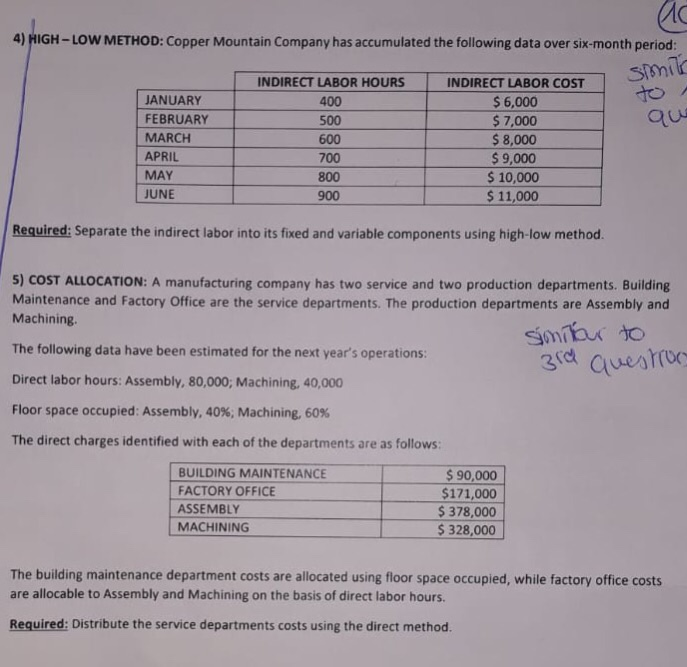

Question: step by step and clear ans plz? 4) HIGH-LoW METHOD: Copper Mountain Company has accumulated the following data over six-month period: simi INDIRECT LABOR HOURS

4) HIGH-LoW METHOD: Copper Mountain Company has accumulated the following data over six-month period: simi INDIRECT LABOR HOURS 400 500 600 700 800 900 INDIRECT LABOR COST 6,000 $7,000 $ 8,000 9,000 10,000 $ 11,000 JANUARY FEBRUARY MARCH APRIL MAY JUNE Required: Separate the indirect labor into its fixed and variable components using high-low method. 5) COST ALLOCATION: A manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining The following data have been estimated for the next year's operations: Direct labor hours: Assembly, 80,000; Machining, 40,000 Floor space occupied: Assembly, 40%, Machining, 60% The direct charges identified with each of the departments are as follows BUILDING MAINTENANCE FACTORY OFFICE ASSEMBLY MACHINING 90,000 $171,000 $ 378,000 $ 328,000 The building maintenance department costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. Required: Distribute the service departments costs using the direct method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts