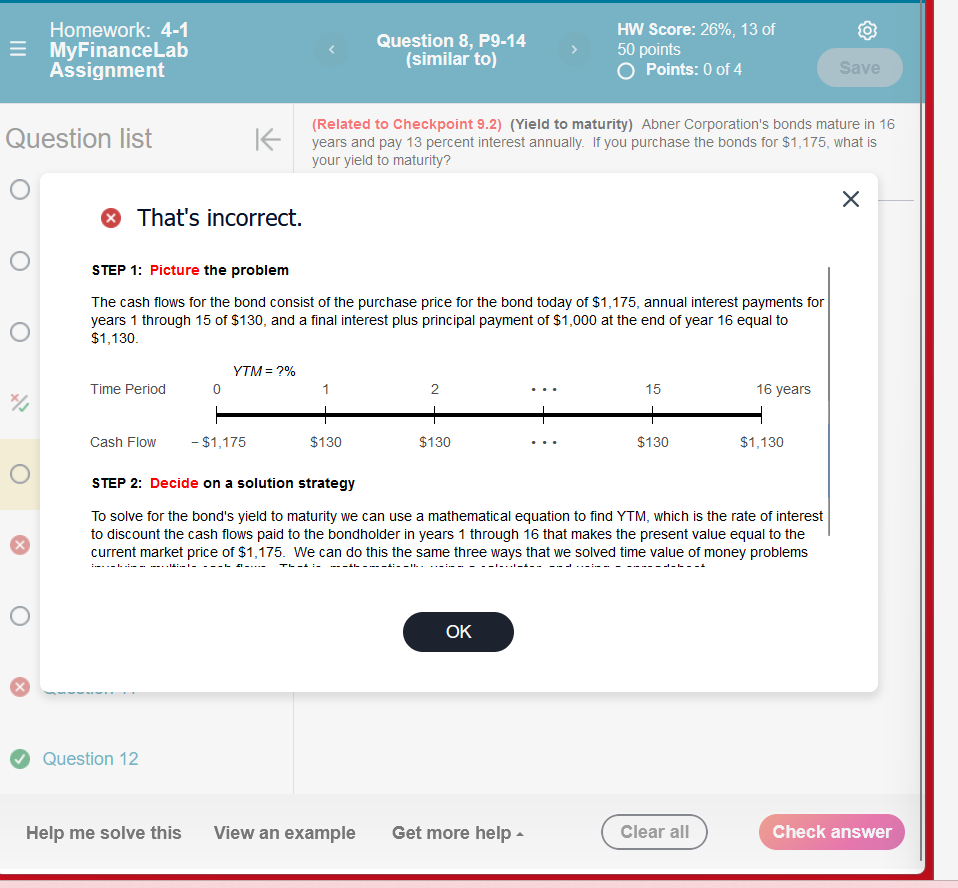

Question: STEP 1: Picture the problem The cash flows for the bond consist of the purchase price for the bond today of $1,175, annual interest payments

STEP 1: Picture the problem The cash flows for the bond consist of the purchase price for the bond today of $1,175, annual interest payments for years 1 through 15 of $130, and a final interest plus principal payment of $1,000 at the end of year 16 equal to $1,130 STEP 2: Decide on a solution strategy To solve for the bond's yield to maturity we can use a mathematical equation to find YTM, which is the rate of interest to discount the cash flows paid to the bondholder in years 1 through 16 that makes the present value equal to the current market price of $1,175. We can do this the same three ways that we solved time value of money problems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts