Question: step 3 is wrong, please solve and provide work. all green boxes are right! Question 1 : Suppose that OSG undertakes the same mandatory hedging

step is wrong, please solve and provide work. all green boxes are right!

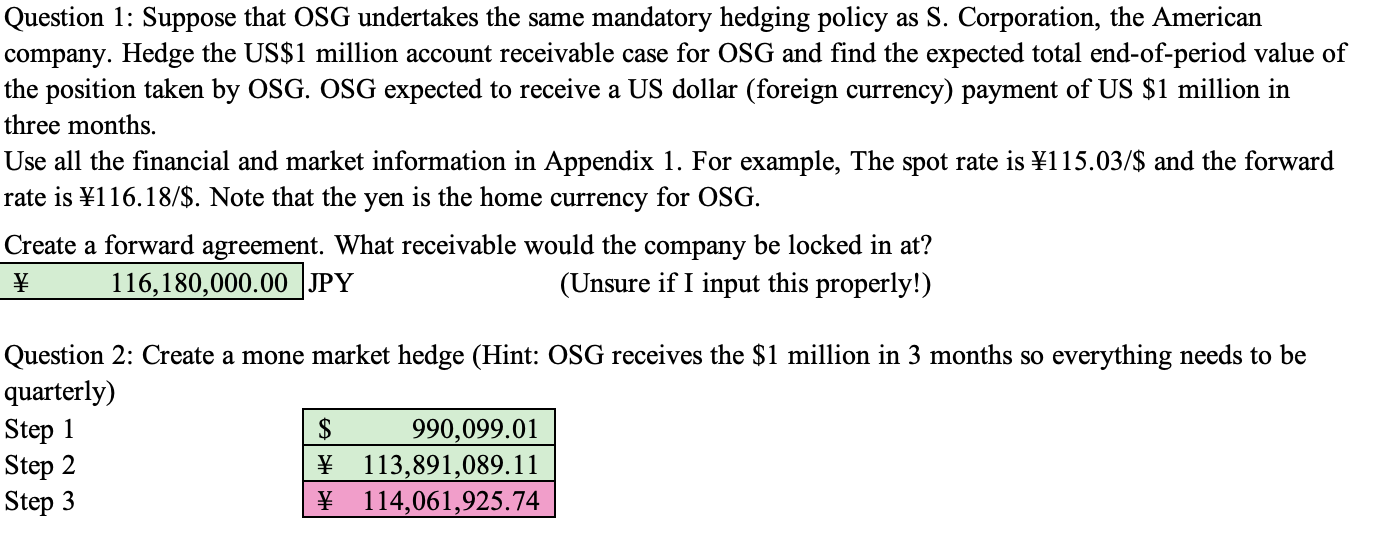

Question : Suppose that OSG undertakes the same mandatory hedging policy as S Corporation, the American company. Hedge the US$ million account receivable case for OSG and find the expected total endofperiod value of the position taken by OSG. OSG expected to receive a US dollar foreign currency payment of US $ million in three months. Use all the financial and market information in Appendix For example, The spot rate is $ and the forward rate is $ Note that the yen is the home currency for OSG. Create a forward agreement. What receivable would the company be locked in atbeginarraylllhline & hline endarrayUnsure if I input this properly! Question : Create a mone market hedge Hint: OSG receives the $ million in months so everything needs to be quarterly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock