Question: step by step, no excel please Finance 4200 In Class Problem 1. Suppose that firm Ds shares are currently selling for $38. After six months

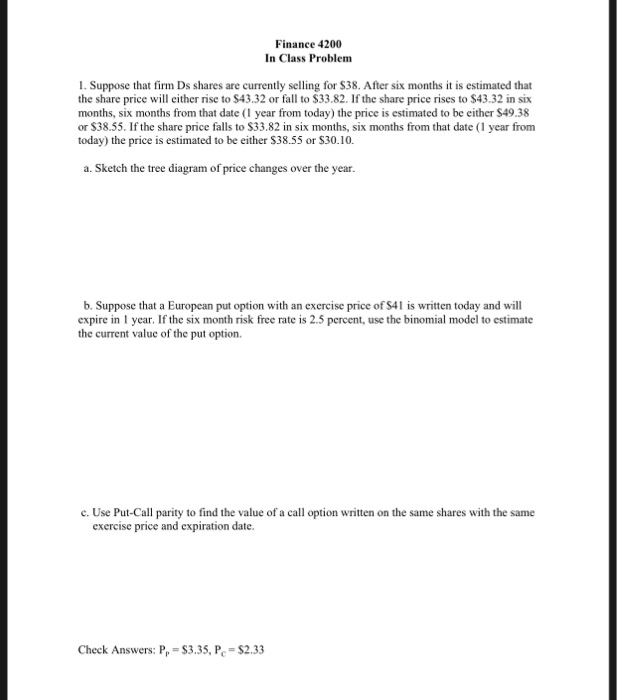

Finance 4200 In Class Problem 1. Suppose that firm Ds shares are currently selling for $38. After six months it is estimated that the share price will either rise to $43.32 or fall to $33.82. If the share price rises to $43.32 in six months, six months from that date (I year from today) the price is estimated to be either $49.38 or $38.55. If the share price falls to S33.82 in six months, six months from that date (1 year from today) the price is estimated to be either $38.55 or $30.10. a. Sketch the tree diagram of price changes over the year. b. Suppose that a European put option with an exercise price of S41 is written today and will expire in 1 year. If the six month risk free rate is 2.5 percent, use the binomial model to estimate the current valuc of the put option c. Use Put-Call parity to find the value of a call option written on the same shares with the same exercise price and expiration date. Check Answers: Pr S3.35, Pc S2.33 Finance 4200 In Class Problem 1. Suppose that firm Ds shares are currently selling for $38. After six months it is estimated that the share price will either rise to $43.32 or fall to $33.82. If the share price rises to $43.32 in six months, six months from that date (I year from today) the price is estimated to be either $49.38 or $38.55. If the share price falls to S33.82 in six months, six months from that date (1 year from today) the price is estimated to be either $38.55 or $30.10. a. Sketch the tree diagram of price changes over the year. b. Suppose that a European put option with an exercise price of S41 is written today and will expire in 1 year. If the six month risk free rate is 2.5 percent, use the binomial model to estimate the current valuc of the put option c. Use Put-Call parity to find the value of a call option written on the same shares with the same exercise price and expiration date. Check Answers: Pr S3.35, Pc S2.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts