Question: Step 2 and Step 3 1 44672 1/8/12 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18

Step 2 and Step 3

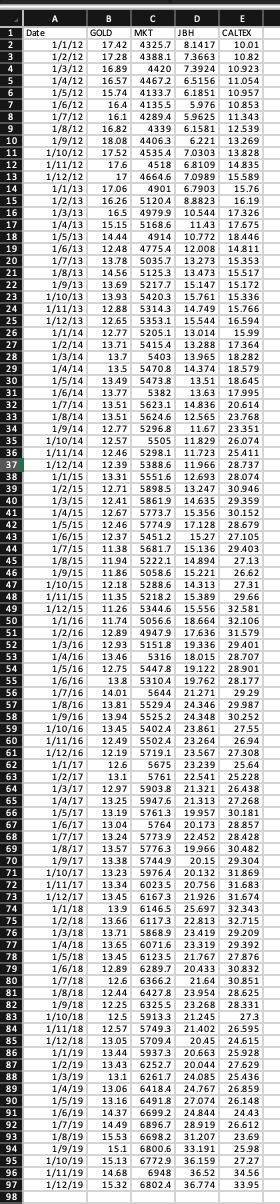

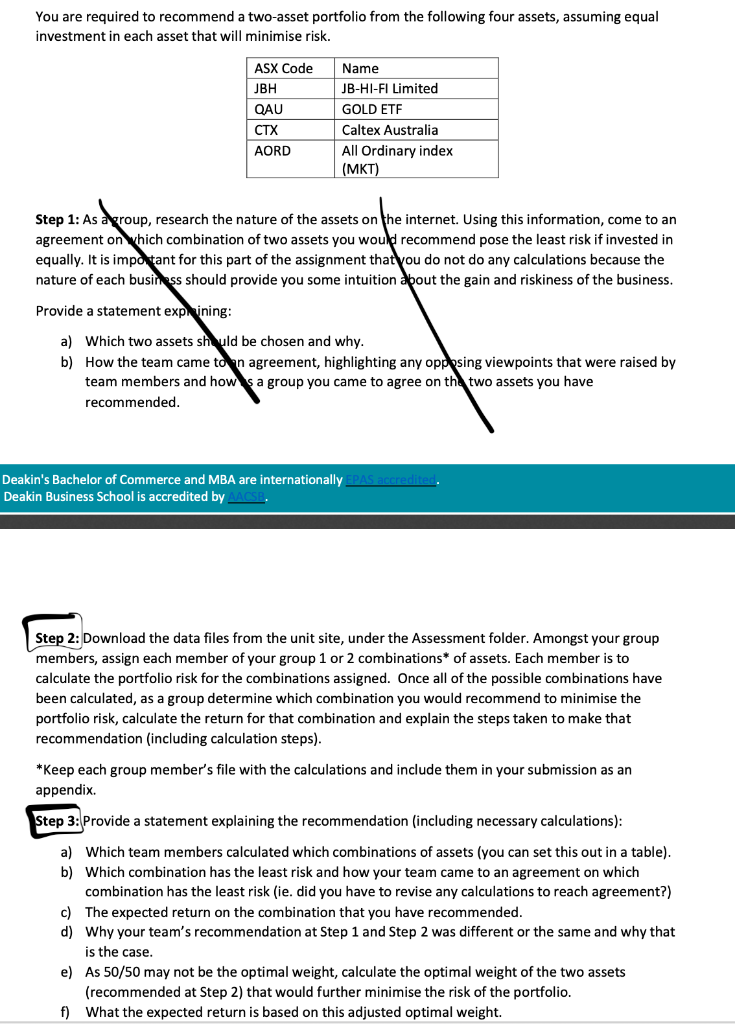

1 44672 1/8/12 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 A B C D E Date GOLD MKT JBH CALTEX 1/1/12 17.42 4325.7 8.1417 10.01 1/2/12 17.28 4388.1 7.3663 10.82 1/3/12 16.89 4420 7.3924 10.923 1/4/12 16.57 6.5156 11.054 1/5/12 15.74 4133.7 6.1851 10.957 1/6/12 16.4 4135.5 5.976 10.853 1/7/12 16.1 42894 5.9625 11.343 16.82 4339 6.1581 12.539 1/9/12 18.08 4406.3 6.221 13.269 1/10/12 17.52 4535.4 70303 13828 1/11/12 17.6 4518 6.8109 14.835 1/12/12 17 4664.6 7.0989 15.589 1/1/13 17.06 4901 6.7903 15.76 1/2/13 16.26 51204 8.8823 16.19 1/3/13 165 4979.9 10.544 17.326 1/4/13 15.15 5168.6 11.43 17.675 1/5/13 14.44 4914 10.772 18.446 1/6/13 12.48 4775.4 12.008 14.811 1/7/13 13.78 5035.7 13.273 15.353 1/8/13 14.56 5125.3 13.473 15.517 1/9/13 13.69 5217.7 15.147 15.172 1/10/13 13.93 5420.3 15.761 15.336 1/11/13 12.88 5314.3 14.749 15.766 1/12/13 12.65 5353.1 15.544 16.594 1/1/14 12.77 5205.1 13.014 15.99 1/2/14 13.71 54154 13.288 17.364 1/3/14 13.7 5403 13.965 18.282 1/4/14 13.5 5470.8 14.374 18.579 1/5/14 13.49 5473.8 13.51 18.645 1/6/14 13.77 5382 13.63 17.995 1/7/14 13.51 5623.1 14.836 20.614 1/8/14 13.51 5624.6 12.565 23.768 1/9/14 12.77 5296.8 11.67 23.351 1/10/14 12.57 5505 11.829 26.074 1/11/14 12.46 5298.1 11.723 25.411 1/12/14 12.39 5388.6 11.966 28.737 1/1/15 13.31 5551.6 12.693 28.074 1/2/15 12.71 5898.5 13.247 30.946 1/3/15 12.41 5861.9 14.635 29.359 1/4/15 12.67 5773.7 15.356 30.152 1/5/15 12.46 57749 17.128 28.679 1/6/15 12.37 5451.2 15.27 27.105 1/7/15 11.38 5681.7 15.136 29.403 1/8/15 11.94 5222.1 14.894 27.13 1/9/15 11.86 5058.6 15.221 26.62 1/10/15 12.18 5288.6 14.313 27.31 1/11/15 11.35 5218.2 15.389 29.66 1/12/15 11.26 5344.6 15.556 32.581 1/1/16 11.74 5056.6 18.664 32.106 1/2/16 12.89 4947.9 17.636 31.579 1/3/16 12.93 51518 19.336 29.401 1/4/16 13.46 5316 18.015 28.707 1/5/16 12.75 5447.8 19.122 28.901 1/6/16 13.8 5310.4 19.762 28.177 1/7/16 14.01 5644 21.271 29.29 1/8/16 13.81 5529.4 24.346 29.987 1/9/16 13.94 5525.2 24.348 30.252 1/10/16 13.45 54024 23.861 27.55 1/11/16 12.49 5502.4 23.264 26.94 1/12/16 12.19 5719.1 23.567 27.308 1/1/17 12.6 5675 23.239 25.64 1/2/17 13.1 5761 22.541 25.228 1/3/17 12.97 59038 21.321 26.438 1/4/17 13.25 5947.6 21.313 27.268 1/5/17 13.19 5761.3 19.957 30.181 1/6/17 13.04 5764 20.173 28.857 1/7/17 13.24 5773.9 22.452 28.428 1/8/17 13.57 5776.3 19.966 30.482 1/9/17 13.38 5744.9 20.15 29.304 1/10/17 13.23 5976.4 20.132 31.869 1/11/17 13.34 6023.5 20.756 31.683 1/12/17 13.45 6167.3 21.926 31.674 1/1/18 13.9 6146.5 25.697 32.343 1/2/18 13.66 6117.3 22.813 32.715 1/3/18 13.71 5868.9 23.419 29.209 1/4/18 13.65 6071.6 23.319 29.392 1/5/18 13.45 6123.5 21.767 27.876 1/6/18 12.89 6289.7 20.433 30.832 1/7/18 12.6 6366.2 21.64 30.851 1/8/18 12.44 64278 23.954 28.625 1/9/18 12.25 6325.5 23.268 28.331 1/10/18 12.5 5913.3 21.245 27.3 1/11/18 12.57 5749.3 21.402 26.595 1/12/18 13.05 57094 20.45 24.615 1/1/19 13.44 5937.3 20.663 25.928 1/2/19 13.43 6252.7 20.044 27.629 1/3/19 13.1 6261.7 24.085 25.436 1/4/19 13.06 64184 24.767 26.859 1/5/19 13.16 64918 27.074 26.148 1/6/19 14.37 66992 24.844 24.43 1/7/19 14.49 6896.7 28.919 26.612 1/8/19 15.53 6698.2 31.207 23.69 1/9/19 15.1 6800.6 33.191 25.98 1/10/19 15.13 6772.9 36.159 27.27 1/11/19 14.68 6948 36.52 34.56 1/12/19 15.32 6802.4 36.774 33.95 You are required to recommend a two-asset portfolio from the following four assets, assuming equal investment in each asset that will minimise risk. ASX Code JBH QAU CTX AORD Name JB-HI-FI Limited GOLD ETF Caltex Australia All Ordinary index (MKT) Step 1: As a group, research the nature of the assets on the internet. Using this information, come to an agreement on which combination of two assets you would recommend pose the least risk if invested in equally. It is important for this part of the assignment that you do not do any calculations because the nature of each business should provide you some intuition about the gain and riskiness of the business. Provide a statement expNining: a) Which two assets should be chosen and why. b) How the team came to an agreement, highlighting any opposing viewpoints that were raised by team members and how sa group you came to agree on the two assets you have recommended. Deakin's Bachelor of Commerce and MBA are internationally EPAS accredited. Deakin Business School is accredited by AACSB Step 2: Download the data files from the unit site, under the Assessment folder. Amongst your group members, assign each member of your group 1 or 2 combinations* of assets. Each member is to calculate the portfolio risk for the combinations assigned. Once all of the possible combinations have been calculated, as a group determine which combination you would recommend to minimise the portfolio risk, calculate the return for that combination and explain the steps taken to make that recommendation (including calculation steps). *Keep each group member's file with the calculations and include them in your submission as an appendix. Step 3: Provide a statement explaining the recommendation (including necessary calculations): a) Which team members calculated which combinations of assets (you can set this out in a table). b) Which combination has the least risk and how your team came to an agreement on which combination has the least risk (ie. did you have to revise any calculations to reach agreement?) c) The expected return on the combination that you have recommended. d) Why your team's recommendation at Step 1 and Step 2 was different or the same and why that is the case. e) As 50/50 may not be the optimal weight, calculate the optimal weight of the two assets (recommended at Step 2) that would further minimise the risk of the portfolio. f) What the expected return is based on this adjusted optimal weight. 1 44672 1/8/12 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 A B C D E Date GOLD MKT JBH CALTEX 1/1/12 17.42 4325.7 8.1417 10.01 1/2/12 17.28 4388.1 7.3663 10.82 1/3/12 16.89 4420 7.3924 10.923 1/4/12 16.57 6.5156 11.054 1/5/12 15.74 4133.7 6.1851 10.957 1/6/12 16.4 4135.5 5.976 10.853 1/7/12 16.1 42894 5.9625 11.343 16.82 4339 6.1581 12.539 1/9/12 18.08 4406.3 6.221 13.269 1/10/12 17.52 4535.4 70303 13828 1/11/12 17.6 4518 6.8109 14.835 1/12/12 17 4664.6 7.0989 15.589 1/1/13 17.06 4901 6.7903 15.76 1/2/13 16.26 51204 8.8823 16.19 1/3/13 165 4979.9 10.544 17.326 1/4/13 15.15 5168.6 11.43 17.675 1/5/13 14.44 4914 10.772 18.446 1/6/13 12.48 4775.4 12.008 14.811 1/7/13 13.78 5035.7 13.273 15.353 1/8/13 14.56 5125.3 13.473 15.517 1/9/13 13.69 5217.7 15.147 15.172 1/10/13 13.93 5420.3 15.761 15.336 1/11/13 12.88 5314.3 14.749 15.766 1/12/13 12.65 5353.1 15.544 16.594 1/1/14 12.77 5205.1 13.014 15.99 1/2/14 13.71 54154 13.288 17.364 1/3/14 13.7 5403 13.965 18.282 1/4/14 13.5 5470.8 14.374 18.579 1/5/14 13.49 5473.8 13.51 18.645 1/6/14 13.77 5382 13.63 17.995 1/7/14 13.51 5623.1 14.836 20.614 1/8/14 13.51 5624.6 12.565 23.768 1/9/14 12.77 5296.8 11.67 23.351 1/10/14 12.57 5505 11.829 26.074 1/11/14 12.46 5298.1 11.723 25.411 1/12/14 12.39 5388.6 11.966 28.737 1/1/15 13.31 5551.6 12.693 28.074 1/2/15 12.71 5898.5 13.247 30.946 1/3/15 12.41 5861.9 14.635 29.359 1/4/15 12.67 5773.7 15.356 30.152 1/5/15 12.46 57749 17.128 28.679 1/6/15 12.37 5451.2 15.27 27.105 1/7/15 11.38 5681.7 15.136 29.403 1/8/15 11.94 5222.1 14.894 27.13 1/9/15 11.86 5058.6 15.221 26.62 1/10/15 12.18 5288.6 14.313 27.31 1/11/15 11.35 5218.2 15.389 29.66 1/12/15 11.26 5344.6 15.556 32.581 1/1/16 11.74 5056.6 18.664 32.106 1/2/16 12.89 4947.9 17.636 31.579 1/3/16 12.93 51518 19.336 29.401 1/4/16 13.46 5316 18.015 28.707 1/5/16 12.75 5447.8 19.122 28.901 1/6/16 13.8 5310.4 19.762 28.177 1/7/16 14.01 5644 21.271 29.29 1/8/16 13.81 5529.4 24.346 29.987 1/9/16 13.94 5525.2 24.348 30.252 1/10/16 13.45 54024 23.861 27.55 1/11/16 12.49 5502.4 23.264 26.94 1/12/16 12.19 5719.1 23.567 27.308 1/1/17 12.6 5675 23.239 25.64 1/2/17 13.1 5761 22.541 25.228 1/3/17 12.97 59038 21.321 26.438 1/4/17 13.25 5947.6 21.313 27.268 1/5/17 13.19 5761.3 19.957 30.181 1/6/17 13.04 5764 20.173 28.857 1/7/17 13.24 5773.9 22.452 28.428 1/8/17 13.57 5776.3 19.966 30.482 1/9/17 13.38 5744.9 20.15 29.304 1/10/17 13.23 5976.4 20.132 31.869 1/11/17 13.34 6023.5 20.756 31.683 1/12/17 13.45 6167.3 21.926 31.674 1/1/18 13.9 6146.5 25.697 32.343 1/2/18 13.66 6117.3 22.813 32.715 1/3/18 13.71 5868.9 23.419 29.209 1/4/18 13.65 6071.6 23.319 29.392 1/5/18 13.45 6123.5 21.767 27.876 1/6/18 12.89 6289.7 20.433 30.832 1/7/18 12.6 6366.2 21.64 30.851 1/8/18 12.44 64278 23.954 28.625 1/9/18 12.25 6325.5 23.268 28.331 1/10/18 12.5 5913.3 21.245 27.3 1/11/18 12.57 5749.3 21.402 26.595 1/12/18 13.05 57094 20.45 24.615 1/1/19 13.44 5937.3 20.663 25.928 1/2/19 13.43 6252.7 20.044 27.629 1/3/19 13.1 6261.7 24.085 25.436 1/4/19 13.06 64184 24.767 26.859 1/5/19 13.16 64918 27.074 26.148 1/6/19 14.37 66992 24.844 24.43 1/7/19 14.49 6896.7 28.919 26.612 1/8/19 15.53 6698.2 31.207 23.69 1/9/19 15.1 6800.6 33.191 25.98 1/10/19 15.13 6772.9 36.159 27.27 1/11/19 14.68 6948 36.52 34.56 1/12/19 15.32 6802.4 36.774 33.95 You are required to recommend a two-asset portfolio from the following four assets, assuming equal investment in each asset that will minimise risk. ASX Code JBH QAU CTX AORD Name JB-HI-FI Limited GOLD ETF Caltex Australia All Ordinary index (MKT) Step 1: As a group, research the nature of the assets on the internet. Using this information, come to an agreement on which combination of two assets you would recommend pose the least risk if invested in equally. It is important for this part of the assignment that you do not do any calculations because the nature of each business should provide you some intuition about the gain and riskiness of the business. Provide a statement expNining: a) Which two assets should be chosen and why. b) How the team came to an agreement, highlighting any opposing viewpoints that were raised by team members and how sa group you came to agree on the two assets you have recommended. Deakin's Bachelor of Commerce and MBA are internationally EPAS accredited. Deakin Business School is accredited by AACSB Step 2: Download the data files from the unit site, under the Assessment folder. Amongst your group members, assign each member of your group 1 or 2 combinations* of assets. Each member is to calculate the portfolio risk for the combinations assigned. Once all of the possible combinations have been calculated, as a group determine which combination you would recommend to minimise the portfolio risk, calculate the return for that combination and explain the steps taken to make that recommendation (including calculation steps). *Keep each group member's file with the calculations and include them in your submission as an appendix. Step 3: Provide a statement explaining the recommendation (including necessary calculations): a) Which team members calculated which combinations of assets (you can set this out in a table). b) Which combination has the least risk and how your team came to an agreement on which combination has the least risk (ie. did you have to revise any calculations to reach agreement?) c) The expected return on the combination that you have recommended. d) Why your team's recommendation at Step 1 and Step 2 was different or the same and why that is the case. e) As 50/50 may not be the optimal weight, calculate the optimal weight of the two assets (recommended at Step 2) that would further minimise the risk of the portfolio. f) What the expected return is based on this adjusted optimal weight

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts