Question: Step by step solution with formulas? A financial engineer designs a new financial instrument that he calls, the Stax. This instrument gives the holder access

Step by step solution with formulas?

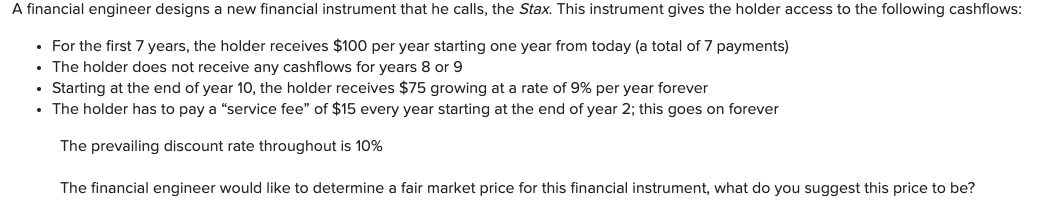

A financial engineer designs a new financial instrument that he calls, the Stax. This instrument gives the holder access to the following cashflows: For the first 7 years, the holder receives $100 per year starting one year from today (a total of 7 payments) The holder does not receive any cashflows for years 8 or 9 Starting at the end of year 10, the holder receives $75 growing at a rate of 9% per year forever The holder has to pay a "service fee" of $15 every year starting at the end of year 2; this goes on forever The prevailing discount rate throughout is 10% The financial engineer would like to determine a fair market price for this financial instrument, what do you suggest this price to be? A financial engineer designs a new financial instrument that he calls, the Stax. This instrument gives the holder access to the following cashflows: For the first 7 years, the holder receives $100 per year starting one year from today (a total of 7 payments) The holder does not receive any cashflows for years 8 or 9 Starting at the end of year 10, the holder receives $75 growing at a rate of 9% per year forever The holder has to pay a "service fee" of $15 every year starting at the end of year 2; this goes on forever The prevailing discount rate throughout is 10% The financial engineer would like to determine a fair market price for this financial instrument, what do you suggest this price to be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts