Question: Step 2: Write out correct and recorded journal entries for each bullet, assuming 12th Man Co uses a perpetual inventory system. Use the COGS formula

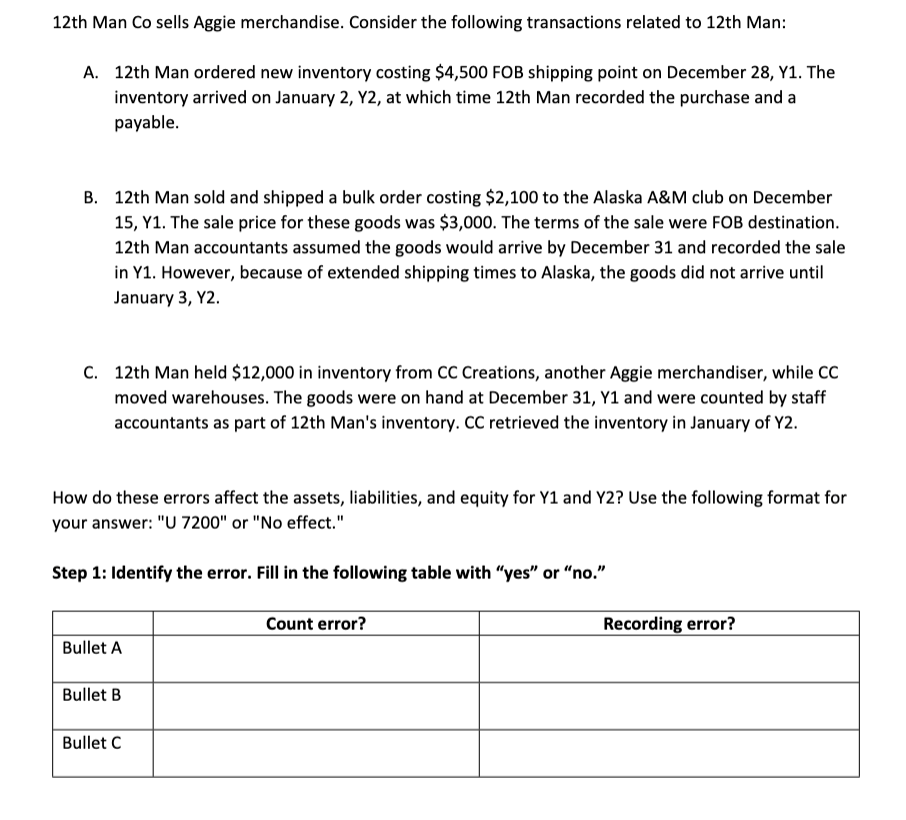

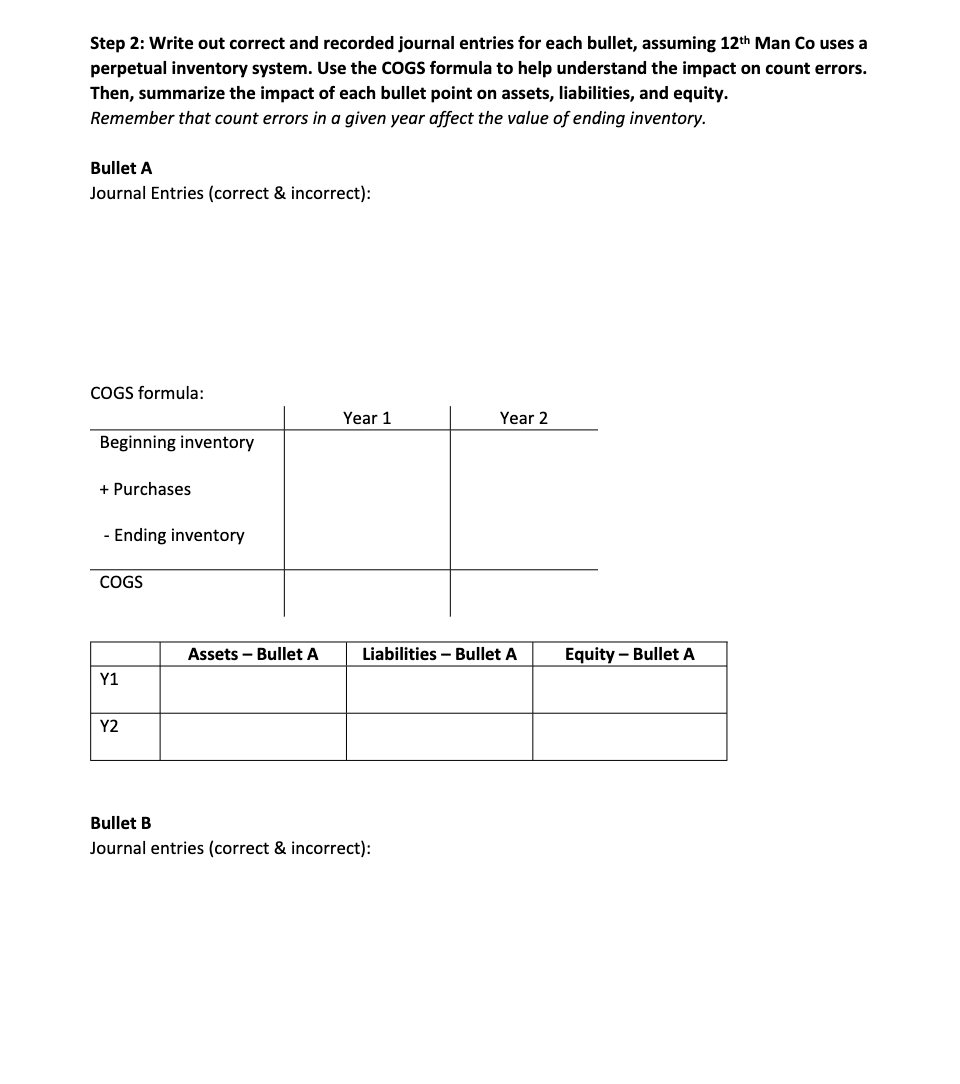

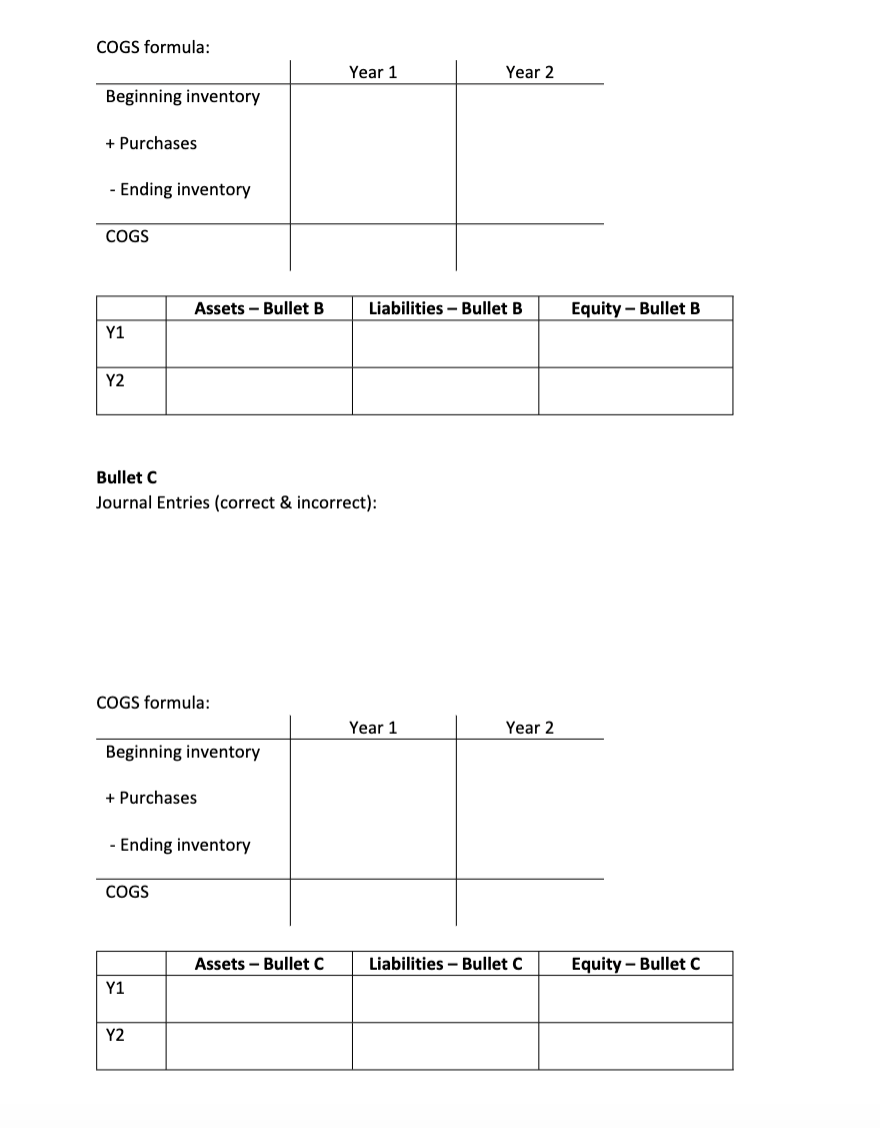

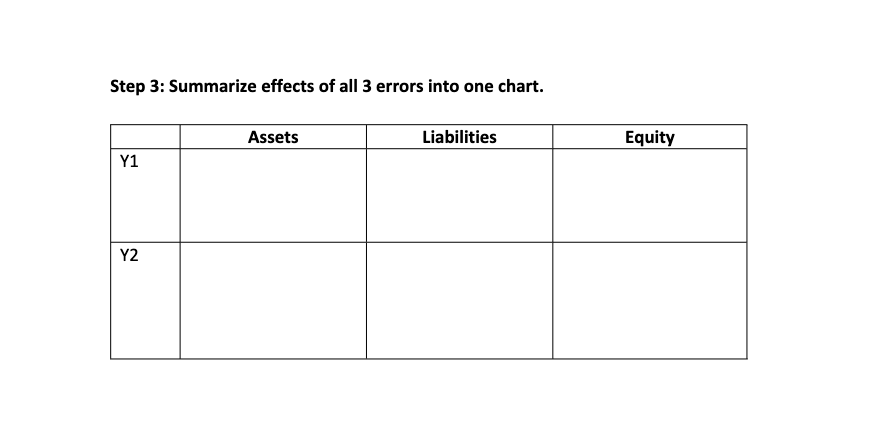

Step 2: Write out correct and recorded journal entries for each bullet, assuming 12th Man Co uses a perpetual inventory system. Use the COGS formula to help understand the impact on count errors. Then, summarize the impact of each bullet point on assets, liabilities, and equity. Remember that count errors in a given year affect the value of ending inventory. Bullet A Journal Entries (correct \& incorrect): COGS formula: Bullet B Journal entries (correct \& incorrect): 12th Man Co sells Aggie merchandise. Consider the following transactions related to 12 th Man: A. 12th Man ordered new inventory costing $4,500 FOB shipping point on December 28,Y1. The inventory arrived on January 2, Y2, at which time 12th Man recorded the purchase and a payable. B. 12th Man sold and shipped a bulk order costing $2,100 to the Alaska A\&M club on December 15,Y1. The sale price for these goods was $3,000. The terms of the sale were FOB destination. 12th Man accountants assumed the goods would arrive by December 31 and recorded the sale in Y1. However, because of extended shipping times to Alaska, the goods did not arrive until January 3,Y2. C. 12th Man held $12,000 in inventory from CC Creations, another Aggie merchandiser, while CC moved warehouses. The goods were on hand at December 31, Y1 and were counted by staff accountants as part of 12th Man's inventory. CC retrieved the inventory in January of Y2. How do these errors affect the assets, liabilities, and equity for Y1 and Y2 ? Use the following format for your answer: "U 7200 " or "No effect." Step 1: Identify the error. Fill in the following table with "yes" or "no." Step 3: Summarize effects of all 3 errors into one chart. COGS formula: Bullet C Journal Entries (correct \& incorrect): COGS formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts