Question: step by step on answering each requirements required with the work shown in the same format shown 2018 Jul. 2 Purchased 4,200 shares of Naradon,

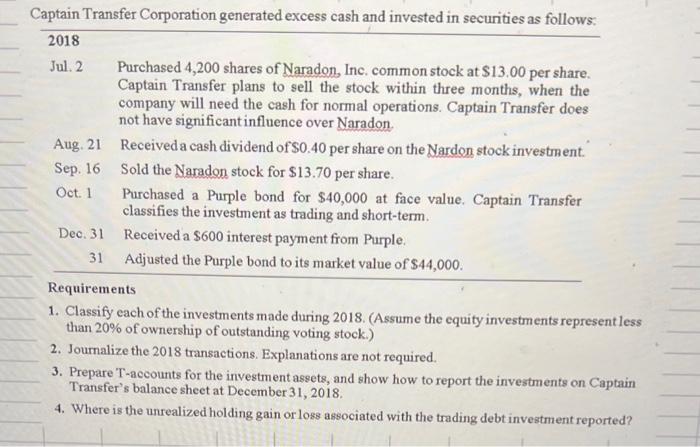

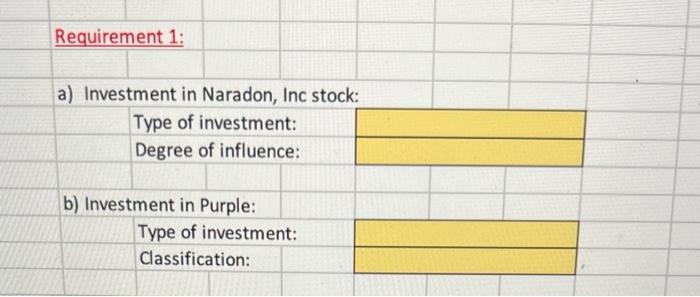

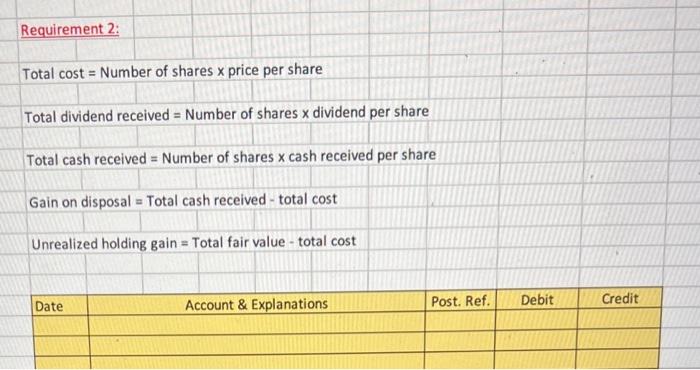

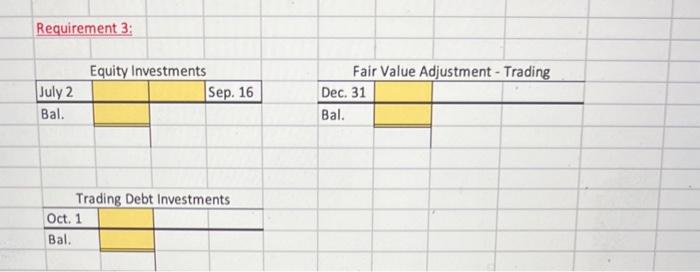

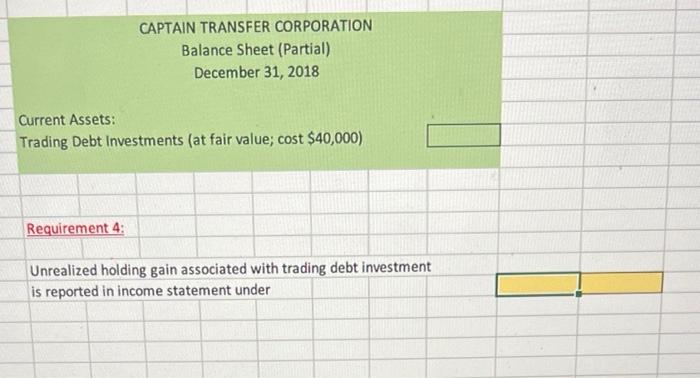

2018 Jul. 2 Purchased 4,200 shares of Naradon, Inc. common stock at $13.00 per share. Captain Transfer plans to sell the stock within three months, when the company will need the cash for normal operations. Captain Transfer does not have significantinfluence over Naradon. Aug. 21 Received a cash dividend of $0.40 per share on the Nardon stock investment. Sep. 16 Sold the Naradon stock for $13.70 per share. Oct. 1 Purchased a Purple bond for $40,000 at face value. Captain Transfer classifies the investment as trading and short-term. Dec. 31 Received a $600 interest payment from Purple. 31 Adjusted the Purple bond to its market value of $44,000. Requirements 1. Classify each of the investments made during 2018. (Assume the equity investments representless than 20% of ownership of outstanding voting stock.) 2. Journalize the 2018 transactions. Explanations are not required. 3. Prepare T-accounts for the investment assets, and show how to report the investments on Captain Transfer's balance sheet at December 31,2018 . 4. Where is the unrealized holding gain or loss associated with the trading debt investment reported? Requirement 1: a) Investment in Naradon, Inc stock: Type of investment: Degree of influence: b) Investment in Purple: Type of investment: Classification: Requirement 2: Total cost = Number of shares x price per share Total dividend received = Number of shares x dividend per share Total cash received = Number of shares x cash received per share Gain on disposal = Total cash received total cost Unrealized holding gain = Total fair value total cost \begin{tabular}{|l|l|l|l|c|} \hline Date & Account \& Explanations & Post. Ref. & Debit & Credit \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Requirement 3: \begin{tabular}{|l|l|l|l|} \hline July 2 & & & Sep. 16 \\ \hline Bal. & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|} \hline \multicolumn{2}{|l|}{ Trading Debt Investments } \\ \hline Oct. 1 & & \\ \hline Bal. & & \\ \hline \hline \end{tabular} \begin{tabular}{l} Fair Valu \\ \hline Dec. 31 \\ \hline Bal. \\ \hline \end{tabular} CAPTAIN TRANSFER CORPORATION Balance Sheet (Partial) December 31, 2018 Current Assets: Trading Debt Investments (at fair value; cost $40,000 ) Requirement 4: Unrealized holding gain associated with trading debt investment is reported in income statement under

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts