Question: step by step please Stellar Inc. offers a five-year bond with the 5% coupon payment once a year the par value is 1000 similar bonds

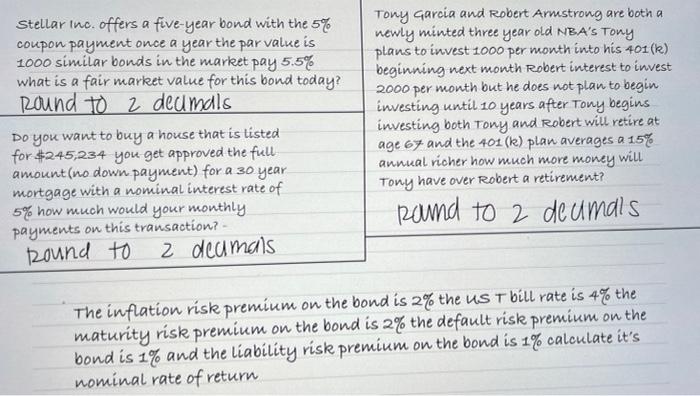

Stellar Inc. offers a five-year bond with the 5% coupon payment once a year the par value is 1000 similar bonds in the market pay 5.5% what is a fair market value for this bond today? Round to 2 decimals Tony Garcia and Robert Armstrong are both a newly minted three year old NBA's Tony plans to invest 1000 per month into his 401(k) beginning next month Robert interest to invest 2000 per month but he does not plan to begin investing until 10 years after Tony begins investing both Tony and Robert will retire at age 67 and the 401(k) plan averages a 15% annual richer how much more money will Tony have over Robert a retirement? round to 2 deumals Do you want to buy a house that is listed for $245,234 you get approved the full amount (no down payment) for a 30 year mortgage with a nominal interest rate of 5% how much would your monthly payments on this transaction? Round to 2 deamals The inflation risk premium on the bond is 2% the us T bill rate is 4% the maturity risk premium on the bond is 2% the default risk premium on the bond is 1% and the liability risk premium on the bond is 1% calculate it's nominal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts