Question: step by step for each part thanks Question 4 Which of the following statements is true? A. The discounted payback period is always shorter than

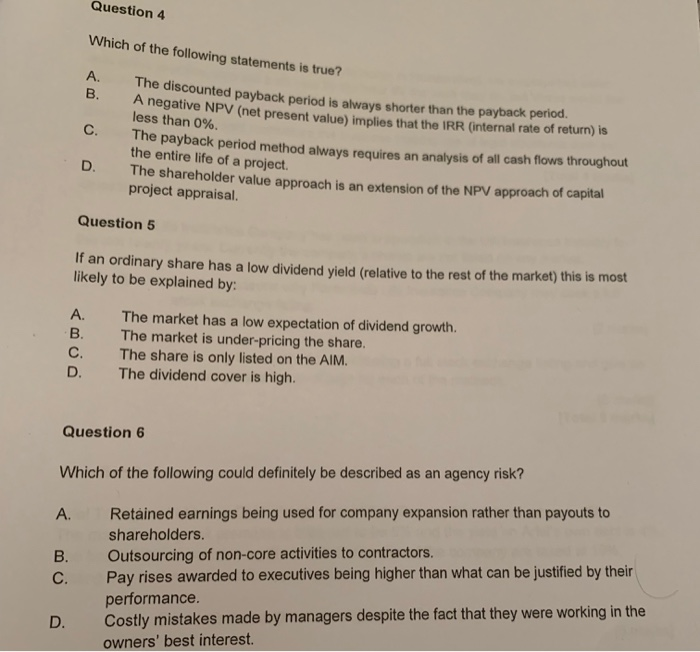

Question 4 Which of the following statements is true? A. The discounted payback period is always shorter than the payback period. A negative NPV (net present value) implies that the IRR (internal rate of return) is less than 0% B. C. The payback period method always requires an analysis of all cash flows throughout the entire life of a project. D. The shareholder value approach is an extension of the NPV approach of capital project appraisal. Question 5 If an ordinary share has a low dividend yield (relative to the rest of the market) this is most likely to be explained by: The market has a low expectation of dividend growth. The market is under-pricing the share. The share is only listed on the AlIM. The dividend cover is high. A. Question 6 Which of the following could definitely be described as an agency risk? Retained earnings being used for company expansion rather than payouts to shareholders. A. Outsourcing of non-core activities to contractors. Pay rises awarded to executives being higher than what can be justified by their performance Costly mistakes made by managers despite the fact that they were working in the owners' best interest B. C. D. BCD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts