Question: step by step Question 21 (3 points) According to a summary of the payroll of Scotland Company, $450,000 was subject to the 6.0% social security

step by step

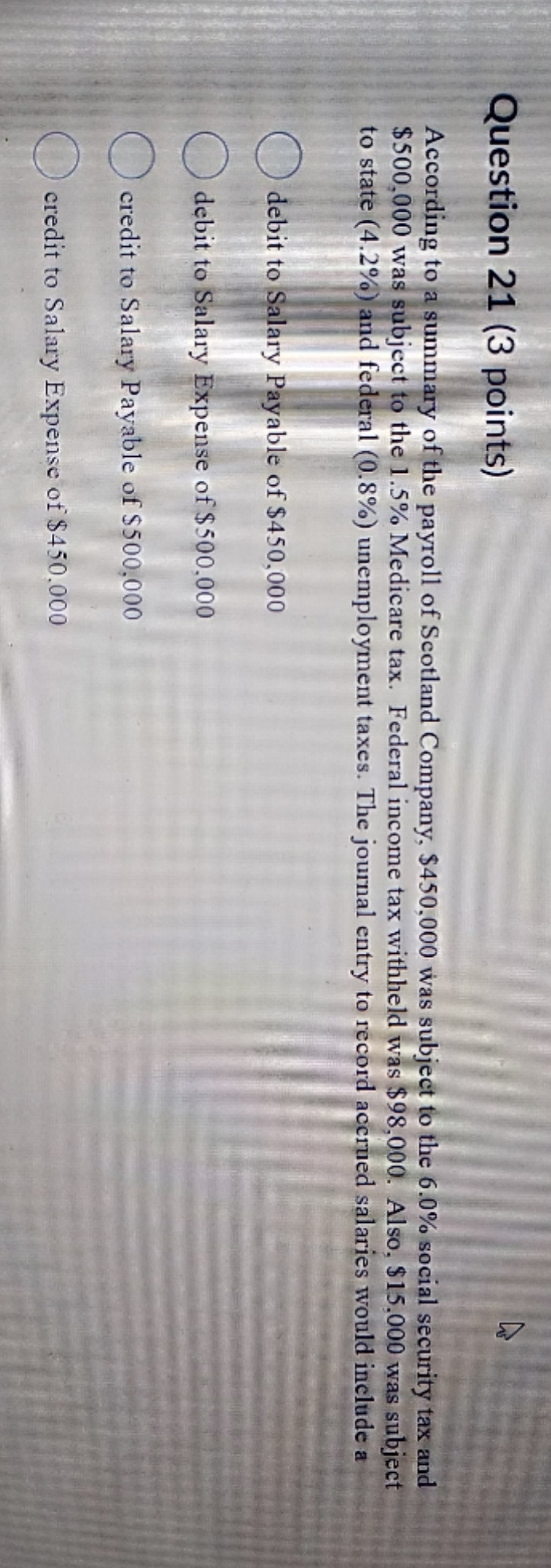

Question 21 (3 points) According to a summary of the payroll of Scotland Company, $450,000 was subject to the 6.0% social security tax and $500,000 was subject to the 1.5% Medicare tax. Federal income tax withheld was $98,000. Also, $15,000 was subject to state (4.2%) and federal (0.8%) unemployment taxes. The journal entry to record accrued salaries would include a O debit to Salary Payable of $450,000 O debit to Salary Expense of $500,000 O credit to Salary Payable of $500,000 O credit to Salary Expense of $450.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts