Question: Step by step explanation and show work please Last year, Hammond Corporation had sales of $120 million, costs of goods sold of $65 million, and

Step by step explanation and show work please

Step by step explanation and show work please

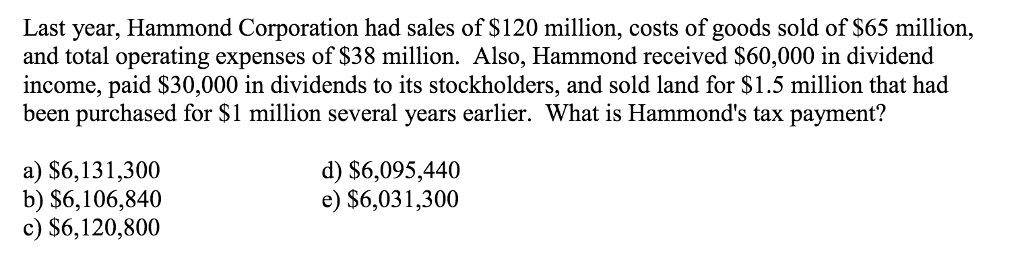

Last year, Hammond Corporation had sales of $120 million, costs of goods sold of $65 million, and total operating expenses of $38 million. Also, Hammond received $60,000 in dividend income, paid $30,000 in dividends to its stockholders, and sold land for $1.5 million that had been purchased for $1 million several years earlier. What is Hammond's tax payment? $6, 131, 300 $6, 106, 840 $6, 120, 800 $6, 095, 440 $6, 031, 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts