Question: Step by step solution needed to obtain the answers thanks :) Need part c (answer c = 19.4) The performance of an investment fund is

Step by step solution needed to obtain the answers thanks :)

Need part c

(answer c = 19.4)

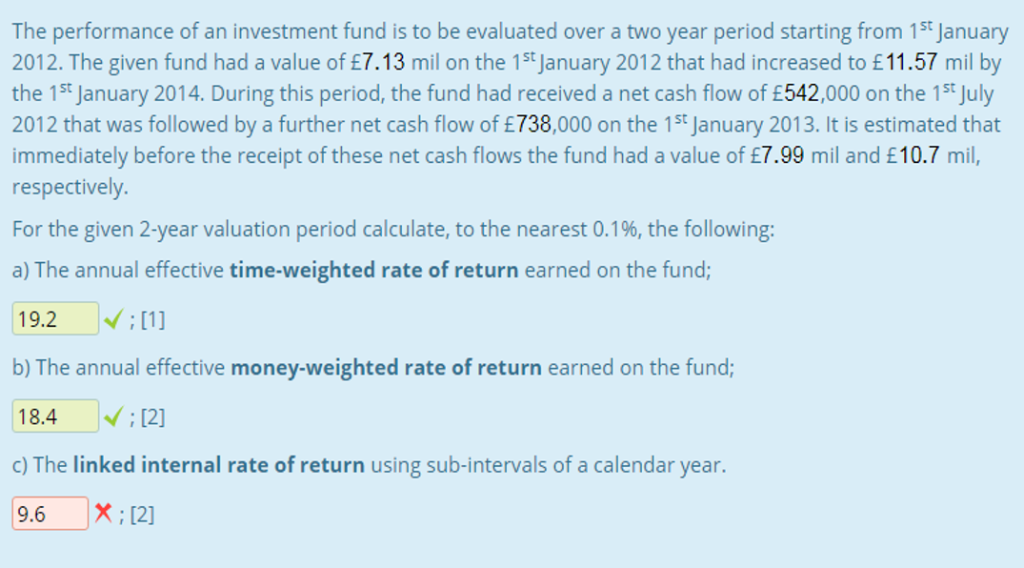

The performance of an investment fund is to be evaluated over a two year period starting from 1st January 2012. The given fund had a value of 7.13 mil on the 1st January 2012 that had increased to 11.57 mil by the 1t January 2014. During this period, the fund had received a net cash flow of 542,000 on the 15t July 2012 that was followed by a further net cash flow of 738,000 on the 15t January 2013. It is estimated that immediately before the receipt of these net cash flows the fund had a value of 7.99 mil and 10.7 mil, respectively. For the given 2-year valuation period calculate, to the nearest 0.1%, the following: a) The annual effective time-weighted rate of return earned on the fund; 19.2 b) The annual effective money-weighted rate of return earned on the fund; 18.4 [2] c) The linked internal rate of return using sub-intervals of a calendar year. X ; [2] 9.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts