Question: Step 1: Set up a multi-step income statement format. Use 21% as the federal income tax rate. Apply the rate to the pre-tax income and

Step 1: Set up a multi-step income statement format.

Use 21% as the federal income tax rate. Apply the rate to the pre-tax income and calculate the final net income after the tax expense.

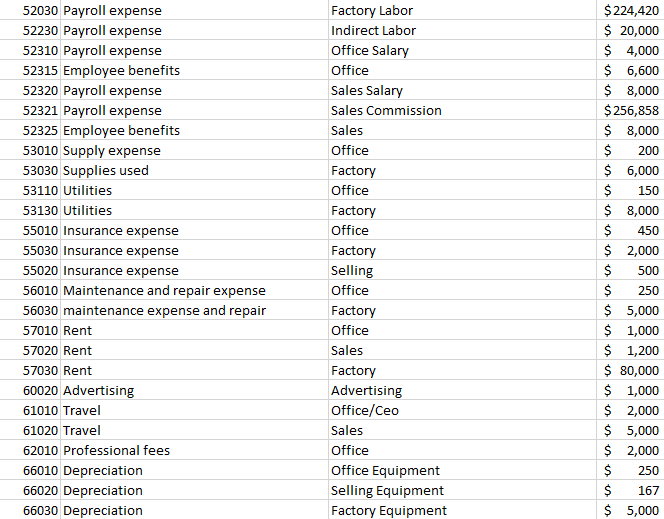

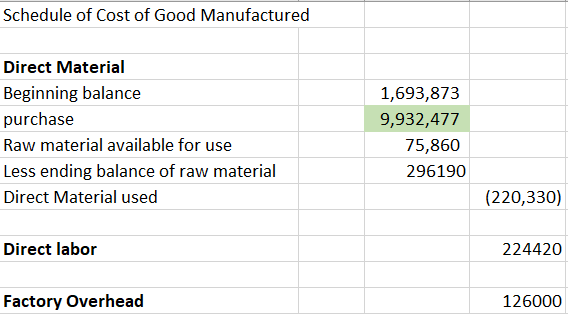

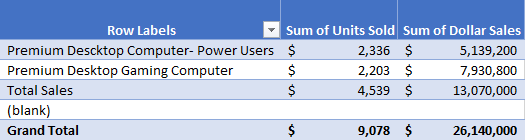

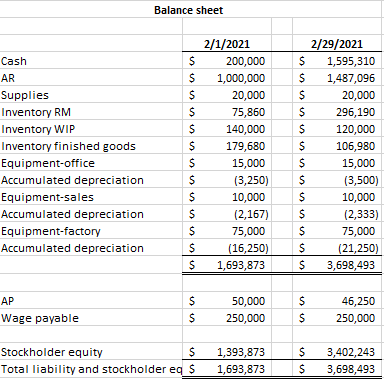

Schedule of Cost of Good Manufactured Direct Material \begin{tabular}{l|r|} \hline Beginning balance & 1,693,873 \\ \hline purchase & 9,932,477 \\ \hline Raw material available for use & 75,860 \\ \hline Less ending balance of raw material & 296190 \\ \hline \end{tabular} Direct Material used (220,330) Direct labor 224420 Factory Overhead 126000 Row Labels \begin{tabular}{lrrlr} \hline Premium Descktop Computer- Power Users & $ & 2,336 & $ & 5,139,200 \\ \hline Premium Desktop Gaming Computer & $ & 2,203 & $ & 7,930,800 \\ \hline Total Sales & $ & 4,539 & $ & 13,070,000 \\ \hline (blank) & & & & \\ \hline Grand Total & $ & 9,078 & $ & 26,140,000 \end{tabular} Balance sheet \begin{tabular}{l|rr|r|rr|} \hline & \multicolumn{2}{|c|}{2/1/2021} & \multicolumn{2}{c}{2/29/2021} \\ \cline { 2 - 6 } Cash & $ & 200,000 & & $ & 1,595,310 \\ \hline AR & $ & 1,000,000 & & $ & 1,487,096 \\ \hline Supplies & $ & 20,000 & $ & 20,000 \\ \hline Inventory RM & $ & 75,860 & $ & 296,190 \\ \hline Inventory WIP & $ & 140,000 & $ & 120,000 \\ \hline Inventory finished goods & $ & 179,680 & $ & 106,980 \\ \hline Equipment-office & $ & 15,000 & $ & 15,000 \\ \hline Accumulated depreciation & $ & (3,250) & $ & (3,500) \\ \hline Equipment-sales & $ & 10,000 & $ & 10,000 \\ \hline Accumulated depreciation & $ & (2,167) & $ & (2,333) \\ \hline Equipment-factory & $ & 75,000 & $ & 75,000 \\ \hline Accumulated depreciation & $ & (16,250) & $ & (21,250) \\ \hline & $ & 1,693,873 & $ & 3,698,493 \\ \hline \hline \end{tabular} \begin{tabular}{l|rr|r|rr|} AP & $ & 50,000 & & $ & 46,250 \\ \hline Wage payable & $ & 250,000 & & $ & 250,000 \\ \hline Stockholder equity & & & & & \\ \hline Total liability and stockholder eq & $ & 1,393,873 & & $ & 3,402,243 \\ \cline { 2 - 6 } & & 1,693,873 & & $ & 3,698,493 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts