Question: Step 2: Using the constant growth formula from Chapter 5 to estimate the price at Year 4: P, = D; / (r - g). Notice

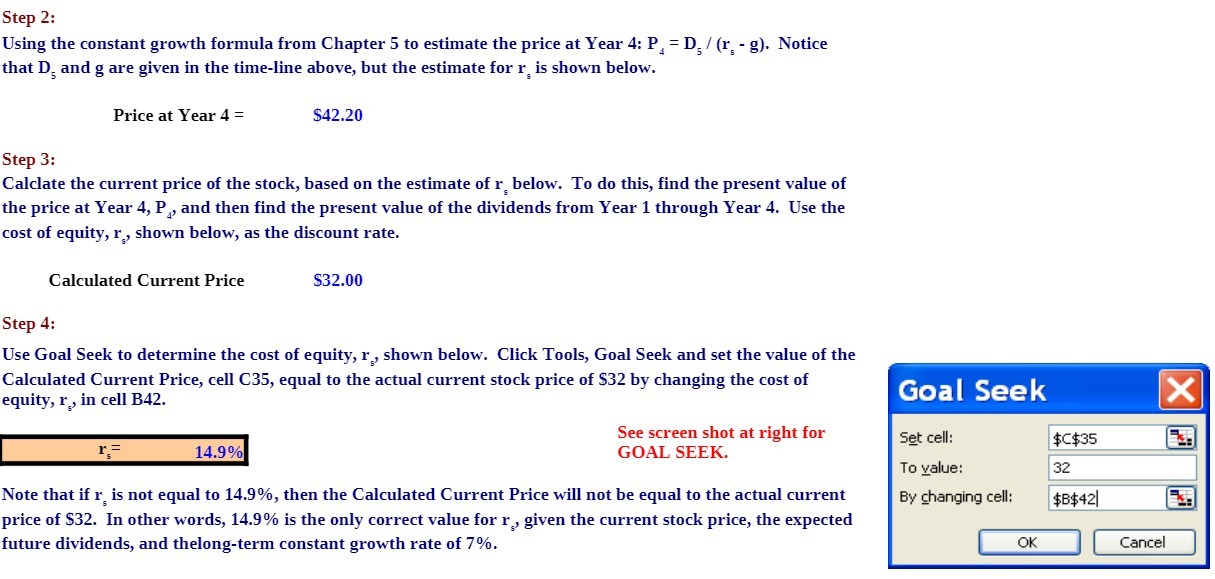

Step 2: Using the constant growth formula from Chapter 5 to estimate the price at Year 4: P, = D; / (r - g). Notice that D, and g are given in the time-line above, but the estimate for r, is shown below. Price at Year 4 = $42.20 Step 3: Calclate the current price of the stock, based on the estimate of r, below. To do this, find the present value of the price at Year 4, P , and then find the present value of the dividends from Year 1 through Year 4. Use the cost of equity, r, shown below, as the discount rate. Calculated Current Price $32.00 Step 4: Use Goal Seek to determine the cost of equity, r, shown below. Click Tools, Goal Seek and set the value of the Calculated Current Price, cell C35, equal to the actual current stock price of $32 by changing the cost of equity, r, in cell B42. Goal Seek X See screen shot at right for Set cell: r. = $C$35 14.9% GOAL SEEK. To value: 32 Note that if r, is not equal to 14.9%, then the Calculated Current Price will not be equal to the actual current By changing cell: $B$42 price of $32. In other words, 14.9% is the only correct value for r, given the current stock price, the expected future dividends, and thelong-term constant growth rate of 7%. OK Cancel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts