Question: step by step solution (a) Consider the sequential trading model of Glosten and Milgrom (1985). Let us assume that: The future value of the asset,

step by step solution

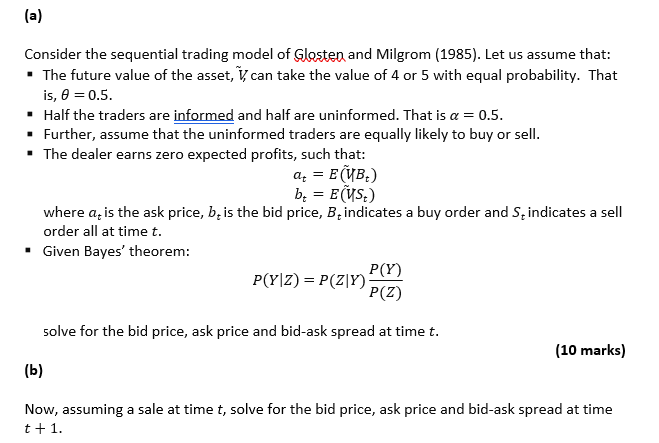

(a) Consider the sequential trading model of Glosten and Milgrom (1985). Let us assume that: The future value of the asset, V, can take the value of 4 or 5 with equal probability. That is, 0 =0.5. . Half the traders are informed and half are uninformed. That is a = 0.5. . Further, assume that the uninformed traders are equally likely to buy or sell. The dealer earns zero expected profits, such that: ar = E(UB) by = Ecus.) where a, is the ask price, b, is the bid price, B, indicates a buy order and S, indicates a sell order all at time t. . Given Bayes' theorem: P(Y|Z) = P(ZY) P(Y) P(Z) solve for the bid price, ask price and bid-ask spread at time t. (10 marks) (b) Now, assuming a sale at time t, solve for the bid price, ask price and bid-ask spread at time t+1. (a) Consider the sequential trading model of Glosten and Milgrom (1985). Let us assume that: The future value of the asset, V, can take the value of 4 or 5 with equal probability. That is, 0 =0.5. . Half the traders are informed and half are uninformed. That is a = 0.5. . Further, assume that the uninformed traders are equally likely to buy or sell. The dealer earns zero expected profits, such that: ar = E(UB) by = Ecus.) where a, is the ask price, b, is the bid price, B, indicates a buy order and S, indicates a sell order all at time t. . Given Bayes' theorem: P(Y|Z) = P(ZY) P(Y) P(Z) solve for the bid price, ask price and bid-ask spread at time t. (10 marks) (b) Now, assuming a sale at time t, solve for the bid price, ask price and bid-ask spread at time t+1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts