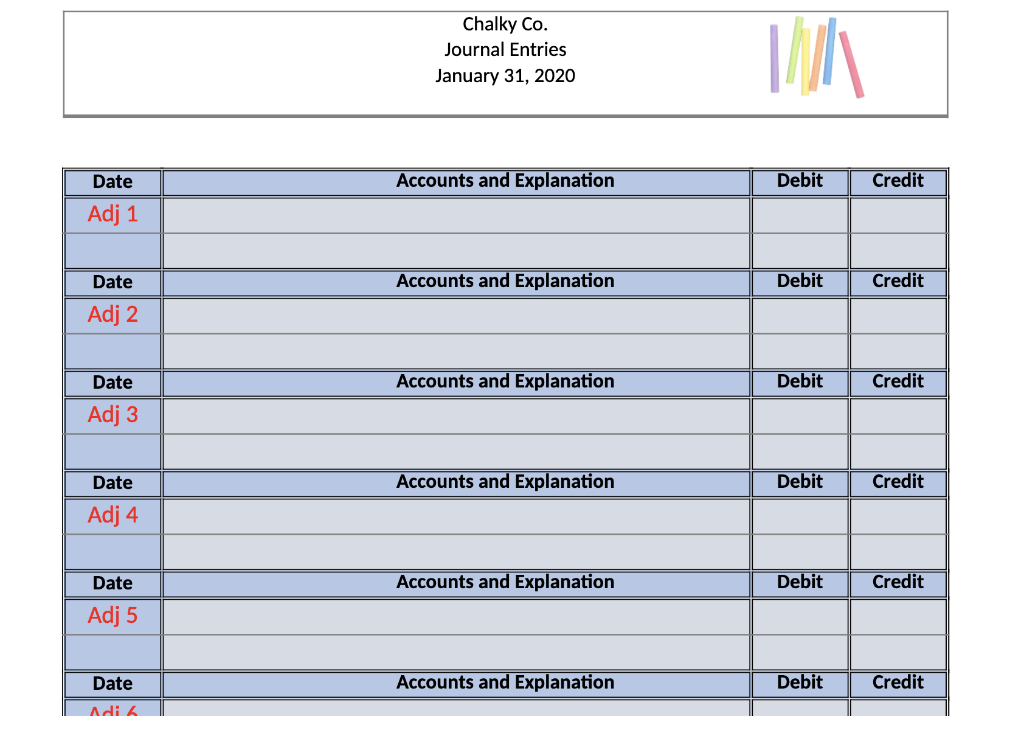

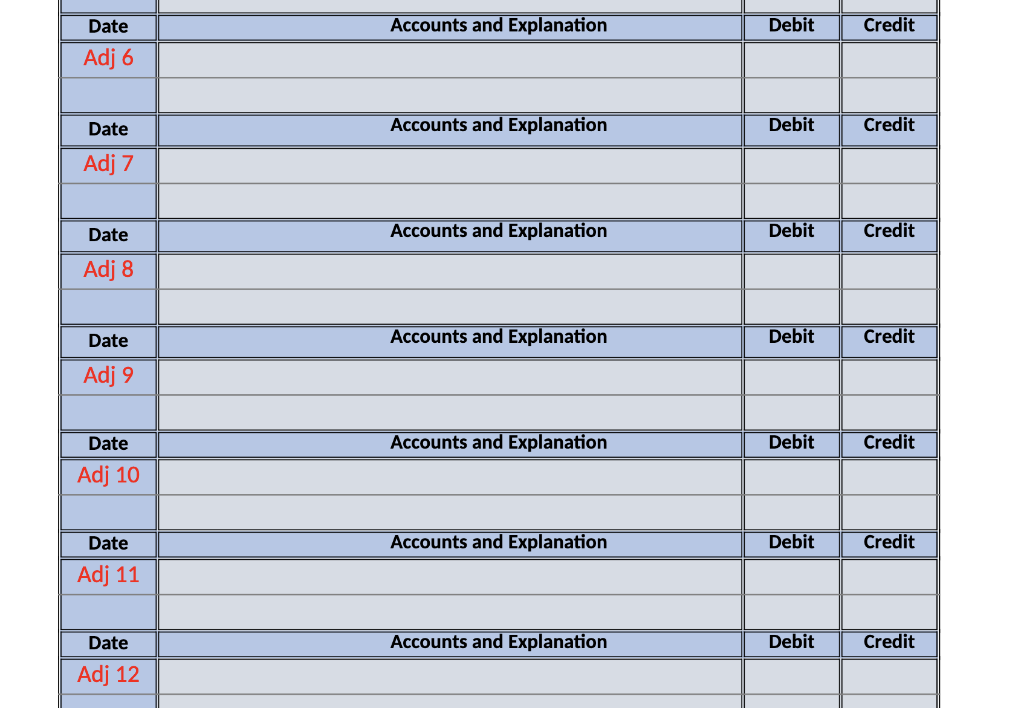

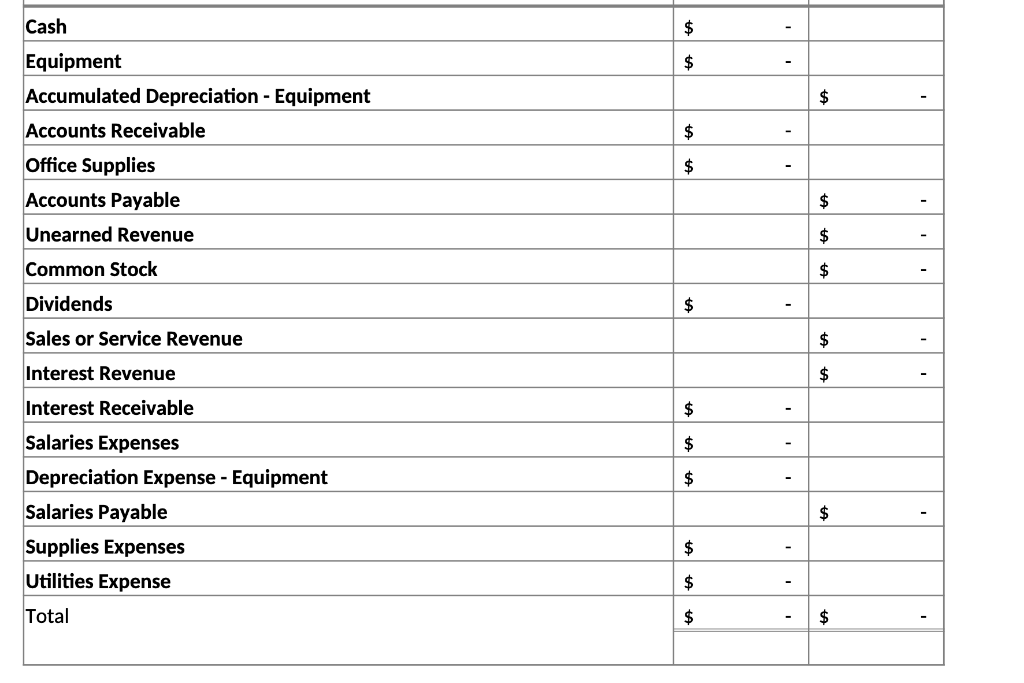

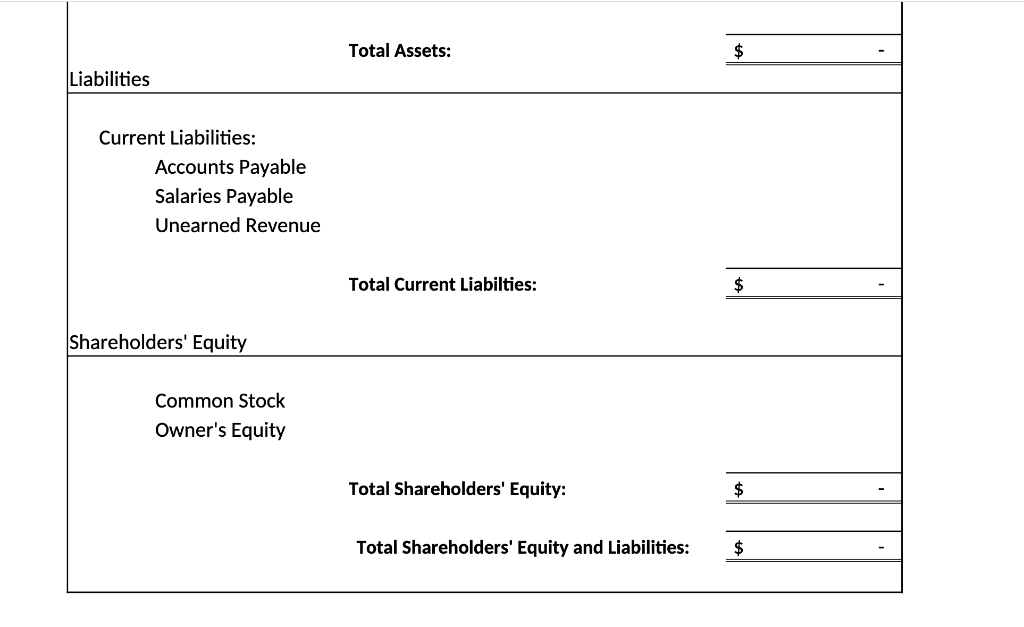

1. On January 8, 2020 Chalky Co. issues $30,000 shares of common stock for cash. 2. On January 12, 2020 new equipment was purchased on account for $5,000. Payment will be due in 30 days. 3. On January 15, 2020 Star Co. paid Chalky Co. $6,000 in advance to install new chalkboards. Chalky Co. plans on performing the service next month. 4. On January 16, 2020 Chalky Co. provided installation services to Marker Pros for $6,600. Marker Pros asked to be billed for the service performed. 5. On January 18, 2020 Chalky Co. pays their utilities bills of $450 with cash. 6. On January 20, 2020 Chalky Co. distributes $200 cash in dividends to stockholders 7. On January 21, 2020 Chalky Co. provides installation service to BD Company and receives a cash payment of $5,000. 8. On January 22, 2022 Chalky Co. decides to pay in full with cash for the equipment purchased on January 12, 2020. 9. On January 23, 2020 salary expenses of $3,400 was paid in cash. 10. On January 23, 2020 Marker Pros paid cash for the services that were performed on January 16, 2020. 11. On January 27, 2020 Chalky Co. provided installation services to Pen Inc. for $800. Pen Inc. asked to be billed for the service performed. 12. On January 28, 2020, Chalky Co. purchases office supplies for $700, payment will be made in 30 days. 13. On January 31, Chalky Co. took inventory of its office supplies and realized that $400 worth of supplies were used during the month. 14. The equipment purchased on January 12 depreciated $100 in January 15. Chalky Co. was running ahead of schedule and performed $200 of service during January for Star Co. (Jan 15th transaction) 16. When reviewing the bank statement for Chalky Co. you discover that $95 of interest earned in January was uncollected and not recorded. 17. Employees earned $1,200 in salaries for the period of January 24 - January 31, which has not been paid or recorded. Date Adj 1 Date Adj 2 Date Adj 3 Date Adj 4 Date Adj 5 Date Adi 6 Chalky Co. Journal Entries January 31, 2020 Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation TAN Debit Debit Debit Debit Debit Debit Credit Credit Credit Credit Credit Credit Date Adj 6 Date Adj 7 Date Adj 8 Date Adj 9 Date Adj 10 Date Adj 11 Date Adj 12 Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Debit Debit Debit Debit Debit Debit Debit Credit Credit Credit Credit Credit Credit Credit Bal. Bal. $ $ Cash Accounts Receivable Office Supplies Chalky Co. General Ledger January 31, 2020 TIN Accounts Payable $ Unearned Revenue $ Common Stock $ Sales or Service Revenue - Bal. - Bal. Bal. Bal. Bal. Bal. Bal. $ $ $ $ Accounts Receivable Office Supplies Dividends Equipment Bal. Bal. Common Stock $ Sales or Service Revenue $ - Utilities Expense Salary Expense $ $ Bal. Bal. Cash Equipment Accounts Receivable Office Supplies Accounts Payable Unearned Revenue Common Stock Dividends Service Revenue Salaries Expenses Utilities Expense Total Chalky Co. Unadjusted Trial Balance January 31, 2020 Account Title TAN Debit $ $ $ $ $ $ $ $ LA LA LA LA LA A LA Balance Credit - ' LA LA LA GA $ I Date Adj 13 Date Adj 14 Date Adj 15 Date Adj 16 Date Adj 17 Chalky Co. Journal Entries January 31, 2020 Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation Accounts and Explanation TA Debit Debit Debit Debit Debit Credit Credit Credit Credit Credit Beg Balance $ Bal. $ Beg Balance $ Bal. $ Beg Balance $ Bal. $ Cash Accounts Receivable Office Supplies Dividends Chalky Co. General Ledger January 31, 2020 WA Sales or Service Revenue $ $ Unearned Revenue $ $ Common Stock $ $ Accounts Payable Beg Balance Bal. Beg Balance - - Bal. Beg Balance Bal. Dividends Beg Balance $ - Bal. $ Equipment Beg Balance $ Bal. $ Supplies Expense Beg Balance $ Bal. $ Depreciation Expense - Equipment Beg Balance $ Bal. $ - Accounts Payable $ $ Utilities Expense Beg Balance $ Bal. $ Salary Expense Beg Balance $ Bal. $ Accumulated Depreciation - Equipment Beg Balance $ - Bal. $ - Beg Balance Bal. Interest Revenue $ $ Salaries Payable $ $ Beg Balance Bal. Beg Balance Bal. Beg Balance $ Bal. $ Interest Receivable Chalky Co. Adjusted Trial Balance January 31, 2020 Account Title Cash Equipment Accumulated Depreciation - Equipment Accounts Receivable Office Supplies Accounts Payable Unearned Revenue Common Stock Dividends Sales or Service Revenue Interest Revenue Interest Receivable Salaries Expenses Depreciation Expense - Equipment Salaries Payable TA Debit $ $ $ $ $ $ $ $ Balance - - - $ $ $ $ $ $ $ Credit Cash Equipment Accumulated Depreciation - Equipment Accounts Receivable Office Supplies Accounts Payable Unearned Revenue Common Stock Dividends Sales or Service Revenue Interest Revenue Interest Receivable Salaries Expenses Depreciation Expense - Equipment Salaries Payable Supplies Expenses Utilities Expense Total $ $ $ tA to $ $ $ $ $ $ $ $ +A $ $ $ $ LA GA $ $ $ LA Revenues: Sales or Service Revenue Interest Revenue Gross Income: AS APVINNY Salary Expense Supplies Expense Depreciation Expense- Equipment Total Expenses: Expenses: Chalky Co. Income Statement January 31, 2020 $ $ Net Income: $ TAN Chalky Co. Statement of Owners Equity January 31, 2020 $ $ Beginning Balance Net income Dividends Ending Balance, December 31, 2018 TAN Assets Chalky Co. Balance Sheet January 31, 2020 Current Assets: Cash Interest Receivable Net Accounts Receivable Office Supplies Total Current Assets: Property, Plant, and Equipment: Equipment Less: Accumulated Depreciation - Equipment Liabilities Total Property, Plant, and Equipment Total Assets: VA $ $ $ Liabilities Current Liabilities: Accounts Payable Salaries Payable Unearned Revenue Shareholders' Equity Common Stock Owner's Equity Total Assets: Total Current Liabilties: Total Shareholders' Equity: Total Shareholders' Equity and Liabilities: $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

To assist you with this task lets break it down step by step Step 1 Identify and Analyze Transactions 112 1 January 8 2020 Issuance of common stock for cash Debit Cash 30000 Credit Common Stock 30000 ... View full answer

Get step-by-step solutions from verified subject matter experts