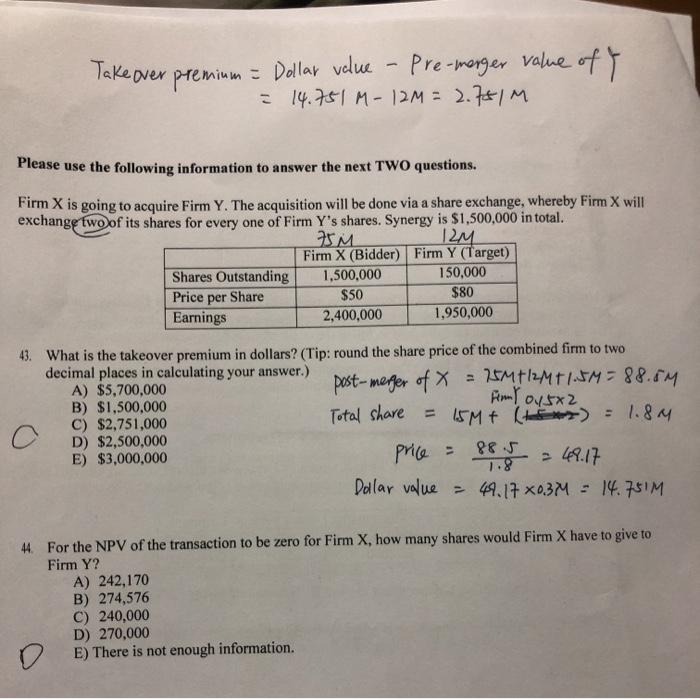

Question: step by step no.44 question Take over premium = Dollar value Pre-merger value off = 14.751 M - 12M = 2.761M Please use the following

Take over premium = Dollar value Pre-merger value off = 14.751 M - 12M = 2.761M Please use the following information to answer the next TWO questions. Firm X is going to acquire Firm Y. The acquisition will be done via a share exchange, whereby Firm X will exchange two of its shares for every one of Firm Y's shares. Synergy is $1,500,000 in total. 75M 12M Firm X (Bidder) Firm Y (Target) Shares Outstanding 1,500,000 150,000 Price per Share $50 $80 Earnings 2,400,000 1,950,000 front ou 5x2 43. What is the takeover premium in dollars? (Tip: round the share price of the combined firm to two decimal places in calculating your answer.) A) $5,700,000 post-merger of x = 25M+12M +1.5M = 88.5M B) $1,500,000 C) $2,751,000 Total share = 15M+ (t) = 1.8M D) $2,500,000 E) $3,000,000 price = 885 = 49.17 Dollar value = 44.17X0.3M = 14.751M 44. For the NPV of the transaction to be zero for Firm X, how many shares would Firm X have to give to Firm Y? A) 242,170 B) 274,576 C) 240,000 D) 270,000 E) There is not enough information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts