Question: Step by step solution in this problem 27. Griffin-Kornberg is reviewing the following projects for next year's capital program. Initial Length Annual Project Investment in

Step by step solution in this problem

Step by step solution in this problem

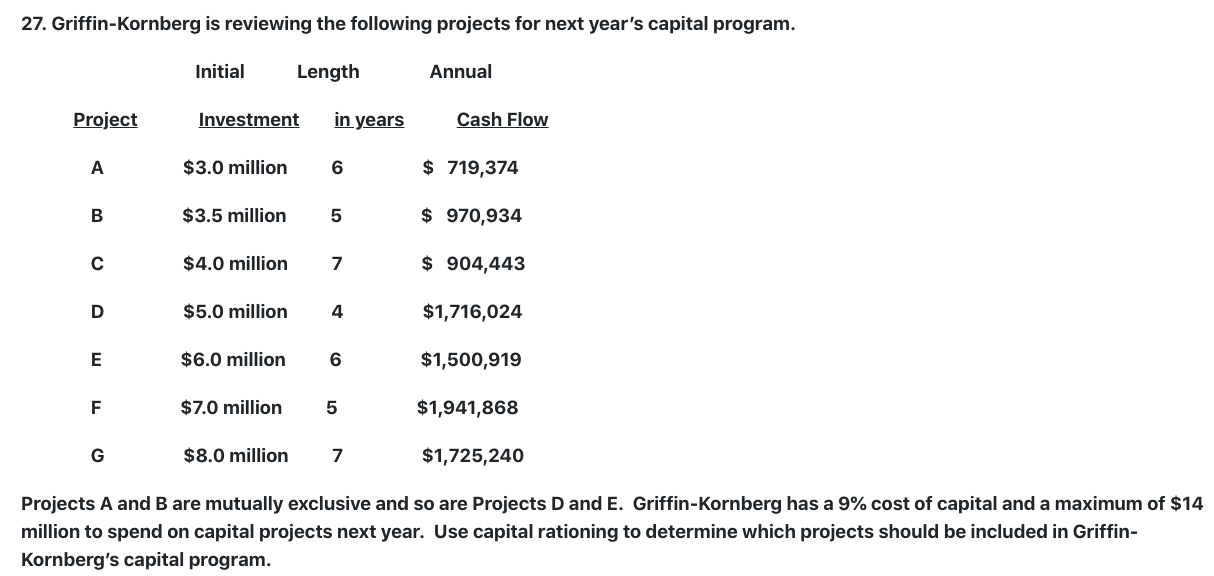

27. Griffin-Kornberg is reviewing the following projects for next year's capital program. Initial Length Annual Project Investment in years Cash Flow $3.0 million 6 $ 719,374 B $3.5 million 5 $ 970,934 $4.0 million 7 $ 904,443 D $5.0 million 4 $1,716,024 E $6.0 million 6 $1,500,919 F $7.0 million 5 $1,941,868 G $8.0 million 7 $1,725,240 Projects A and B are mutually exclusive and so are Projects D and E. Griffin-Kornberg has a 9% cost of capital and a maximum of $14 million to spend on capital projects next year. Use capital rationing to determine which projects should be included in Griffin- Kornberg's capital program

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts