Question: step by step solution please for each part Question 1 Which of the following assets (all issued by the same company) has the lowest risk?

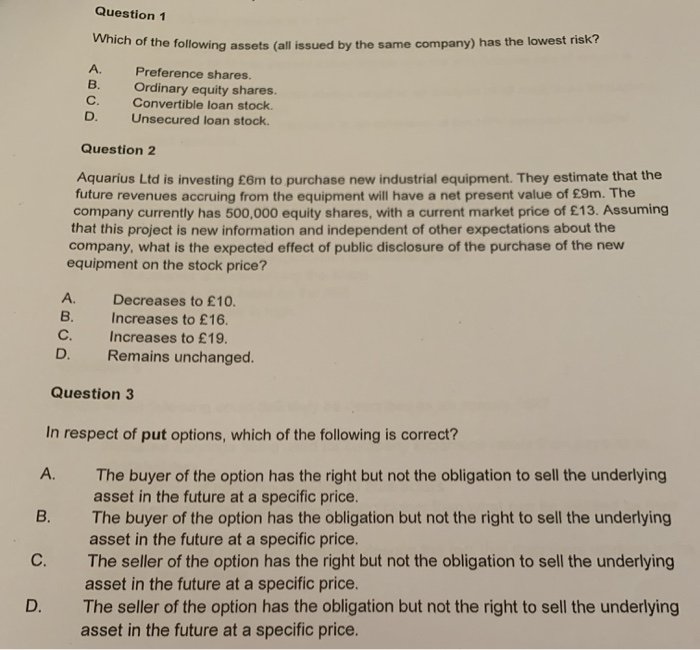

Question 1 Which of the following assets (all issued by the same company) has the lowest risk? A. Preference shares. Ordinary equity shares. Convertible loan stock Unsecured loan stock Question 2 Aquarius Ltd is investing 6m to purchase new industrial equipment. They estimate that the future revenues accruing from the equipment willl have a net present value of 9m. The company currently has 500,000 equity shares, with a current market price of 13. Assuming that this project is new information and independent of other expectations about the company, what is the expected effect of public disclosure of the purchase of the new equipment on the stock price? A. Decreases to 10. Increases to 16. Increases to 19. Remains unchanged. Question 3 In respect of put options, which of the following is correct? A. The buyer of the option has the right but not the obligation to sell the underlying asset in the future at a specific price. The buyer of the option has the obligation but not the right to sell the underlying asset in the future at a specific price. The seller of the option has the right but not the obligation to sell the underlying asset in the future at a specific price. The seller of the option has the obligation but not the right to sell the underlying asset in the future at a specific price. B. C. D. BCD ABCD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts