Question: Step by step solution in need for each part with answers thanks oCr 335 Art Ltd's trial balance at 31/10/X7 was as follows:- Purchases/Sales Other

Step by step solution in need for each part with answers thanks

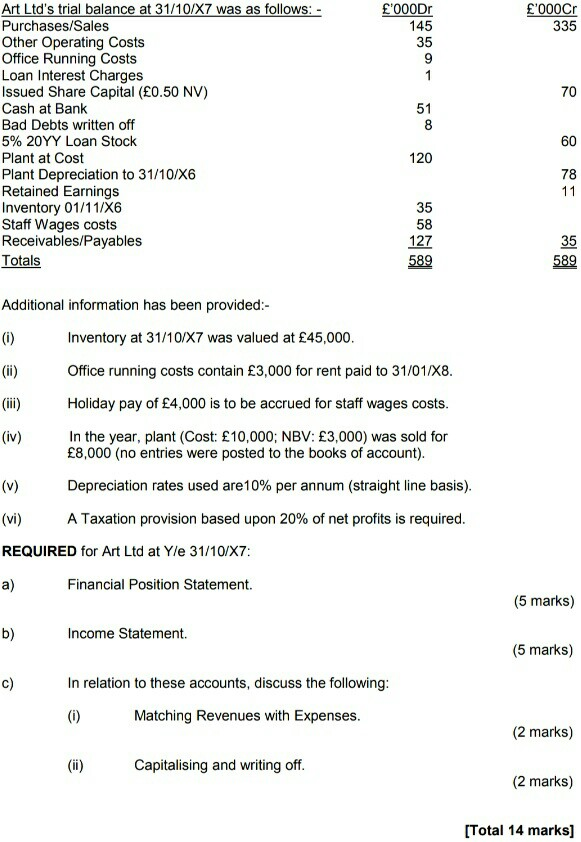

oCr 335 Art Ltd's trial balance at 31/10/X7 was as follows:- Purchases/Sales Other Operating Costs Office Running Costs Loan Interest Charges Issued Share Capital (0.50 NV) Cash at Bank Bad Debts written off 5% 20YY Loan Stock Plant at Cost Plant Depreciation to 31/10X6 Retained Earnings Inventory 01/11/X6 Staff Wages costs Receivables/Payables Totals 00Dr 145 35 70 51 60 120 78 35 58 127 35 Additional information has been provided Inventory at 31/10/x7 was valued at 45,000 Office running costs contain 3,000 for rent paid to 31/01/X8 Holiday pay of 4,000 is to be accrued for staff wages costs In the year, plant (Cost: 10,000; NBV: 3,000) was sold for (iv) 8,000 (no entries were posted to the books of account) Depreciation rates used are 10% per annum (straight line basis) A Taxation provision based upon 20% of net profits is required (vi) REQUIRED for Art Ltd at Yle 31/10/X7 a) Financial Position Statement. (5 marks) b) Income Statement. (5 marks) c) In relation to these accounts, discuss the following Matching Revenues with Expenses (2 marks) Capitalising and writing off (2 marks) [Total 14 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts