Question: Step 2 : Create pro forma financial statements given specific dollar inputs ( listed below ) that might relate to a given start - up

Step : Create pro forma financial statements given specific dollar inputs listed below that might relate to a given startup income statement and balance sheet with a beginning balance sheet, three year forecast balance sheet and income statement and estimated value use x projected net earnings for year Assume for your initial balance sheet you receive a bank loan of $ simple interest along with a personal investment by your ownership group. With these funds you acquire $ in inventory and $ in fixed assets. You are able to get a supplier to carry of inventory in AP and you begin with an initial cash account of $ In your initial balance sheet you will need to determine how much cash your investment group needs to contribute to support your business. In step b you will build out the next three years of your financial statements balance sheet and income statement using the following assumptions: Your cash account will increase per year, your initial bank loan of $ charges interest per year. In addition to interest you must make a principal reduction of of the outstanding balance at the end of each year. You anticipate sales in year to be $ and you expect growth in sales in year and in year Cost of Goods sold are of sales, and operating expenses total of sales estimate realistically to each expense item so total equals of sales taxes are of operating profit. Your initial inventory of $increases each year You anticipate an annual ending AR of of annual sales, Fixed Assets, Net, initially of $increase by each year AP initially $ will change with inventory and equal of ending inventory in each year. Owners Equity is the balance between total assets minus total liabilities each year. Assume all earnings are retained and plowed back into the company. This is a privately held company not publicly traded Use the templatespreadsheet attached herein to prepare your financials. Step a beginning balance sheet; Step b ending Balance Sheet for years income statement for the same periods and and company valuation due

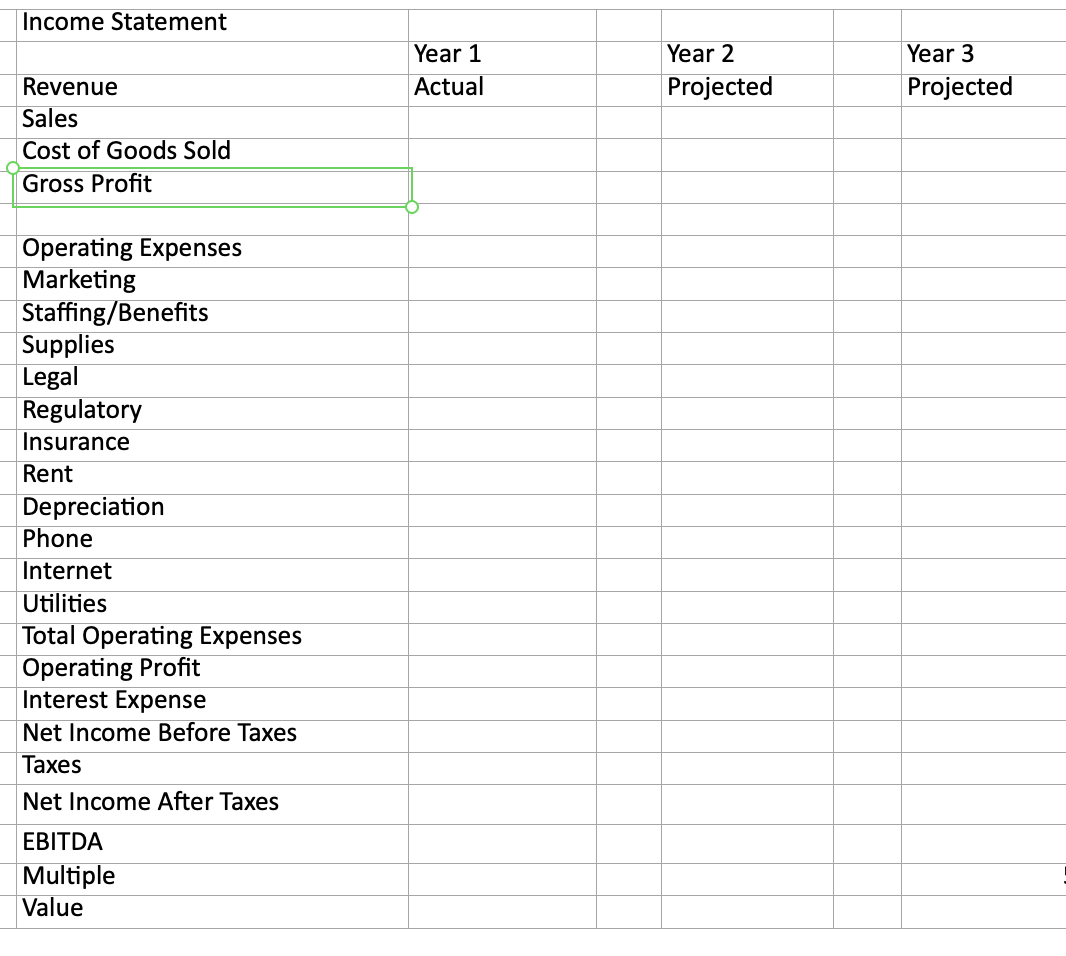

tableIncome Statement,,,Year Year Year RevenueActual,Projected,ProjectedSalesCost of Goods Sold,,,Gross Profit,,,Operating Expenses,,,MarketingStaffingBenefitsSuppliesLegalRegulatoryInsuranceRentDepreciationPhoneInternetUtilitiesTotal

tableIncome Statement,,,Year Year Year RevenueActual,Projected,ProjectedSalesCost of Goods Sold,,,Gross Profit,,,Operating Expenses,,,MarketingStaffingBenefitsSuppliesLegalRegulatoryInsuranceRentDepreciationPhoneInternetUtilitiesTotal Operating Expenses,,,Operating Profit,,,Interest Expense,,,Net Income Before Taxes,,,TaxesNet Income After Taxes,,,EBITDAMultipleValueOperating Expenses,,,Operating Profit,,,Interest Expense,,,Net Income Before Taxes,,,TaxesNet Income After Taxes,,,EBITDAMultipleValue

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock